- Aave outperformed most crypto coins at press time.

- Aave’s funding rates showed bullish bias.

Aave [AAVE] appears poised to continue outperforming other cryptocurrencies, with the AAVE/BTC chart demonstrating this trend.

The AAVE/USDT pair has been steadily rising, forming higher highs and higher lows. Recently, the weekly candle closed above the true close of a consolidation range that has lasted over 800 days.

Should AAVE’s price experience a pullback on the daily chart, the $108 support zone will be critical.

As long as the price stays above this zone, the resistance levels may serve as potential price targets.

Source: TradingView

If it maintains its price above the $150 level, it could aim for the $200 mark before this cycle ends.

However, it is highly probable that Aave will reach the $108 price level before advancing toward the $200 target.

Funding rates turn green

Funding rates for have turned green, according to the Hyblock Capital tool, which indicates growing trader optimism about Aave’s price potential.

Positive funding rates suggest rising demand for long positions, creating upward momentum as the market anticipates higher prices.

Combined with the current price action of AAVE/USDT, Aave is likely to move higher.

Source: Hyblock Capital

However, if it shows significant downward movement, it might be best to stay on the sidelines or cut losses.

Market performance

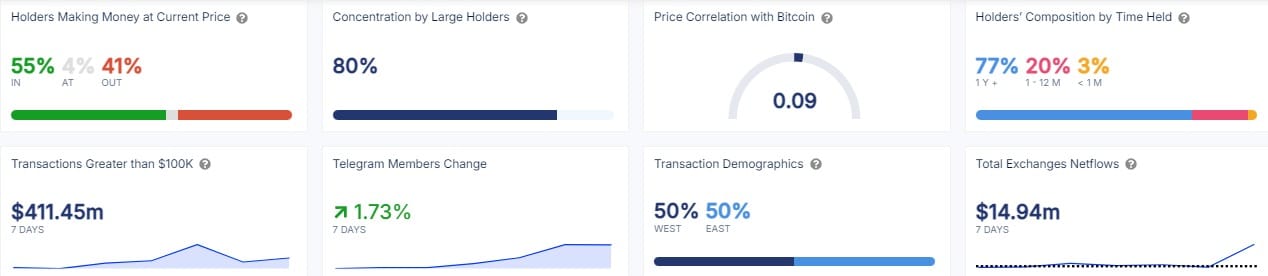

It’s market performance further supports this bullish outlook. Currently, more than 55% of Aave holders are making a profit at the current price level.

This is a positive indicator, as these holders are less likely to liquidate their positions. Furthermore, 80% of Aave’s supply is concentrated among large holders, adding to the expectation of an upward trend.

A large portion, around 77% of Aave holders, have held their tokens for over a year.

Source: IntoTheBlock

Additionally, large transactions exceeding $100K have totaled more than $411 million, and Telegram membership has increased by 1.73%.

Net exchange inflows currently stand at $14.94 million in the last 7 days, providing additional support for a potential price rise.

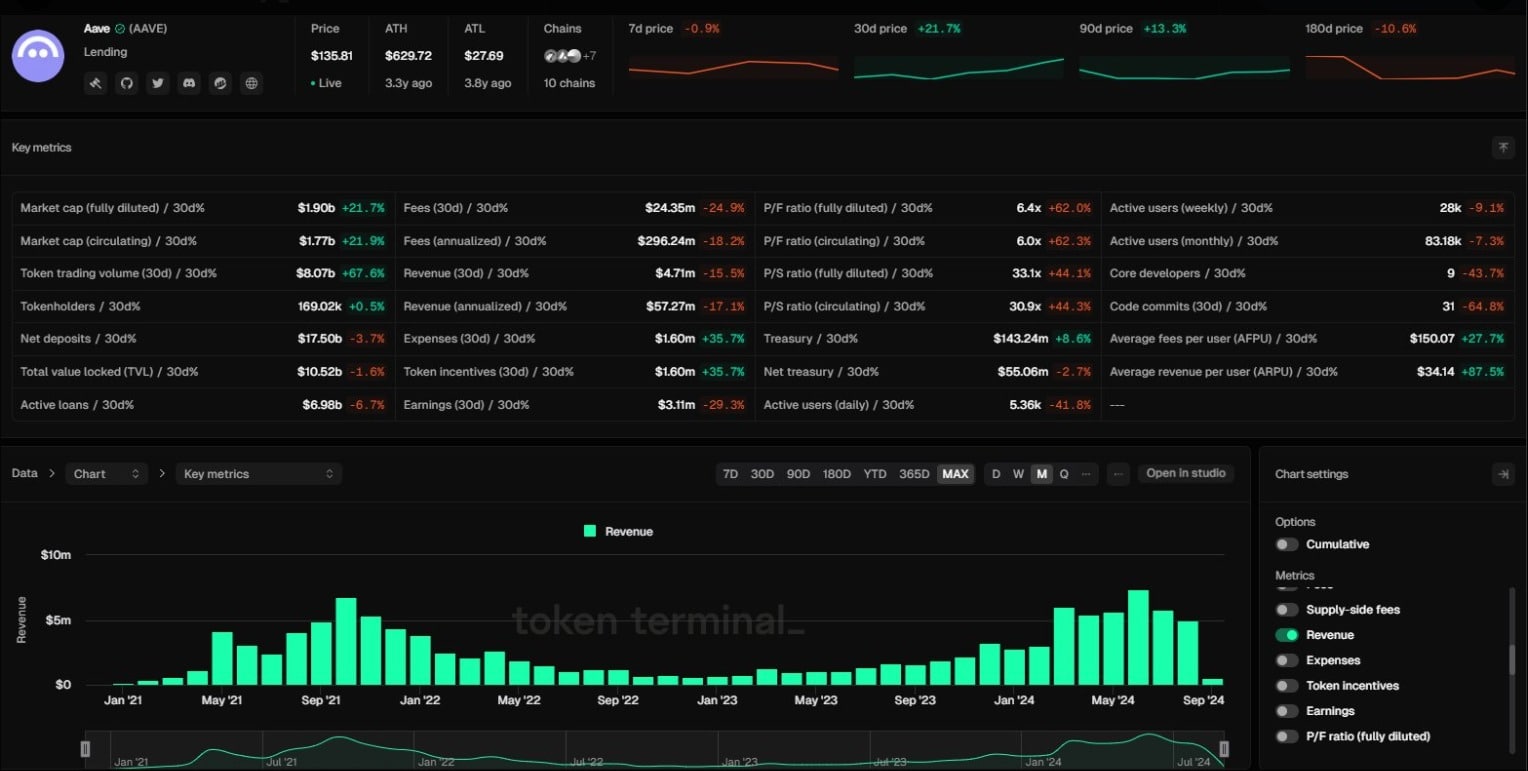

Monthly revenue on the rise

In terms of revenue, Aave has surpassed the previous cycle’s monthly revenue high. Aave now generates $1 million in weekly revenue while distributing only $327K in AAVE incentives.

It’s also one of the few protocols that have exceeded their prior revenue peaks, generating $7.3 million in July 2024, which is about 9% higher than the October 2021 figures.

Read Aave’s [AAVE] Price Prediction 2024–2025

The protocol has gained market share from its peers over the past two years, showcasing product-market fit (PMF).

Source: Token Terminal

Additionally, a proposal introduced in July 2024, which suggested adding a fee switch to return some of the platform’s net excess revenue back to token holders, has further supported the token’s strong price performance this year.

Source: https://ambcrypto.com/is-aave-the-next-big-crypto-winner-what-indicators-tell-you/