On Tuesday, Ethereum spot exchange-traded funds (ETFs) registered a significant positive performance for the first time in nearly two months. The crypto-based investment products have seen a sluggish performance throughout September and have failed to impress investors amid the market pump.

Ethereum ETFs See Best Day Since August

Last week, spot Ethereum (ETH) ETFs saw their sixth consecutive week of negative net flows, with $26.26 million in outflows. While Bitcoin (BTC) spot ETFs continued the positive streak with their second week of inflows in a row, CoinShares’ weekly report noted that products based on the second-largest cryptocurrency remained “outliers.”

In the last thirty days, the investment products were disappointing due to the continuous large outflows from Grayscale Ethereum Trust (ETHE) and the insufficient activity from the newly issued ETFs.

As reported by Bitcoinist, the investment products saw no inflows or outflows across all issuers on August 30 and September 2, which has not been seen since the launch of US spot crypto-based ETFs in January.

Additionally, the spot ETH ETFs trading volume was comparable with those before their launch, accounting for only 15% of the volume registered on their launch week in the US.

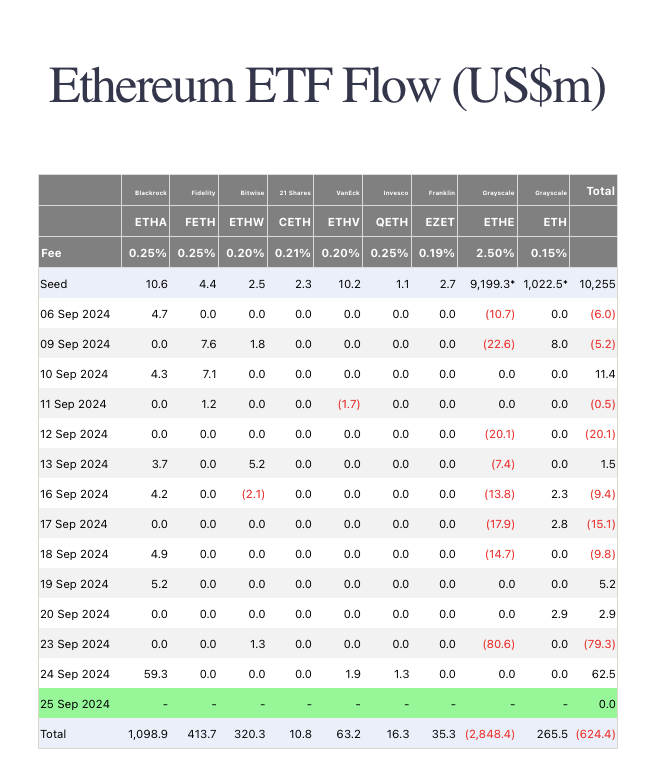

The disappointing performance continued as this week started. The ETH-based products had one of their worst days since their launch in late July, with a net outflow of $79.3 million on Monday.

Ethereum ETFs' performance in the last three weeks. Source: Farside Investors

This marked the Ethereum ETFs’ fifth-largest negative net flow day since their creation and their worst-performing day since July 31. While most funds saw no activity, except for ETHW’s modest $1.3 million inflows, ETHE’s outflows were led by $80.6 million.

However, Mads Eberhardt, senior analyst at Steno Research, noted that US Ethereum spot ETFs also recorded one of their largest net flows on Tuesday, but in the opposite direction. ETH ETFs recovered from the massive Monday outflows, registering $62 million in inflows on the second day of the week.

Blackock’s ETHA led the positive flows with $59.3 million, while VanEck’s ETHV and Invesco’s QETH saw a mild $1.9 and $1.3 million, respectively. The funds also saw no outflows among all issuers, including Grayscale’s ETHE. This accounts for their third-best-performing day since July. Additionally, it became spot ETH ETFs’ and ETHA’s best day since August 6.

SEC Delays ETH ETFs Options Decision

On Tuesday, the US Securities and Exchange Commission (SEC) revealed it had extended the deadline for its decision on the Nasdaq International Securities Exchange (ISE) proposed rule change to list and trade options on Blackrock’s ETHA.

Similarly, the US regulator delayed its decision on NYSE American LCC’s proposed ruled change to trade and list options on Bitwise’s ETHW and Grayscale’s ETHE and Grayscale’s Mini Trust (ETH).

The deadlines have been extended to mid-November, with Nasdaq ISE’s ruling scheduled for November 10 and NYSE American LCC’s date set for November 11. The decision follows the agency’s recent approval of options trading for BlackRock’s iShares Bitcoin Trust (IBIT) on Nasdaq.

The approval was called a “huge win” for spot BTC ETFs by Bloomberg analyst Eric Balchunas, who considered that it would attract more investors and bring in more liquidity. A similar development for spot Ethereum ETFs could potentially boost the appeal of the crypto-based investment products for larger investors.

Ethereum is trading at $2,625 in the weekly chart. Source: ETHUSDT on TradingView

Featured Image from Unsplash.com, Chart from TradingView.com

Source: https://bitcoinist.com/ethereum-spot-etfs-record-best-performing-day-since-early-august/