- USDT’s supply on TON climbed to as high as $729 million in just 4 months

- TON registered gains of 24.64% in the last 7 days

Over the past week, Toncoin [TON], has seen some strong price recovery on the charts. In fact, at press time, TON was trading at $5.79 following a 4.4% hike over the last 24 hours. Over the last 7 days too, the altcoin recorded gains of close to 25%.

These gains have been by-products of greater adoption and market favourability. What has also helped is the growth of USDT on Toncoin since its integration in April 2024.

USDT supply on Toncoin hits $729 million

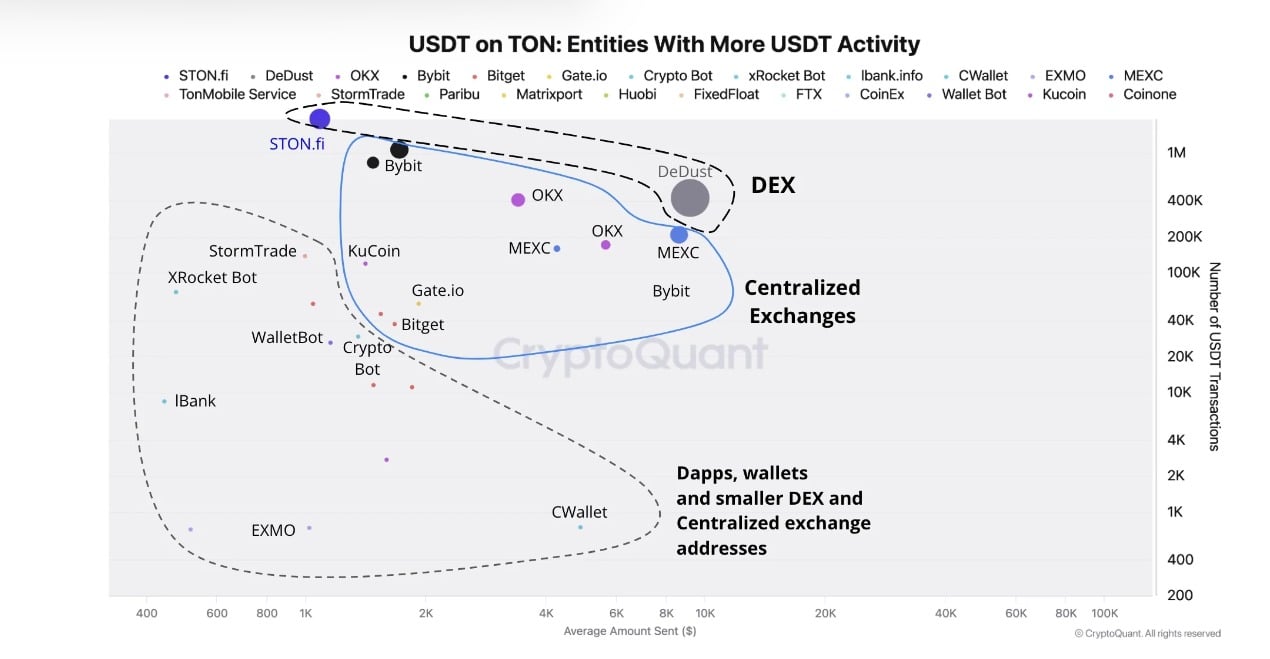

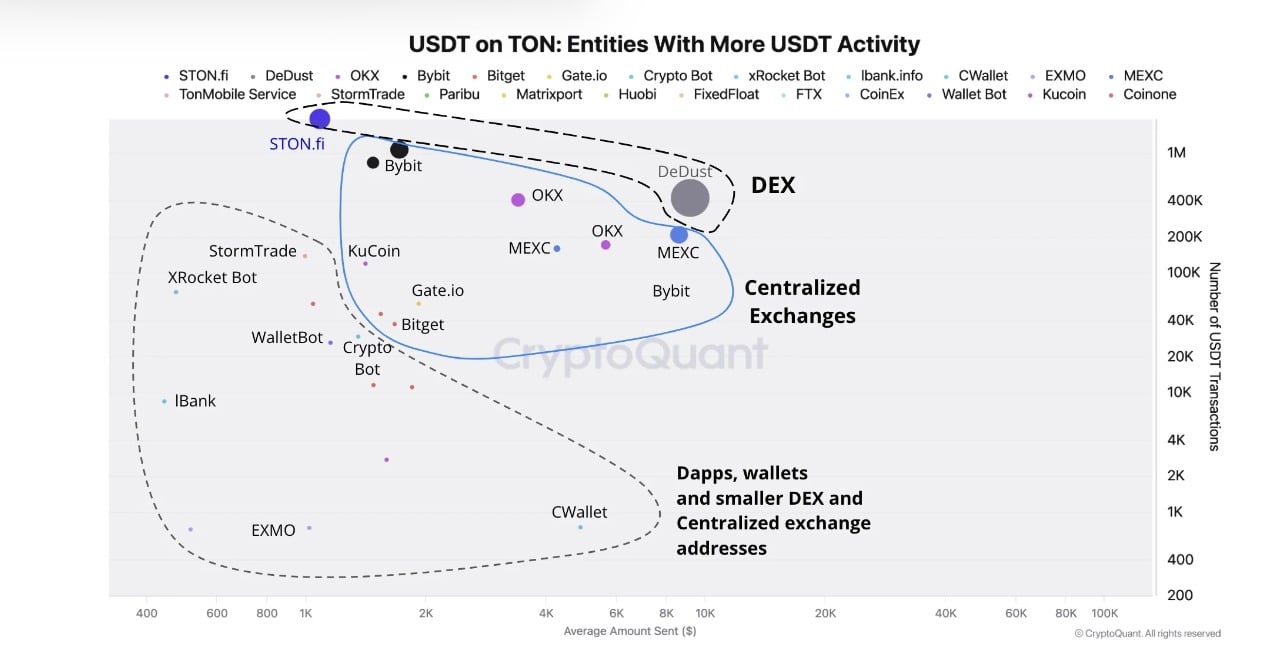

According to Cryptoquant’s analysis, the total supply of USDT on TON soared to a record high of $729 million over the last 4 months. USDT integration into TON started on 18 April 2024, with the months since seeing major growth.

Source: Cryptoquant

The scale of this growth underlined the stablecoin’s growing dominance within the TON blockchain. Undoubtedly, the integration by the TON foundation has been instrumental in attracting the stablecoins required for network expansion. Equally, the growth of USDT in supply within the blockchain has facilitated various financial transactions, while supporting the broader adoption of TON.

According to the aforementioned report, USDT’s growth in TON is also well suited for fast adoption of p2p value transfers. This has increased use by retail investors with median transfers around $15-$100. The preference by small investors is mostly driven by low median transfer fees on TON at 4 cents which makes them economically sound.

Finally, Cryptoquant’s analysis noted that USDT is also making significant moves into the Toncoin blockchain in the form of high usage in decentralized exchanges (DEXs). Thus, the DeFi ecosystem of USDT on Toncoin is predominantly being shaped by interactions from decentralized exchanges.

