- Global liquidity surged, with an annualized rate of over 6%

- Bitcoin seemed set to make a new all-time-high.

The growing global monetary liquidity, which is at an annualized rate of over 6%, marked the fastest growth since April 2022. This is set to impact Bitcoin [BTC].

The upward trend is following a four-year cycle, similar to the one seen in April 2020. This rising liquidity is likely to boost risk asset prices, including Bitcoin, over the medium term.

Central banks, including the Federal Reserve and ECB, are expected to implement rate cuts in the coming weeks, signaling the start of the global easing cycle.

However, short-term headwinds remain, particularly with the ongoing “unfavorable Fed liquidity environment” and a potential increase in the USD strength.

The coming weeks may present golden opportunities, particularly for Bitcoin.

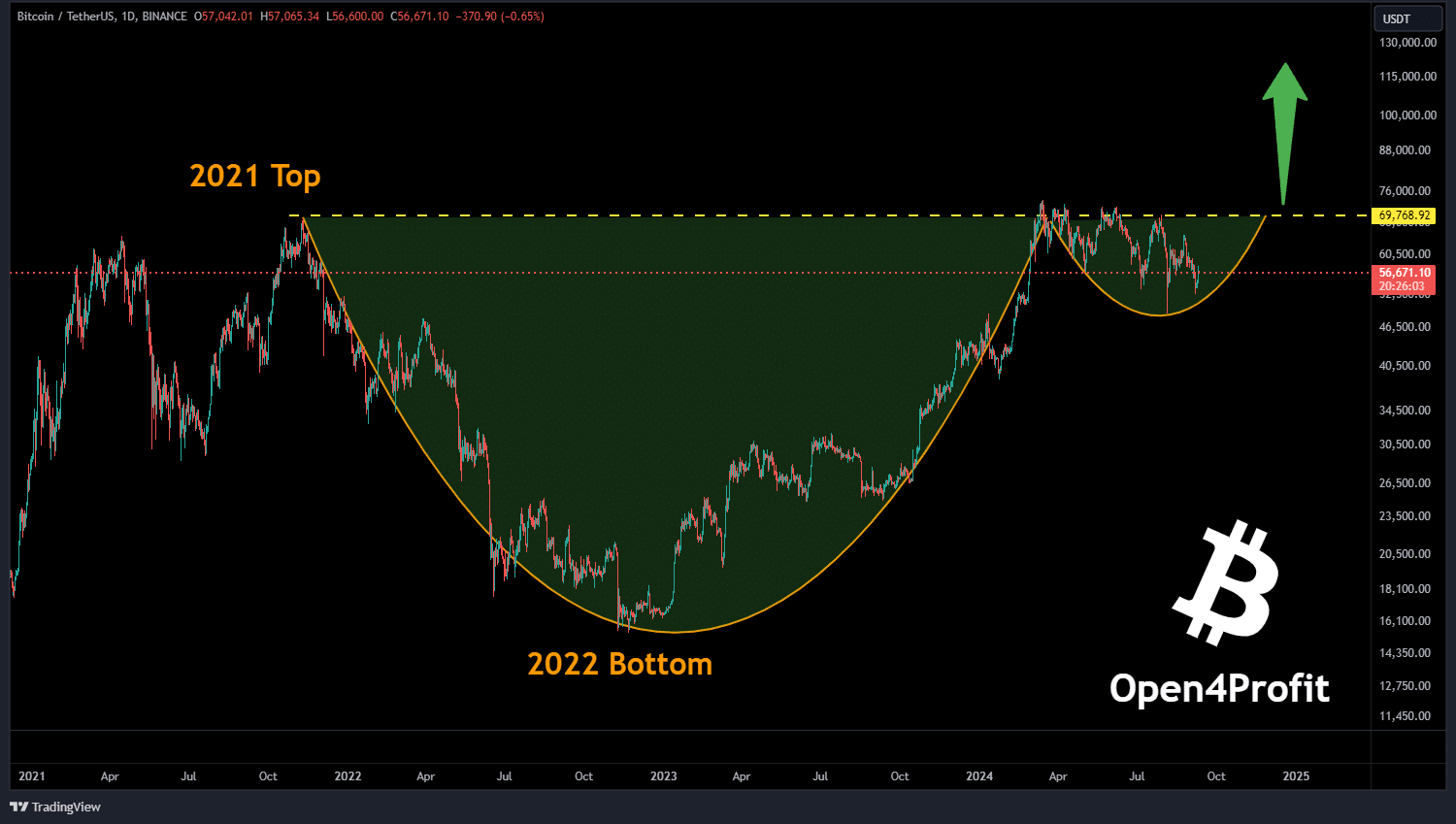

BTC’s cup & handle pattern

The surge in global liquidity will significantly impact Bitcoin’s price. Bitcoin is forming a massive cup-and-handle pattern, with a breakout anticipated around mid-September, likely during or after the Fed’s meeting.

This could trigger a major rally, signaling the start of what analysts are calling the 2024-2025 Bitcoin bull run. Investors are encouraged to hold onto their BTC and prepare for this upward momentum.

