- DOGS’ breakout levels nears as adoption rises, sparking a potential 13% price rally.

- Traders watch DOGS as bullish indicators and rising adoption hint at an imminent breakout.

Recent analysis suggests that DOGS, a Telegram meme coin, could be positioned for a significant breakout despite varied market sentiment.

DOGS recently gained traction after being listed on the Coinbase futures market on the 19th of September, following its earlier listing on Binance’s spot and futures markets.

This move places DOGS in a critical position, potentially accelerating its recent price uptrend or exposing it to further downside pressure.

Recent price action and key levels to watch

DOGS traded at $0.0009937 at press time, with a 24-hour trading volume of $376,474,563, representing a 1.23% increase in the past day but a 2.49% decline over the past week.

The coin’s market cap stood at $513,223,017 with a circulating supply of 520 billion DOGS.

The price action has seen DOGS attempt to break out from the dips near the $0.00095 level, a crucial support zone that has been tested multiple times.

Technical indicators point towards a potential 13% rally from current levels, targeting the one-hour gap at $0.00106.

Key support is noted around $0.00009160, a level where buyers have historically stepped in to maintain bullish momentum.

Source: X

Resistance is seen between $0.00010200 and $0.00010600, with the next higher resistance zone between $0.00011200 and $0.00011400.

A breakout above these levels could trigger further upside, positioning DOGS for a notable move.

Importance of breakout levels near $0.00095

The $0.00095 level was critical for DOGS, as it represented a potential launching point for upward price movements. Holding above this level suggests strong buyer interest and reduces the likelihood of a deeper correction.

Breaking below this zone, however, could expose DOGS to additional downside risk.

Traders are closely watching the resistance around $0.00106, which, if breached, could validate the bullish scenario and encourage more buyers to enter the market.

The Coinglass derivatives data reflected a 15.55% decline in trading volume to $63.11M, indicating reduced market activity.

However, Open Interest has increased by 5.31% to $146.20M, demonstrating heightened trader engagement.

Long/Short ratios on major exchanges such as Binance and OKX are heavily skewed towards long positions, reflecting optimism among traders.

DOGS breakout nears amid rising adoption

The bullish case for DOGS rests on the breakout from recent dips and the push toward the $0.00106 target.

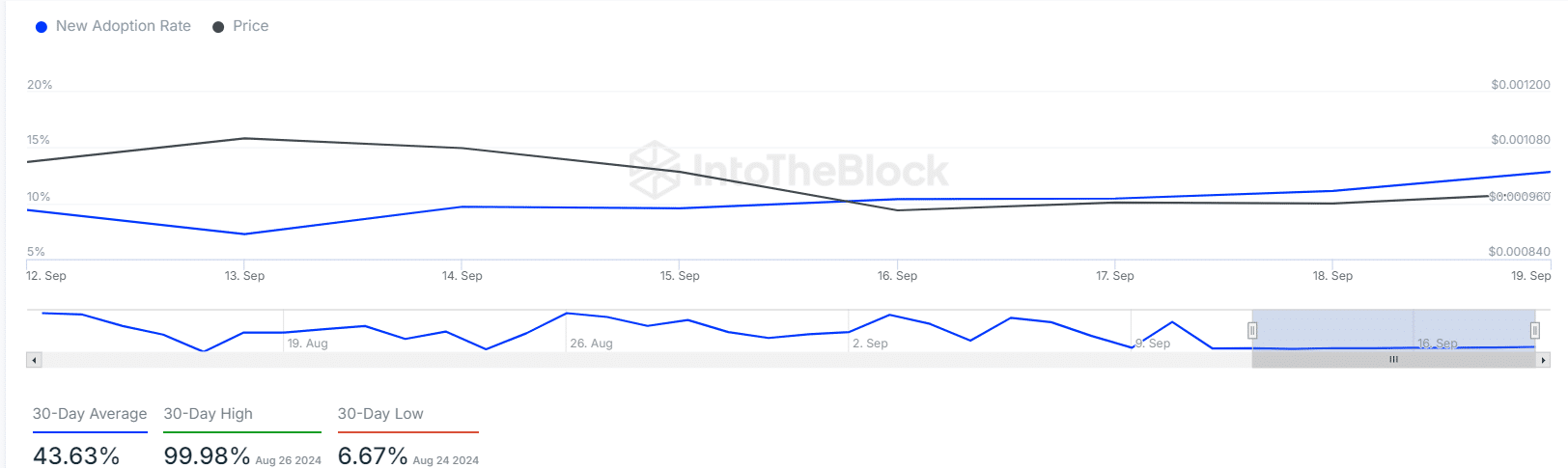

Positive on-chain metrics further support this outlook, with IntoTheBlock data showing an upward trend in new user adoption over the past week.

While the 30-day average adoption rate stands at 43.63%, recent fluctuations indicate the coin is gaining traction, albeit below its recent peak adoption levels.

Source: IntoTheBlock

Read Dogs’ [DOGS] Price Prediction 2024–2025

Risks to this bullish thesis include the possibility of a failed breakout or low trading volume failing to sustain upward momentum.

Despite mixed market sentiment, the rise in Open Interest and strong long positioning suggest that traders are gearing up for potential gains.

Source: https://ambcrypto.com/dogs-eyes-13-rally-as-adoption-rises-key-levels-to-watch/