- Crypto analyst suggests Lido (LDO) might rally to targets of $8.8, $16.6, and even $36.9.

- Despite bearish trends, key metrics indicate a potential change in market direction for LDO.

Lido [LDO] has been in a downtrend for the past year, with a 35% decline year-to-date. This bearish momentum has continued into shorter time frames, as LDO dropped by 3.3% in the last 24 hours, falling below the key psychological level of $1.

Currently, LDO is trading at $0.9919, marking a significant drop from its 24-hour high of $1.03. Despite this ongoing bearish performance, some analysts believe a potential turnaround is on the horizon.

Bullish turnaround ahead for Lido

A recent analysis by CryptoBullet on X suggests that LDO may be gearing up for a multi-month rally. According to the analyst, LDO’s weekly chart presents a “beautiful Leading Diagonal” pattern, indicating that this might be an opportune moment to buy the asset.

Source: CryptoBullet on X

The analyst noted:

“I like this chart. Beautiful Leading Diagonal. If you wanted to buy LDO this is the sweet spot to do it imo. i’m expecting a multi-month rally”

CryptoBullet set forth three targets for the potential rally: $8.8, $16.6 (the main target), and $36.9 if the bullish momentum intensifies. While this outlook appears promising, it is worth delving into LDO’s fundamental metrics to assess the likelihood of such a rally.

Active addresses and open interest

Examining LDO’s fundamentals provides insight into the asset’s current state. One critical metric is retail interest, reflected in the number of active addresses interacting with the network.

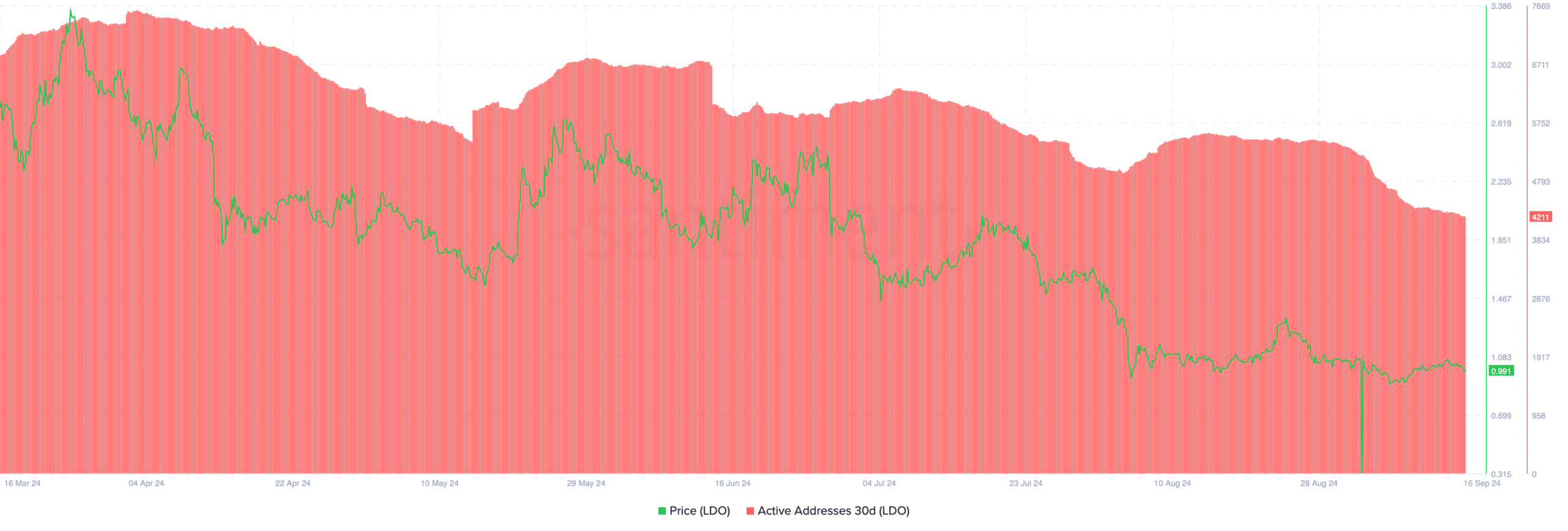

Data from Santiment reveals a consistent decline in LDO’s active addresses since peaking at over 7,500 in April. The latest figures show that this metric now sits at 4,211, representing nearly a 5% drop from the 5,000 active addresses recorded last month.

