- RUNE’s price dropped by 70% in the last six months alone

- Most technical indicators hinted at a trend reversal

THORChain [RUNE] recently underwent a major hard fork, one that brought new changes to the blockchain. However, the hard fork wasn’t enough to stir up bullish sentiment in the market as the token soon registered double-digit declines. Hence, it’s worth taking a closer look at what’s going on with RUNE.

THORChain’s latest hard fork

THORChain developers pushed its latest hard fork on 4 September. The upgrade brought several new updates to the blockchain, such as the removal of obsolete legacy code, upgrading the Cosmos SDK version, trimming node states for faster sync, and adding support for Bitcoin Taproot addresses.

Though this hard fork introduced several important changes, it failed to invite the market bulls. This, on the back of the token’s price dropping by 70% over the last 6 months. In fact, in the last seven days alone, RUNE’s price has dropped by double digits.

According to CoinMarketCap, RUNE’s price fell by 11% in just one week. At the time of writing, it was trading at $3.54 with a market capitalization of over $1.18 billion.

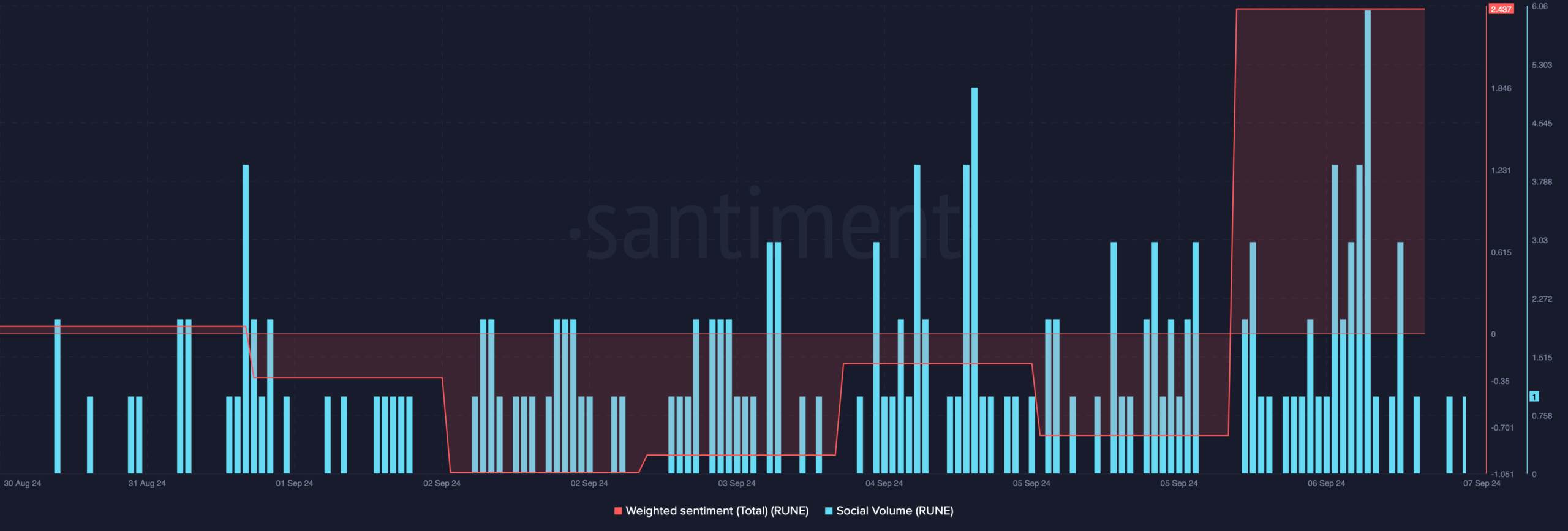

The bad news was that while the token’s price dropped, its trading volume increased. Usually, a rise in volume midst a price decline acts as a foundation for a bear rally. However, it was interesting to note that despite the price decline, RUNE’s weighted sentiment hiked. This pointed to some semblance of bullish sentiment too.

Source: Santiment

Its social volume also spiked, reflecting the token’s popularity in the crypto space.

Apart from that, AMBCrypto’s assessment of Coinglass data revealed yet another bullish signal. As per our analysis, RUNE’s long/short ratio rose. This indicated that there were more long positions in the market than short positions.

Source: Glassnode

What to expect from RUNE?

