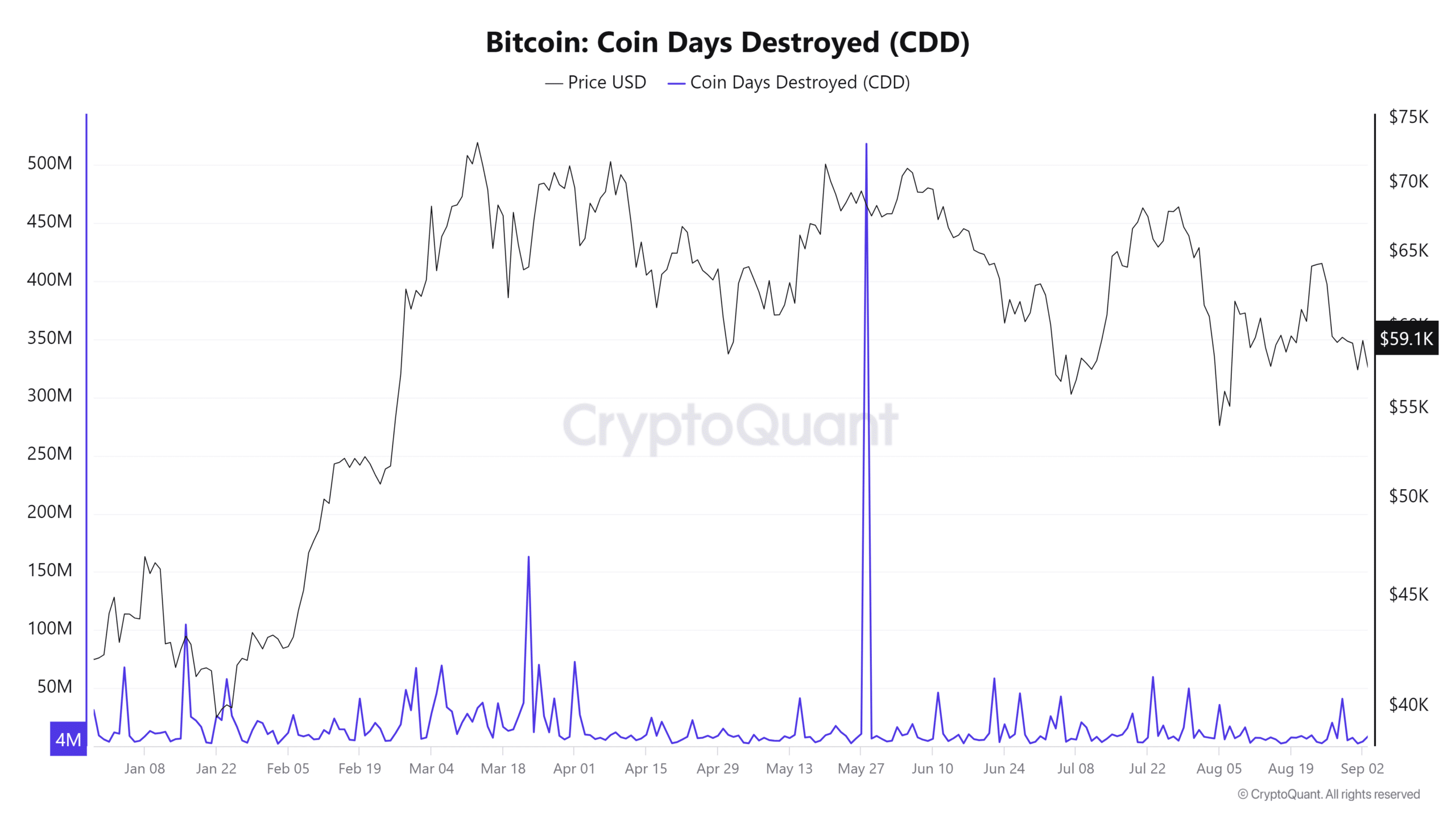

- The BTC CDD suggested that the trend was still below critical levels

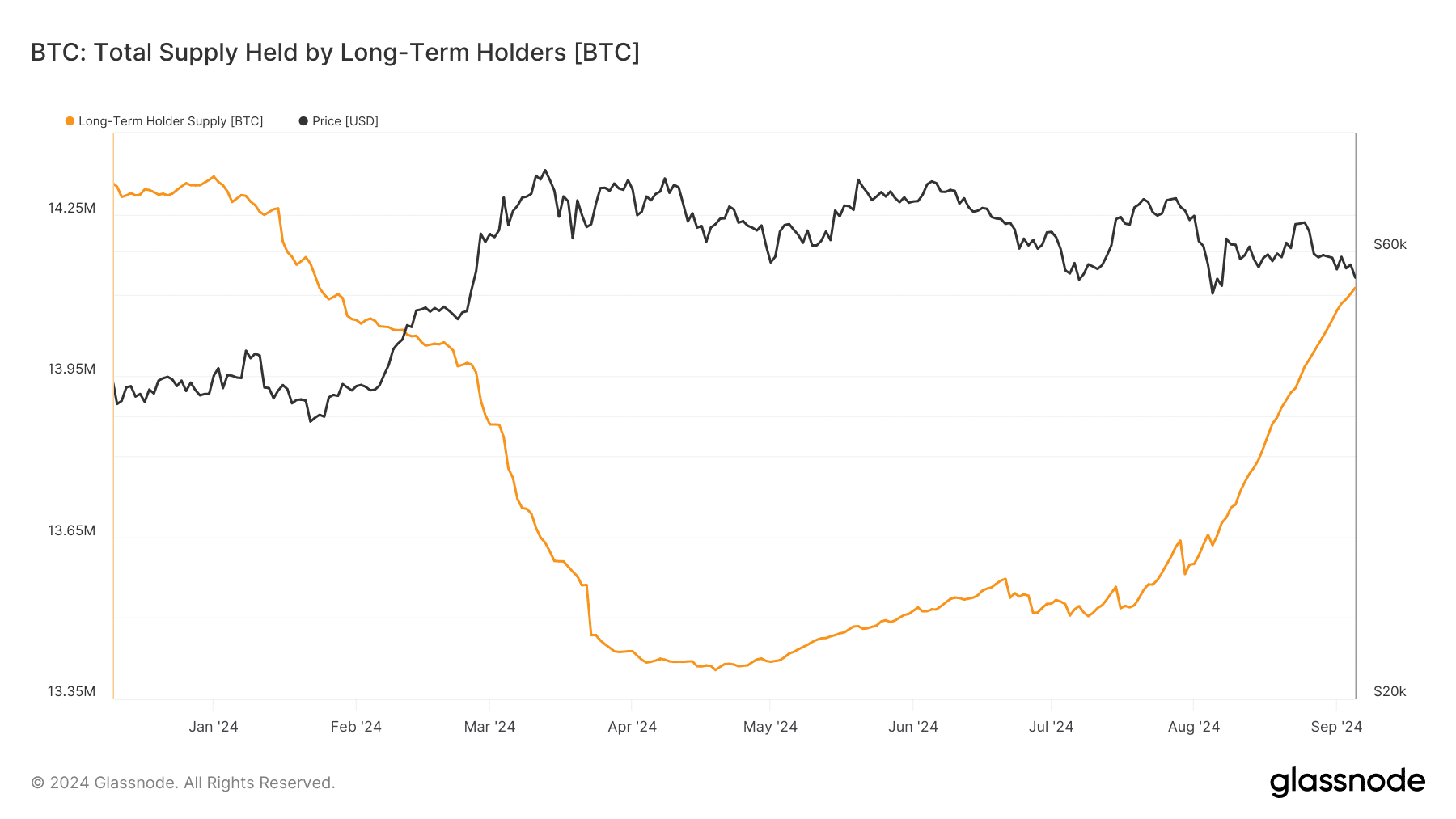

- Long-term holders have accumulated around 1 million BTC since July

In March 2024, Bitcoin hit a new all-time high. It has since sparked debates among investors about whether this marked the peak of the bull market or not. Now, while some argue this could be the final top, on-chain data suggests otherwise.

In fact, metrics like Coin Days Destroyed (CDD) seemed to indicate that the market may still have room for further upside.

Bitcoin’s top in yet?

In March 2024, Bitcoin saw a notable spike in the Coin Days Destroyed (CDD) metric, signaling that some long-term holders took profits around the all-time high. However, further analysis revealed that the CDD has not yet reached the critical “red zone.” This zone typically signals the final market top.

What this means is that while the March peak represented a significant interim high, it likely wasn’t the ultimate peak of the current cycle. By extension, the trend in the CDD metric indicated that there is still potential for further price hikes in the coming months.

Source: CryptoQuant

CDD is an important on-chain metric that tracks the movement of older, long-held Bitcoin. It provides insights into when long-term holders are selling, giving a clearer picture of the market’s maturity and possible future trends.

The fact that the CDD is yet to reach its peak implies that the bull market may still have room to grow. Especially with long-term holders showing caution but not fully exiting.

Long-term holders continue to accumulate Bitcoin

An analysis of Bitcoin Long-term Holders (LTH) supply data from Glassnode also revealed a positive sentiment that aligns with the trend observed in the Coin Days Destroyed (CDD) metric.

According to the same, these long-term holders began increasing their accumulation in July, when Bitcoin’s price started to decline.

Source: Glassnode

Between 19 July and 06 September, the supply of Bitcoin held by long-term holders has grown significantly, rising from approximately 13.5 million BTC to over 14.1 million BTC. This accumulation trend suggests that long-term holders maintain confidence in Bitcoin’s long-term prospects, despite the recent price drop, and are not exiting their positions.

