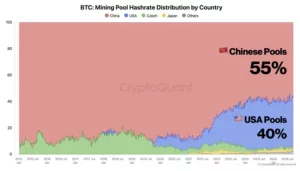

In recent years, the global Bitcoin mining landscape has undergone a dramatic transformation. Once dominated by Chinese miners, the hashrate distribution has shifted significantly. U.S.-based mining operations now command around 40% of the total global Bitcoin mining power. Meanwhile, China, despite a government crackdown, retains approximately 55%. This shift is the result of geopolitical changes and economic factors that are reshaping the future of the Bitcoin mining ecosystem.

Reasons for the Shift

China’s Crackdown on Mining (2021)

The most significant catalyst for this global shift was China’s decision in May 2021 to ban Bitcoin mining. Concerned about financial stability, environmental impacts, and excessive electricity usage, the Chinese government forced miners to shut down or relocate their operations abroad. This policy disrupted China’s near-total dominance of the global hashrate and prompted a mass exodus of mining activities.

Favorable U.S. Regulations

The United States emerged as an attractive destination for displaced Bitcoin miners due to its relatively favorable regulatory environment. Unlike China, the U.S. has not imposed sweeping bans on mining activities. Certain states, like Texas, have actively welcomed crypto miners, offering regulatory clarity and access to financial markets. This supportive atmosphere has made the U.S. a preferred destination for large-scale mining operations.

Affordable Energy and Infrastructure

Access to cheap and reliable energy has been a significant draw for miners relocating to the U.S. States with abundant renewable resources, such as wind and solar power, provide affordable electricity. Regions like Texas and Wyoming offer lower energy costs, enabling mining companies to scale their operations efficiently. U.S. companies like Riot Blockchain and Marathon Digital Holdings have invested heavily in mining infrastructure, increasing their operational capacities.

Implications of the Shift

Decentralization of Bitcoin Mining

The relocation of mining operations to the U.S. has led to greater geographical diversification in Bitcoin mining. This decentralization strengthens the resilience of the Bitcoin network by reducing reliance on any single country. A more distributed mining network enhances security and minimizes the risks associated with political crackdowns or regulatory changes in one region.

Economic Impact in the U.S.

Bitcoin mining has brought economic benefits to various regions in the United States, particularly in rural areas with surplus energy production. The establishment of large-scale mining facilities has created jobs and stimulated local economies. Investment in mining infrastructure contributes to economic growth and provides new opportunities in technology and energy sectors.

Environmental Considerations

The environmental impact of Bitcoin mining remains a topic of debate. However, the U.S. offers a mix of renewable energy sources that can mitigate some environmental concerns. The increased demand for greener mining operations could drive innovation in sustainable energy solutions. This shift may boost the use of renewable energy in mining and promote more environmentally friendly practices.

As the U.S. solidifies its position in the global Bitcoin mining industry, it is likely to influence the future direction of the cryptocurrency market. Supportive regulations, investment in infrastructure, and a focus on sustainable practices may shape the evolution of Bitcoin mining and contribute to the broader acceptance of cryptocurrencies worldwide.

Source: https://www.cryptonewsz.com/us-bitcoin-mining-rise-after-china-crackdown/