- Securitize partners with Wormhole to enable seamless cross-chain transfers for tokenized assets.

- The collaboration enhances liquidity and accessibility, particularly for institutional investors.

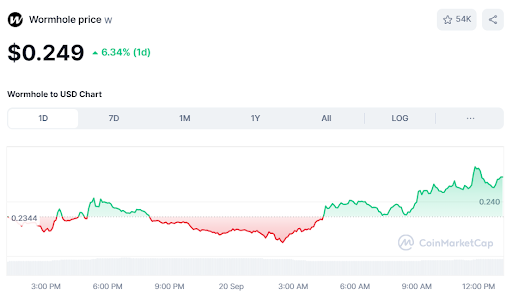

- W token surged 6.35% following the announcement, signaling strong market interest.

Securitize, a major player in real-world asset tokenization, partnered with the Wormhole Foundation to make cross-chain interoperability a reality for all assets tokenized on its platform. The goal of this partnership is to integrate with Wormhole’s interoperability solutions, allowing tokenized assets to move seamlessly across different blockchain ecosystems.

With this integration, Securitize will use Wormhole as its go-to provider for blockchain interoperability. This ensures that all current and future tokenized assets on the platform can flow across multiple blockchain networks easily.

This move is particularly important for institutional investors who want more flexibility in managing their assets across a wider variety of compliant digital asset ecosystems. Carlos Domingo, CEO of Securitize, underscored the importance of this integration:

“Tokenized securities need to thrive on public, permissionless blockchains to unlock the potential of blockchain technology.”

He pointed out that working with Wormhole will allow for quick, affordable transactions, pushing the industry closer to a cross-chain ecosystem for tokenized assets.

Partnership Opens Doors for Asset Issuers and Investors

This collaboration brings new opportunities for both asset issuers and investors. It strengthens the security, trust, and flexibility of cross-chain operations. Combining Securitize’s expertise in compliance with Wormhole’s secure, open-source messaging protocol, the partnership helps in greater institutional adoption of tokenized assets.

Robinson Burkey, co-founder of Wormhole, praised the collaboration as a pivotal moment for bridging traditional finance and decentralized finance.

Wormhole’s Token Sees Price Jump

The announcement has had a positive effect on the platform’s native token, “W.” As of now, W has surged by 6.35%, trading at $0.249. Most of these gains occurred just a few hours after the announcement, following a period of declines earlier in the day.

Even before joining forces with Wormhole, Securitize had formed strategic partnerships with major asset managers like BlackRock, Hamilton Lane InvestCorp, and KKR to bridge the gap between traditional finance and digital assets.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/w-token-price-surges-6-35-on-securitize-wormhole-partnership-news/