- WIF and POPCAT have both reached significant milestones while defending crucial support lines.

- However, only one can lead in the next cycle. Which memecoin will it be?

dogwifhat [WIF] held the $2 support, surging by 4% in the past 24 hours, defying volatility spurred by Bitcoin’s consolidation below $64K.

Meanwhile, POPCAT briefly reached a $1 billion market cap but retraced to $968 million as bulls failed to defend the $1 level. While WIF leads, AMBCrypto notes POPCAT is closing in.

As analysts eye “Uptober” to spark Bitcoin’s bull run, which Solana memecoin will lead the next cycle?

A razor-thin margin between the two

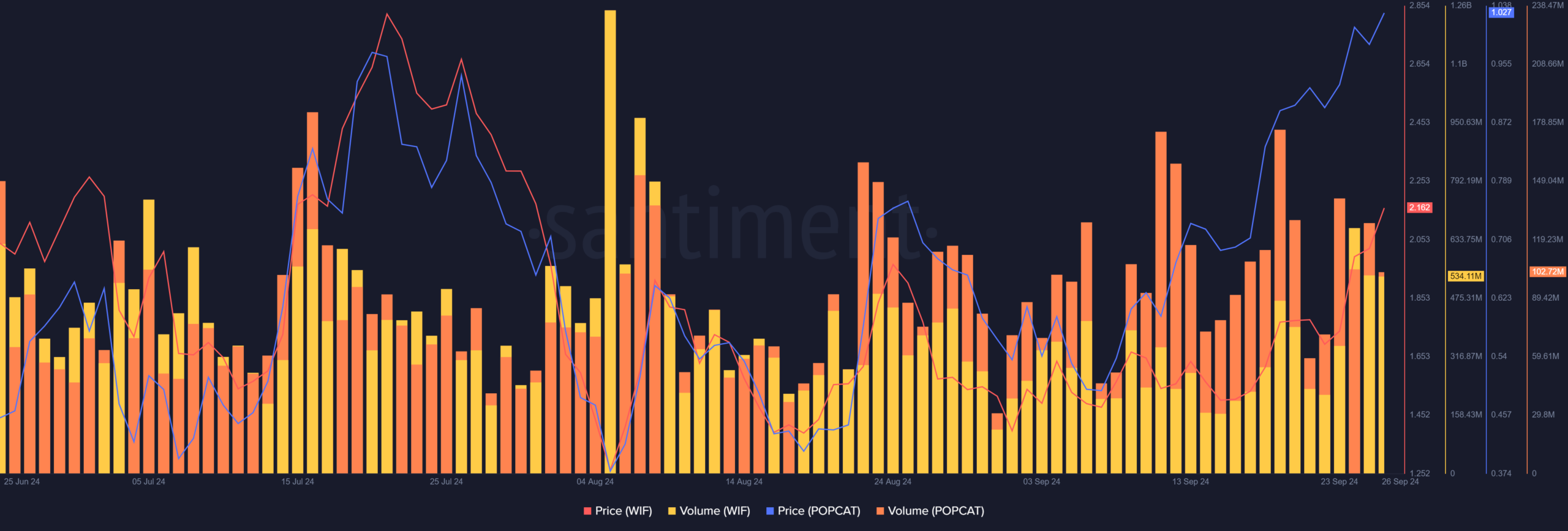

After a rough patch without a bullish swing since late August, WIF rebounded in mid-September, surging 45% to $2.15 on the daily timeframe.

In contrast, POPCAT mirrored Bitcoin’s early September moves, soaring 102% to $1.0194 at press time.

Notably, POPCAT demonstrated greater resilience amid market downturns, hitting a new ATH of $1.0768 on the 25th of September.

Source : Coinalyze

However, POPCAT now stands at a crucial support line. If bulls fail to hold it, a retracement could see the memecoin drop near $0.38. Conversely, another upward push could lead to a new ATH.