What does this mean for Toncoin?

Stablecoins such as USDT play a pivotal role in the cryptocurrency ecosystem by offering a stable store of value and facilitating seamless transactions.

Since USDT is the world’s largest stablecoin and most used, the integration was critically important for Toncoin. The usage of USDT helps in the adoption of Toncoin, especially for users that focus on P2P USDT transactions.

What about TON charts?

A hike in the supply of USDT on TON implies Toncoin is increasingly being adopted by users. Such market favourability positions the altcoin to make more gains.

This market phenomenon can be further illustrated by greater investor preferences.

Source: Santiment

For instance, Toncoin’s Open Interest per exchange has consistently risen over the past few months. In fact, the past week has seen Toncoin’s Open Interest in exchanges rise from $94 million to $104 million.

This is a sign that investors are continuing to open new positions while holding existing ones. This is a bullish signal, with investors anticipating further price gains.

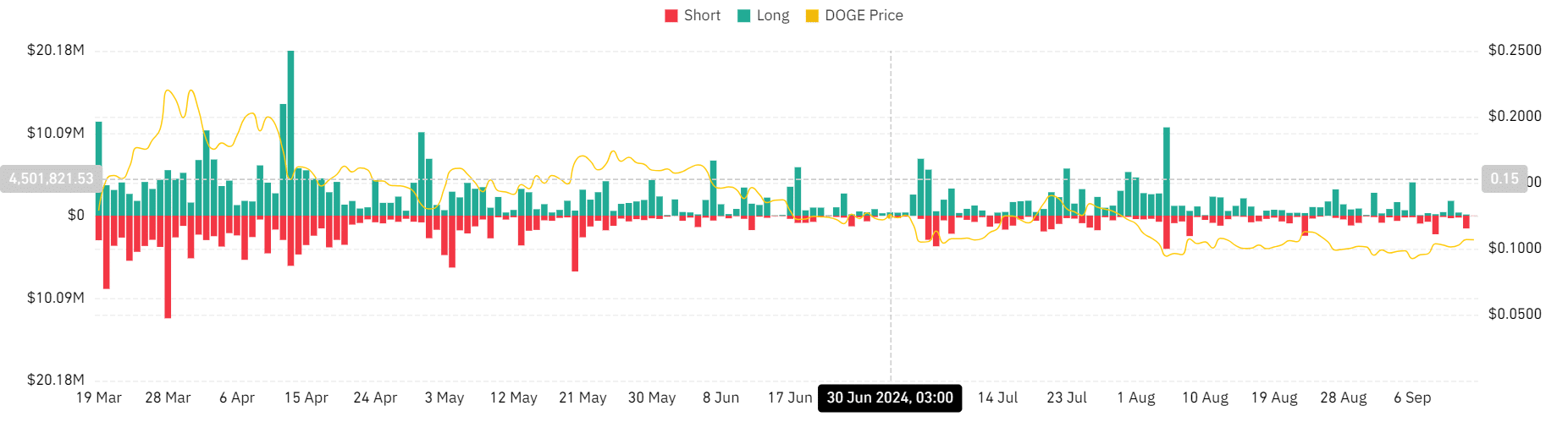

Source: Coinglass

Additionally, liquidations for TON have remained relatively low since 5 August’s market crash. For instance, the last 7 days have seen long positions liquidations drop from $4 million to $8.5k at press time.

To put it simply, TON is experiencing favourability in the market. This phenomenon can be further supported by the greater supply and interaction of USDT on Toncoin. Hence, Toncoin may be well-positioned for further gains. And, if the current conditions hold, the altcoin will challenge the $6.74 resistance level.

Source: https://ambcrypto.com/assessing-the-impact-of-usdt-supply-on-ton-hitting-729m-in-4-months/