- Over the last 24 hours, TON recorded a 6.62% increase following a public statement from Toncoin’s founder, Pavel Durov.

- This upward trend may be short-lived, as whales have yet to show increased buying activity.

Toncoin’s [TON] recent history further underscores caution; the cryptocurrency has experienced a notable decline, dropping 16.03% over the past month, with a 10.43% decrease just last week.

Founder’s public statement spurs Toncoin

After being detained by Paris authorities on the 25th of August, Pavel Durov, the founder of the Telegram-based cryptocurrency, made his first public statement rejecting allegations that Telegram operated as an “anarchic paradise.”

According to the statement, Durov asserted that the platform is,

“Driven by the intention to bring good and defend the basic rights of people, particularly in places where these rights are violated.”

This initial statement post-arrest triggered a 6.62% rise in TON’s price within 24 hours, partially reversing a 20% drop reported by AMBCrypto that occurred immediately following news of his detention.

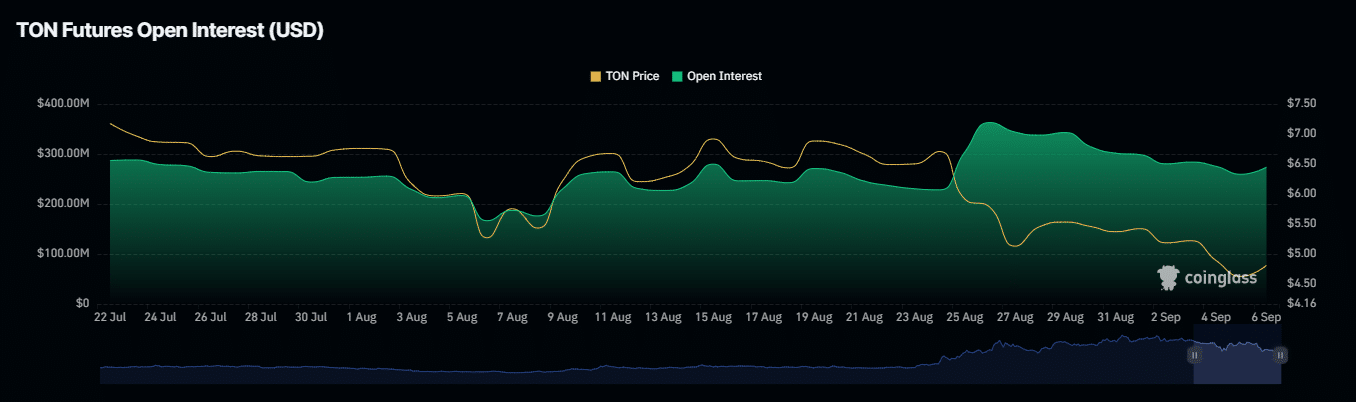

The impact of Durov’s remarks extended beyond its price fluctuations. Market confidence seemed to solidify, as evidenced by metrics like Open Interest (OI) and liquidation volumes.

Open Interest, which represents the total unsettled contracts in derivatives like futures, increased by 7.57% according to Coinglass.

This growth indicates fresh capital entering the market, possibly sustaining the bullish price trajectory. At press time, TON traded at $4.88.

Source: Coinglass

Coinglass also reported that over $646.98k of short positions were forcibly liquidated, unable to meet margin requirements amidst rising prices, from a total of more than $872.41k.

This large-scale liquidation showed the positive market sentiment post-statement.

If this optimistic outlook persists, retail investors might drive TON’s price even higher as more developments unfold. However, further analysis by AMBCrypto suggests that a sustained rally for TON is not yet confirmed.

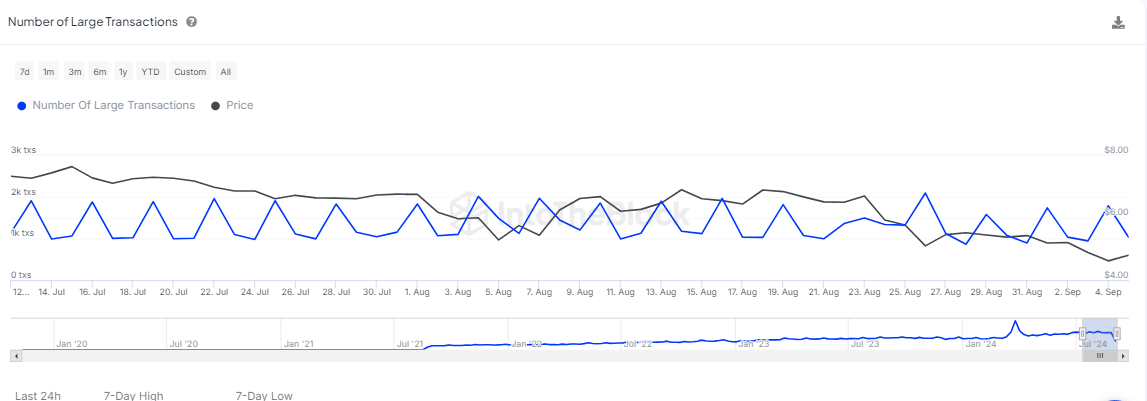

Whales remain on the sideline

Despite recent market movements, whales, who control significant amounts of TON, have not yet shown active participation in the market.

Analysis from IntoTheBlock revealed a noticeable downturn in the volume of large holder transactions, with figures declining from 1.79k to just 1.03k.

Such a reduction in large transactions, typically made by whales, suggests a lack of confidence among this influential group about the current trajectory of TON’s market recovery.

Source: IntoTheBlock

Furthermore, the overall number of active market participants —Active Addresses and New Addresses— remained low according to IntoTheBlock, reflecting a general hesitance to engage with TON.

This lack of engagement could negatively affect the market’s dynamics.

Unless there is a noticeable uptick in activity from these key players, the anticipated rally that retail traders hope for may be distant for TON.

Key movements for TON

TON has recently made a significant swing, now trading above the neckline (support) of the head and shoulders pattern it had formed—a move previously identified as bearish.

Read Toncoin’s [TON] Price Prediction 2024–2025

Should this neckline at $4.8178 establish itself as support again, it could position TON for an upward rally. According to the Fibonacci retracement, the next target would be $5.0832.

Source: Trading View

Conversely, if this support level fails, TON could continue its week-long downward trajectory. The altcoin could fall to the $4.5154 or the $4.3577 support levels, where a substantial buying cluster may exist.

Source: https://ambcrypto.com/toncoin-gains-6-62-after-pavel-durovs-statement-but-this-raises-fresh-concerns/