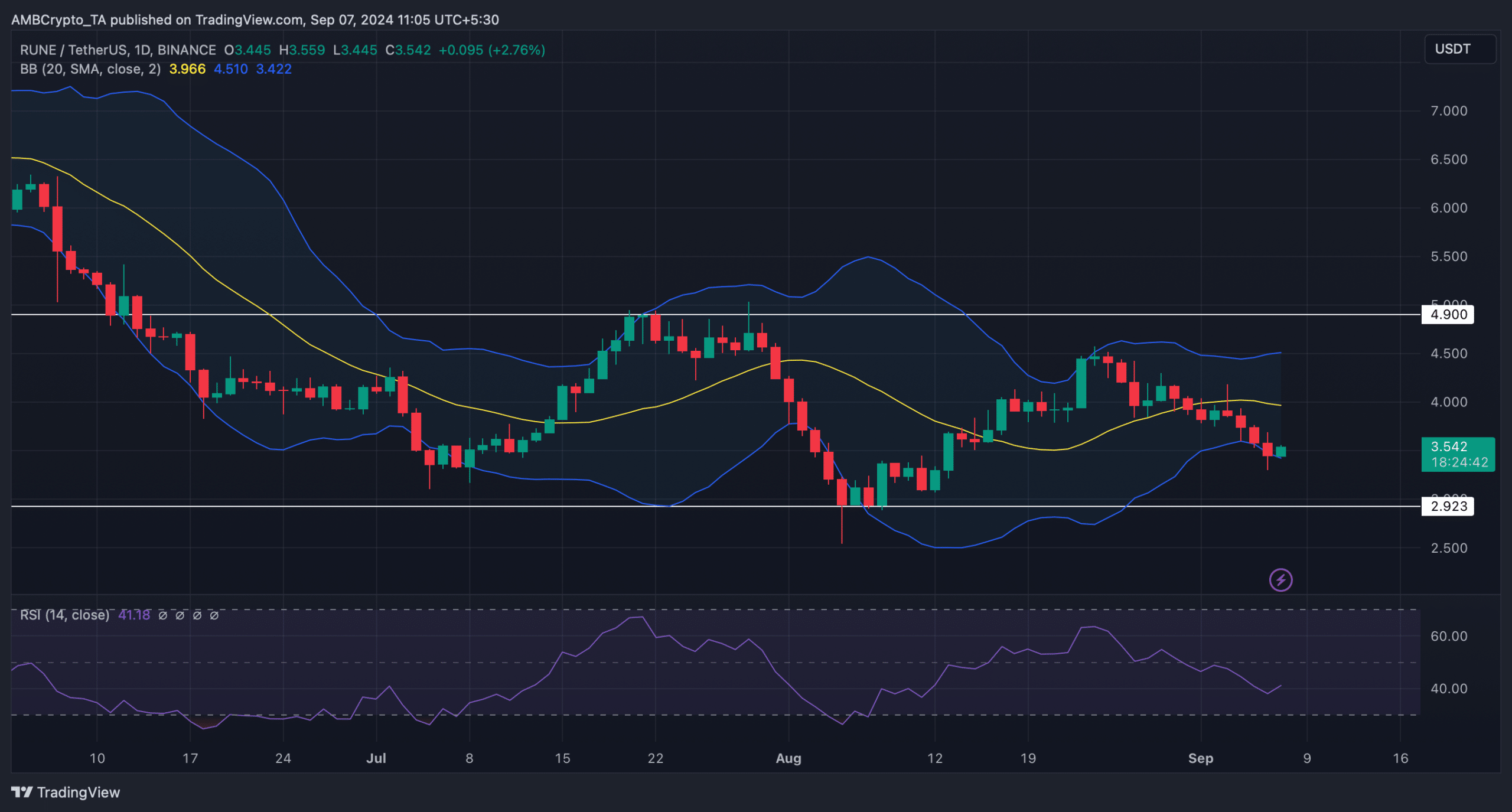

AMBCrypto then checked the token’s daily chart to find out whether the bulls can take over in the coming days. As per our analysis, RUNE’s price has been consolidating inside a parallel channel. However, there was better news.

The token’s price touched the lower limit of the Bollinger Bands, which often results in price upticks. On top of that, its Relative Strength Index (RSI) also registered an uptick, hinting at a bullish trend reversal soon.

Source: TradingView

Read THORChain [RUNE] Price Prediction 2024-25

Finally, AMBCrypto’s analysis of Hyblock Capital’s data revealed the altcoin’s upcoming targets.

As suggested by the technical indicators, if the bulls take control, then investors might witness RUNE reclaiming $4.22 in the coming days. However, in the event of a sustained price drop, it might plummet to $2.9.

Source: Hyblock Capital

Source: https://ambcrypto.com/thorchain-hard-fork-falls-short-can-rune-recover-from-its-70-drop/