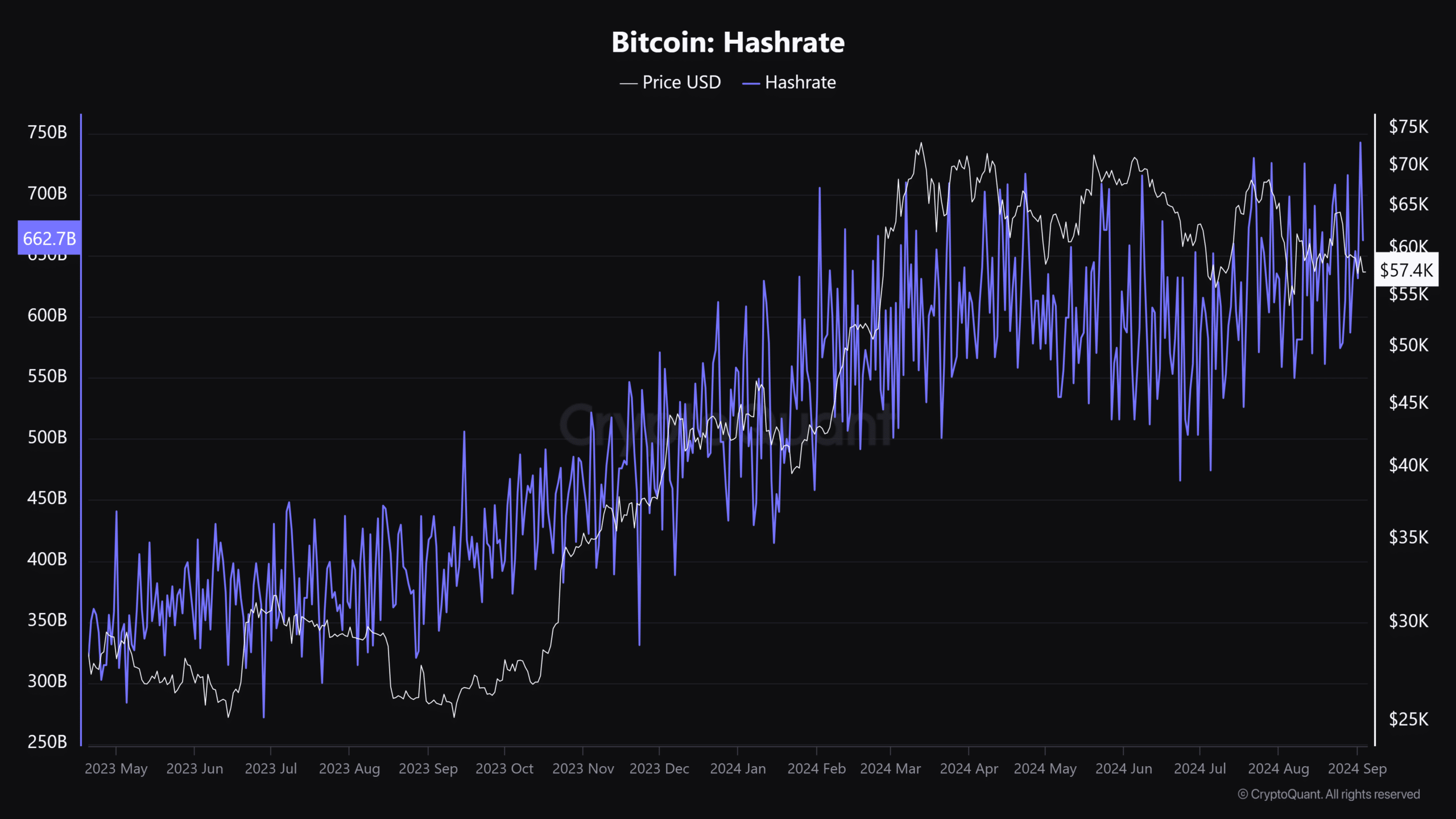

- Network hashrate surged to a record high of 742 EH in September.

- This increased mining costs and slashed miners’ profits, tipping them to sell 3000 BTC.

Bitcoin [BTC] miners had a rough start in September as network hashrate hit a record high and strained revenue. The network hashrate tracks the computational power needed to mine BTC. On the 1st of September, the metric hit a record high of 742 EH.

Source: CryptoQuant

The record hashrate is excellent because network security is much better than before.