Source: Santiment

This decline in active addresses suggests waning retail interest in LDO, which could have implications for its price action. Typically, a decrease in active addresses indicates reduced network activity, potentially signaling a lack of engagement or confidence among retail investors.

This drop may exert additional downward pressure on LDO’s price in the short term, making it challenging for the asset to break out of its current bearish trend.

However, if the predicted rally materializes and market sentiment shifts, an increase in active addresses could follow, indicating renewed investor interest.

In addition to retail activity, examining open interest provides a broader view of market participants’ positions in LDO.

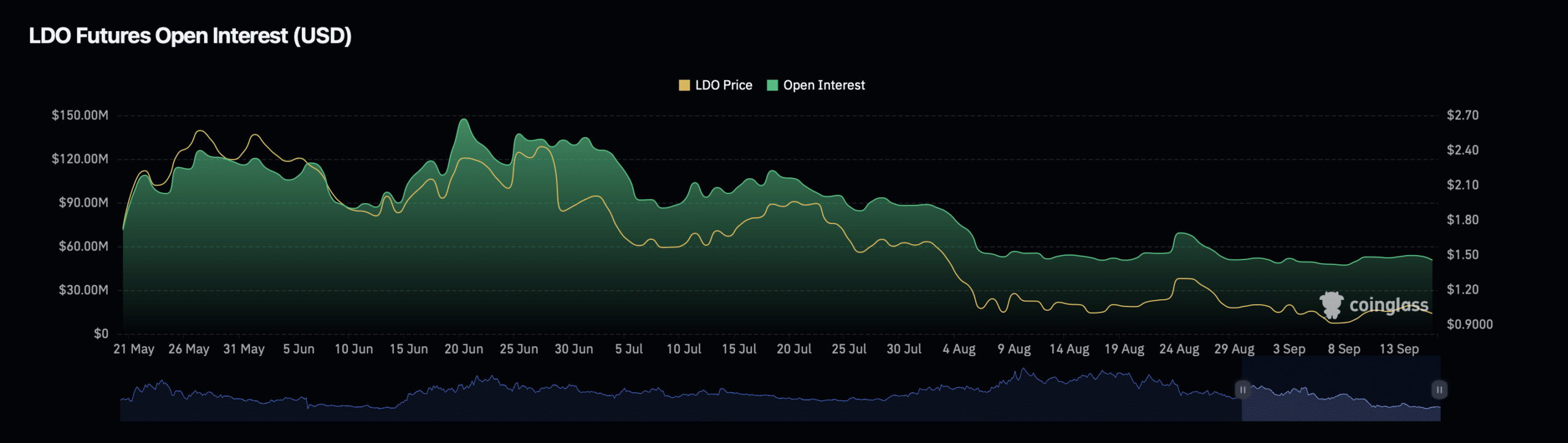

Data from Coinglass indicates that LDO’s open interest has declined by 3.95% to a current valuation of $49.95 million. Conversely, the asset’s open interest volume has seen a significant rise, jumping by 68.91% to $63.21 million.

Source: Coinglass

What about prices?

This divergence in open interest metrics suggests that while the total value of active contracts has decreased, the number of contracts being traded has surged.

This scenario could indicate heightened speculative activity, where traders are increasing their positions in anticipation of a potential price movement.

Realistic or not, here’s LDO’s market cap in BTC’s terms

The rise in open interest volume, despite the overall decline in open interest valuation, may imply that traders are gearing up for a possible market shift.

If the bullish forecast by CryptoBullet materializes, this increased trading activity could provide the necessary momentum for LDO to reverse its current downtrend.

Source: https://ambcrypto.com/is-lido-finally-ready-for-a-turnaround-analyst-predicts-rise-to-36/