This growing supply is a sign that long-term holders are capitalizing on the lower prices, reinforcing the belief that the market still has room for further upside. Especially as these key investors continue to hold and accumulate, rather than sell.

BTC falls further down the charts

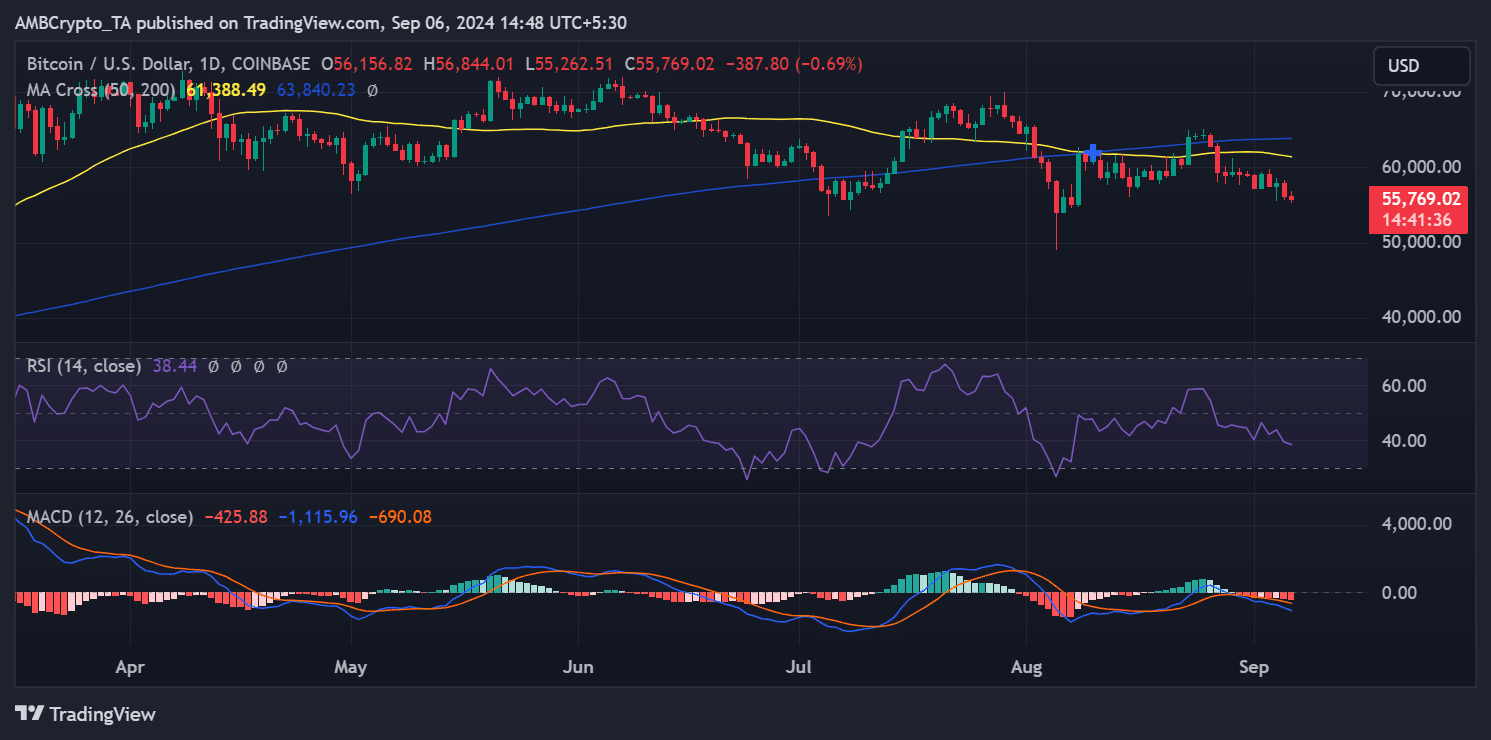

Bitcoin’s price struggle has persisted, with AMBCrypto’s analysis of its daily chart showing a decline of over 3% in the last trading session. The decline brought its price down to around $56,000. At the time of writing, the decline seemed to continue with an additional 0.7% drop, pushing the price to approximately $55,700.

Source: TradingView

The Relative Strength Index (RSI) for Bitcoin had dropped slightly below 40, indicating that it entered the oversold zone. Simply put, selling pressure may have peaked, which could signal a potential price rebound shortly.

– Read Bitcoin (BTC) Price Prediction 2024-25

However, despite the ongoing price decline, the positive trend in Bitcoin’s Long-Term Holder (LTH) supply could encourage further accumulation at this price level.

As long-term holders continue to build their positions, it may provide support for the price. This can potentially lead to stabilization or even recovery, as the market digests the downtrend.

Source: https://ambcrypto.com/one-reason-why-bitcoins-march-2024-ath-wont-stand-for-too-long/