- PEPE faces key resistance levels that could confirm a 300% rally if bullish patterns hold

- Short positions at risk of liquidations could trigger a massive price surge

PEPE Coin (PEPE) has been under close observation by traders and analysts alike after breaking below a key support level. The drop established a new low for September, yet there remains optimism for a significant price rebound.

According to Captain Faibik, a crypto analyst, the token may be gearing up for a major rally in the fourth quarter of 2024.

His prediction suggests,

“$PEPE Still Consolidating inside the Bullish Symmetrical Triangle & Still I’m Bullish on it..!! Looks Primed for another +300% Bullish Rally in Q4.”

Source: X

At the time of writing, PEPE was trading at $0.057447, with a 24-hour trading volume of over $1.1 billion. This represented a 5.03% price hike in the last 24 hours.

However, despite a 1.26% decline over the past seven days, the market remains intrigued by the token’s future trajectory.

Hike in short liquidation positions

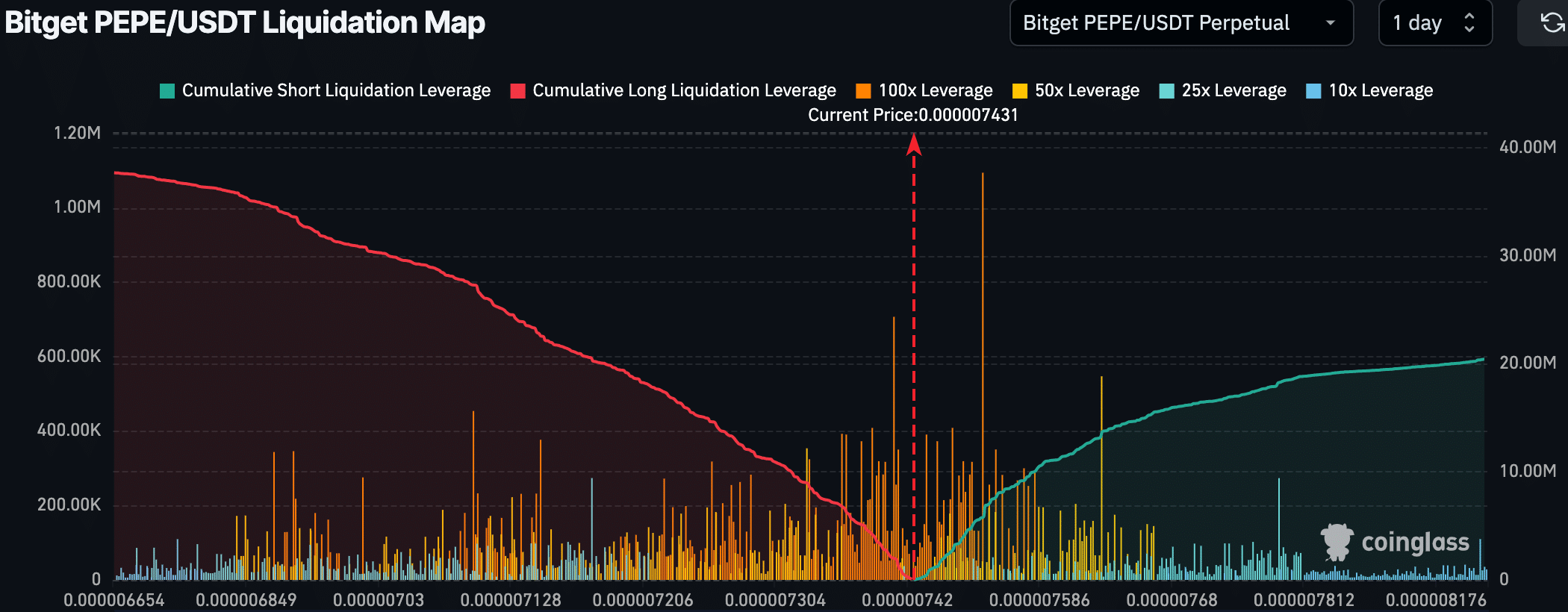

PEPE’s price movement is closely tied to Futures market activity, as shown by the latest liquidation map from Coinglass. The cumulative short liquidation leverage is considerably higher than the long liquidation leverage.

Short positions totaling around 20 million USDT are at risk of liquidation if the price hikes, indicating that a large portion of traders are betting on further price drops. This imbalance could create upward pressure, as a price rally might trigger a cascade of short liquidations, potentially driving the price higher.

Source: Coinglass

Futures traders should thus be cautious. Especially as the strong presence of short positions means that sudden upward movement could accelerate gains for PEPE if liquidation levels are breached.

Transaction activity and market sentiment

Additionally, IntoTheBlock data showed fluctuations in large transactions involving PEPE between 2 September and 9 September. The highest transaction activity occurred on 6 September, with 217 large transfers, while 3 September saw only 80 transactions.

Over the last 24 hours, 103 large transactions were recorded. This indicated moderate market activity as traders awaited clearer signals for PEPE’s next move.

Source: IntoTheBlock

Address data also provided some insights into PEPE’s growing user base. As of 9 September, the number of PEPE addresses had hit 3.18k, with 585 new addresses created over the past week.

In fact, active addresses rose by 6.54%, reflecting a growing interest in the token despite its recent price struggles. On the contrary, new address creation slowed by 13.84% – A sign of mixed market sentiment.

Source: IntoTheBlock

Key technical indicators – Resistance and momentum

PEPE’s daily chart showed that the coin has been attempting to recover from its recent price drop. At press time, it was trading just below two crucial resistance levels— The 50-day EMA at 0.00000839 and the 100-day EMA at 0.00000897.

For PEPE to confirm a bullish reversal, it needs to break above these levels. Failure to do so could lead to further price stagnation or a sustained downward trend.

Source: TradingView

Meanwhile, the Relative Strength Index (RSI) stood at 46.55, indicating neutral momentum but leaning slightly bearish.

This might place PEPE in a delicate position, especially with the MACD indicator also signaling weakening bearish momentum. However, the MACD line seemed to be approaching a bullish crossover, which, if completed, could support a potential price hike.

Source: https://ambcrypto.com/pepe-a-300-rally-on-the-cards-this-bullish-pattern-could-be-key/