Source: TradingView

If Bitcoin breaks its ATH, the price could surge towards $100,000, especially if political events like a Trump win materialize, as some analysts suggest.

However, if BTC encounters rejection near its ATH, analysts will need to conduct further analysis, but the overall bias remains bullish.

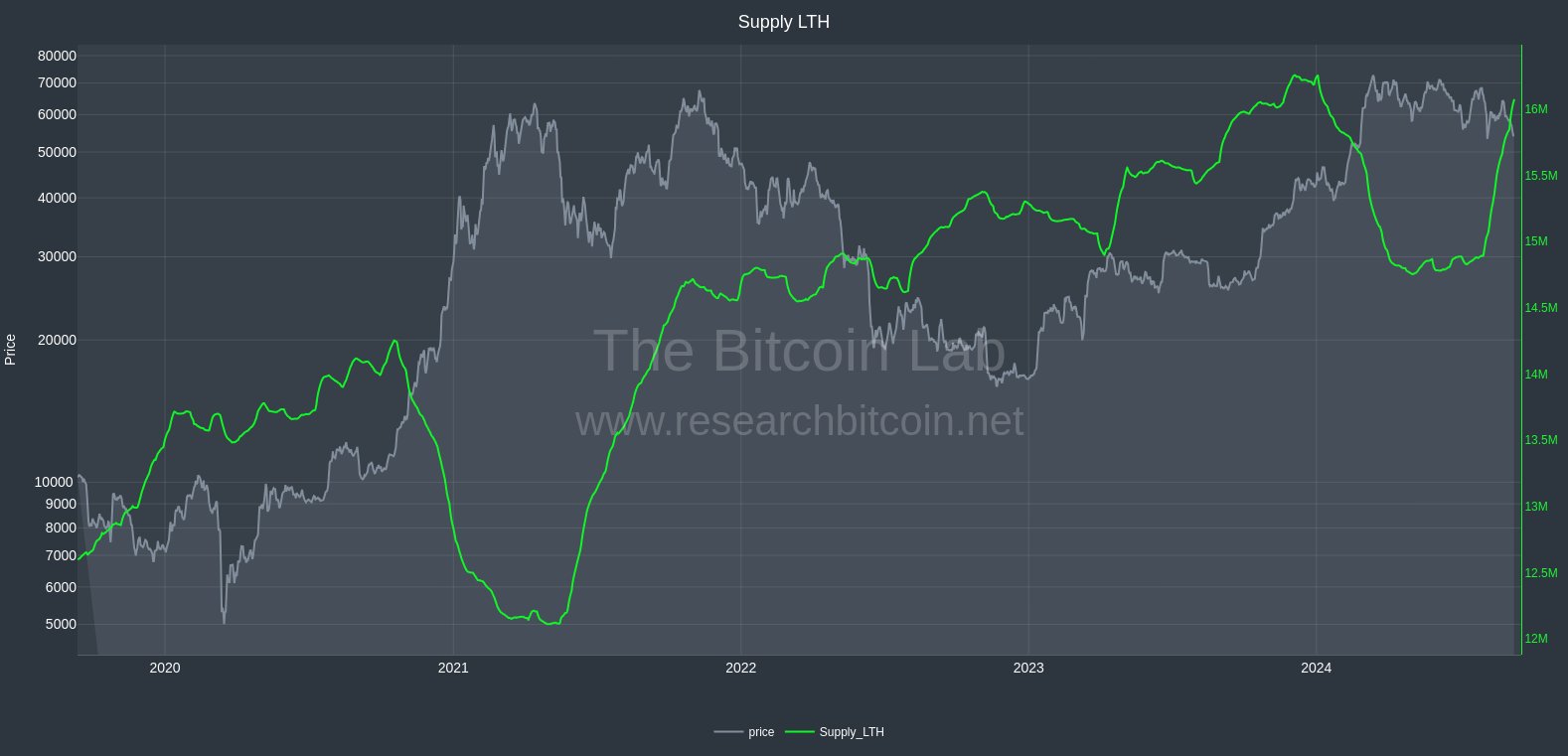

Long-term holder supply

Another bullish indicator is the Bitcoin long-term holder supply, which is nearing a new ATH.

Until press time, long-term holders have kept 16.13 million BTC for more than 155 days, with the previous ATH reaching 16.29 million BTC in December 2023.

This strong accumulation by long-term holders, including institutions, signals that core stakeholders remain committed, reinforcing the likelihood of BTC heading higher in the coming months.

Source: The Bitcoin Lab

Bitcoin volatility and Funding Rates

Bitcoin’s volatility levels have also returned near cycle highs, which could be both positive and negative for traders.

While leveraged traders might face challenges, long-term holders see this as a promising sign of upcoming price movements.

Although volatility remains lower than 2021 levels, it will likely increase as institutional players re-enter the market.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Bitcoin’s Funding Rates have stayed bullish for over a year, supporting expectations of a strong price rise.

Bulls have dominated the Futures market for 381 days. Growing global liquidity will likely keep pushing Bitcoin’s price higher in the near future.

Source: CryptoQuant

Source: https://ambcrypto.com/will-bitcoin-reach-100k-global-liquidity-push-has-the-answer/