Key Takeaways

- Bitcoin’s price increased by 2% before stabilizing ahead of the CPI data release.

- Market anticipates a rate cut at the FOMC meeting, influenced by CPI outcomes.

The price of Bitcoin surged around 2% to $57,900 on Tuesday but the rally hit a pause ahead of August Consumer Price Index (CPI) data, according to data from CoinGecko.

The key update, scheduled for release at 8:30 a.m. ET, is expected to influence the Federal Open Market Committee’s (FOMC) decision on interest rates next week.

August’s CPI report is projected to reveal a continued slowdown in inflation, with the annual rate falling to 2.5% from 2.9%. Month-over-month, consumer prices are anticipated to rise 0.2%.

If inflation continues to decline towards the Federal Reserve’s (Fed) 2% target, it would be a positive sign that the Fed’s actions are working as intended and that the economy may be able to achieve a soft landing.

The weaker-than-expected labor market has also prompted discussions among Fed officials about the need for a policy adjustment to support economic growth.

Several Fed officials, including Governor Chris Waller, have indicated it may be time to adjust the federal funds rate target range, signaling that the Fed is prepared to ease monetary policy.

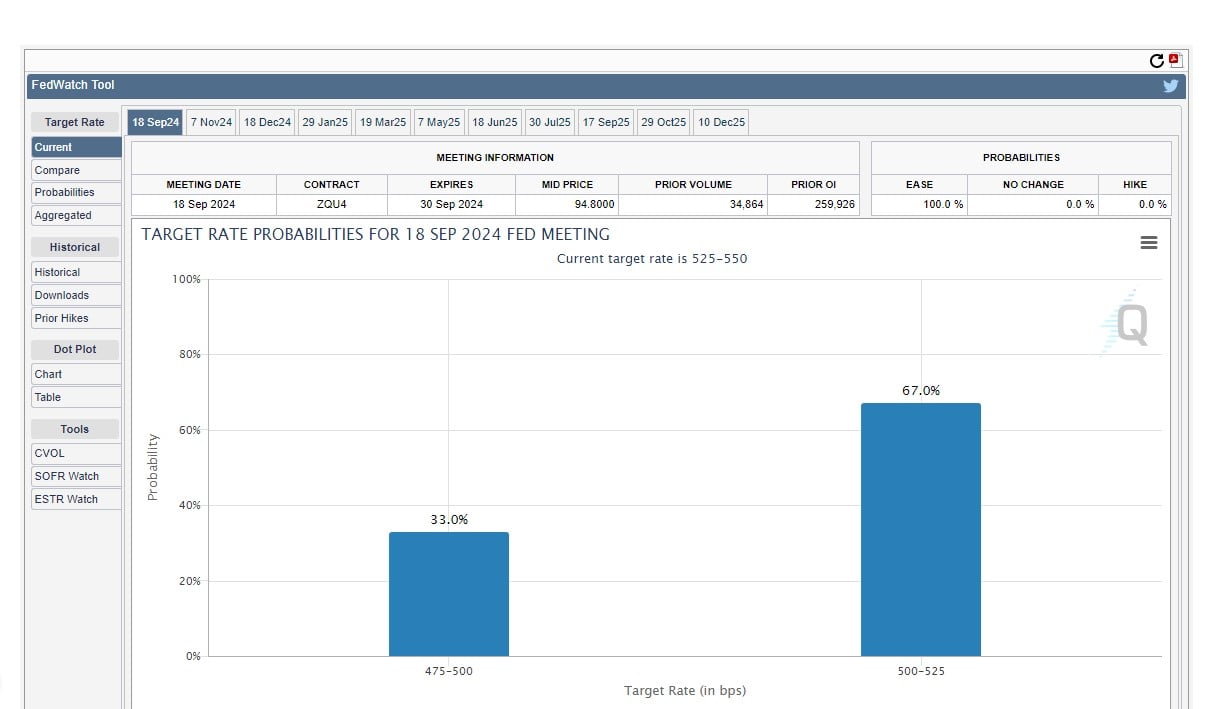

Investors are now confident that the central bank will cut interest rates at the upcoming FOMC meeting, according to the latest data from CME FedWatch. Indeed, the focus is now more on the size of the rate cut, with odds split 67/33 between a 50 basis point cut and a 25 basis point cut.

However, if inflation increases unexpectedly, financial markets, including crypto, might be caught off guard, and cuts may not be justified.

At the time of reporting, the majority of crypto assets are trading in the red. Both Bitcoin and Ethereum registered a 1% decline in the last 24 hours, currently hovering around $56,500 and $2,300, respectively, per CoinGecko’s data.

As the CPI report nears, altcoins have also begun to pull back. Among the top 100 crypto assets by market cap, Aave (AAVE) led the gains with a 12% increase over the past 24 hours, followed by Internet Computer (ICP) at 10%, per CoinGecko’s data.

During the same timeframe, Dogwifhat (WIF) experienced the largest decline, falling nearly 8%, while Arweave (AR) and Starknet (STRK) also lost ground.

The overall crypto market capitalization has decreased by 1.6% in the past 24 hours, now standing at $2.08 trillion.

Source: https://cryptobriefing.com/bitcoin-cpi-anticipation-impact/