Similarly, WIF has demonstrated notable growth, with bulls pushing its price up by 20% in the past three days, evident in the long green candles on the daily price chart. Yet,

There is a catch

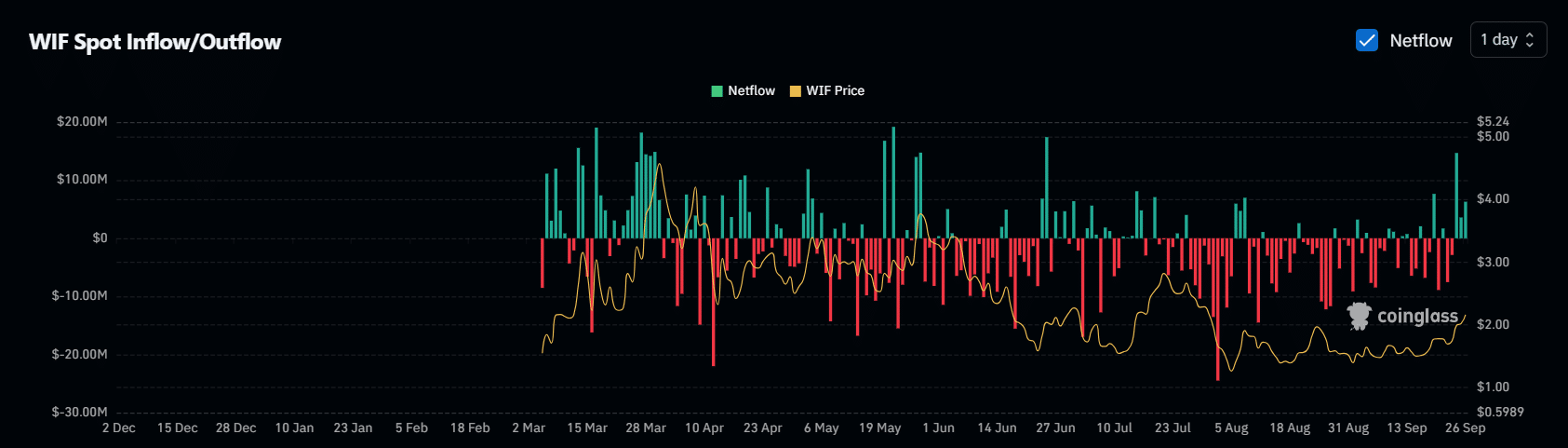

Per AMBCrypto, the rebound in WIF results from a strategic maneuver by spot traders who are aggressively accumulating to squeeze out the significant influx of short positions.

While this is a bullish sign, it could backfire if these traders transition into the distribution phase, which appears increasingly likely.

Source : Coinglass

Since WIF reached its market bottom of $1.26 in early August, net outflows from exchanges have surged to $30M, creating an ideal buy-the-dip opportunity.

Now at $2.16, most of these early withdrawals have turned into profits, putting WIF on the edge of possible exhaustion. This is indicated by a renewed spike in net inflows, which have reached a three-month high of $15M. If the trend holds, WIF may be poised for a reversal, shifting liquidity to POPCAT.

A crucial road ahead for POPCAT

First, POPCAT’s price has largely moved in tandem with WIF’s price, except during the early September rally, when POPCAT surged significantly, indicating growing interest in the memecoin.

Source : Santiment

Additionally, WIF’s trading volume has halved since August when it peaked at $1 billion. A closer look revealed that POPCAT’s volume increased from $104 million to $127 million the following day.

Is your portfolio green? Check out the POPCAT Profit Calculator

In short, POPCAT is targeting WIF’s lead. If WIF falters – which seems likely – POPCAT may have a better chance at a takeover.

This ambition can be more firmly confirmed if bulls hold the $1 support while closely monitoring WIF’s trading activity.

Source: https://ambcrypto.com/popcat-targets-wif-will-it-seize-the-lead-in-the-next-bull-run/