However, the network difficulty, which tracks how difficult it is for miners to find the next BTC block, remained near its record level of 90 trillion.

Put differently, miners needed more computation power to mine Bitcoin, which was getting harder to find. In short, the average production cost to mine a single BTC would potentially increase. This could exert more strain on subscale miners.

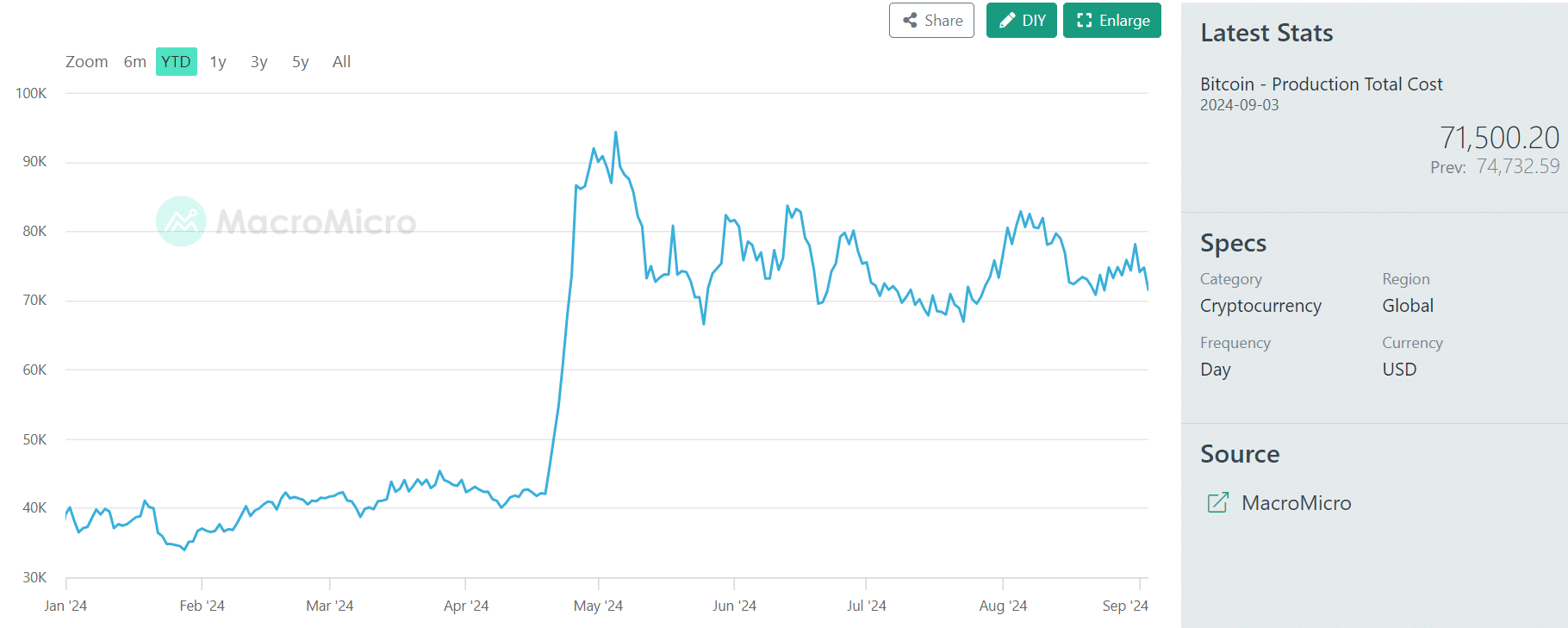

As of 3rd September, the total production cost to mine a single BTC was estimated at $71.5K. The average spot price for the asset on the same day was $57.4K. That’s a short of +$14k to mine a single coin.

Source: MacroMicro

BTC price tends to rally near its production cost in the long run. However, the huge difference at the beginning of September strained miners’ profits. Miner daily revenue had dropped from over $36 million in late August to around $26 million in September.

As a result, miners could be forced to offload their BTC holdings to cover increased production costs amid declining revenue.

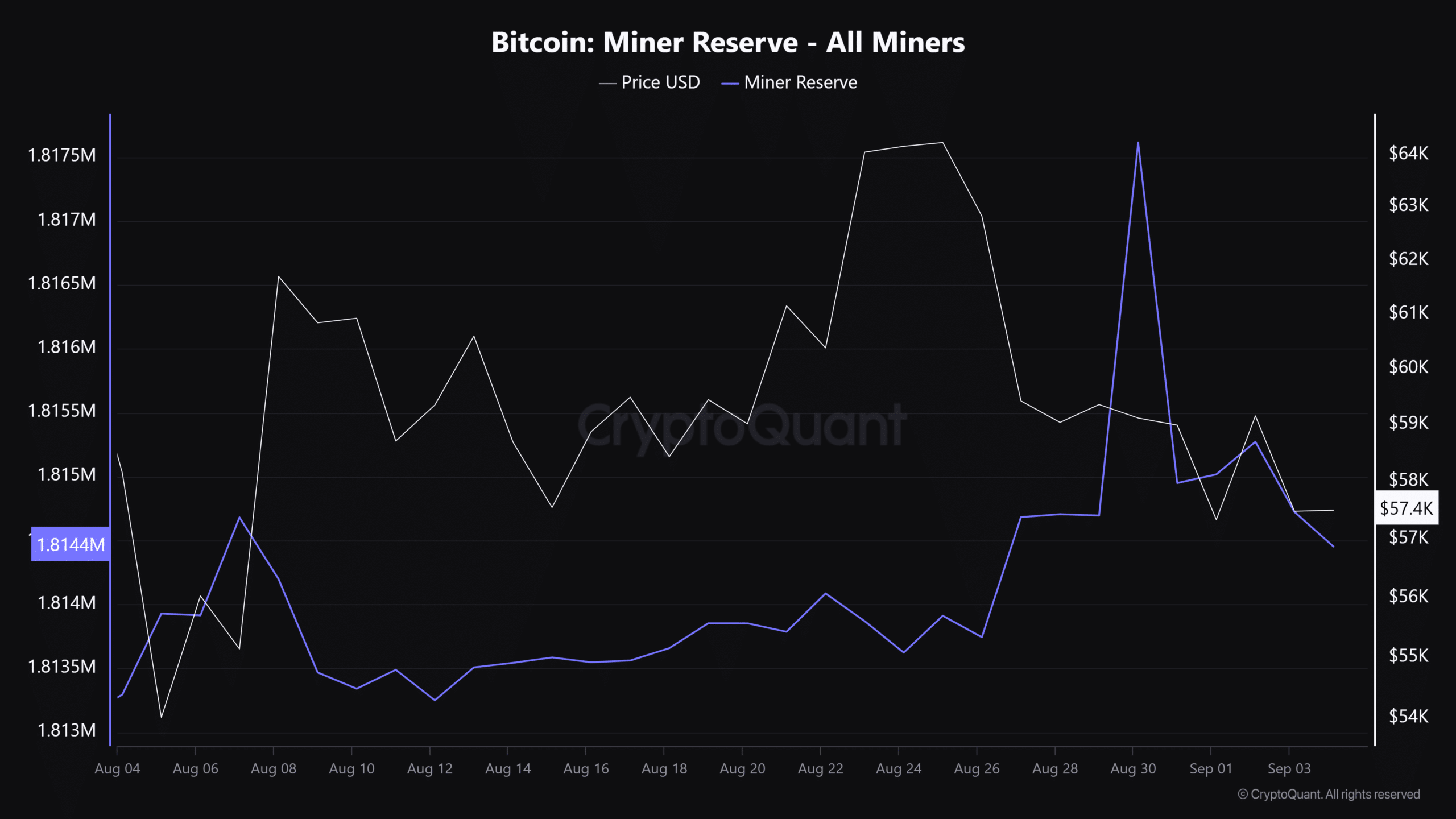

According to CryptoQuant data, the Miner Reserve dropped from 1.817 million BTC to 1.814 million coins in the past few days.

The metric tracks the total BTC held by miners, and it trended upwards in August. This meant that miners held their mined BTC and, by extension, painted a mildly bullish outlook for BTC price.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, the trend reversed at the end of August, meaning miners sold off part of their holdings. So far, miners sold off 3000 BTC in September, likely to cover the rising operational costs.

At the time of writing, BTC was valued at $57.9K. A sustained minor sell-off could put more downward pressure on the BTC price. Hence, it is worth watching this front alongside macro updates.

Source: https://ambcrypto.com/bitcoin-network-hashrate-hits-record-high-that-means-btc-will-now/