- Only 15% of Cardano investors remained in profit at press time.

- A bullish pattern appeared on ADA’s chart, hinting at a price rise.

It has been a few days since Cardano [ADA] successfully completed its Chang hard fork. However, the upgrade wasn’t enough to shake off the bears, as the token’s price charts remained in the red.

But things in the upcoming weeks might be different, as the token was consolidating inside a bull pattern at press time.

Cardano’s state after the Chang hard fork

Cardano pushed its latest Chang upgrade on the 2nd of September. The upgrade now allows ADA holders to shape Cardano’s future by electing governance representatives and voting on development proposals.

As per the official document, the Chang upgrade will usher in the Conway ledger era, a deeply transformative advancement for Cardano’s governance where any ADA holder can submit or participate in the voting process.

This upgrade will ensure transparency, inclusivity, and resilience of governance within the Cardano ecosystem.

However, despite this major upgrade, ADA remained bearish. According to CoinMarketCap, ADA was down by more than 7.5% in the last seven days.

At the time of writing, ADA was trading at $0.3243 with a market capitalization of over $11.6 billion, making it the 11th largest crypto.

As per IntoTheBlock’s data, only 691k ADA addresses were in profit, which accounted for 15% of the total number of Cardano addresses.

Source: IntoTheBlock

However, a bullish pattern appeared on the token’s daily chart, which hinted at a possible trend reversal in the coming weeks.

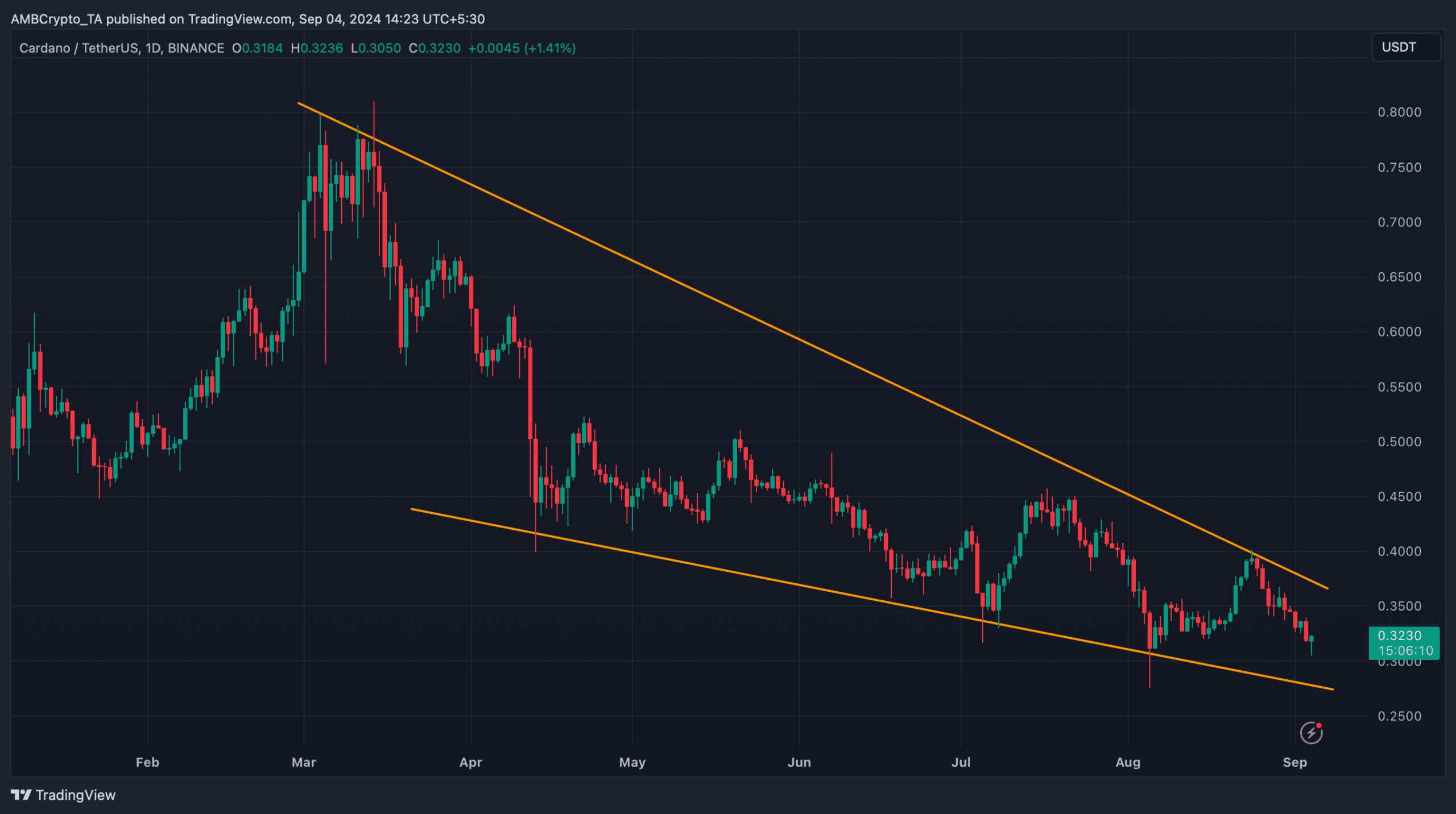

As per AMBCrypto’s analysis, a bullish falling wedge pattern emerged on ADA’s chart in March. At the time of writing, ADA was consolidating inside the pattern and might soon register a breakout.

Source: TradingView

ADA’s bull rally might be delayed

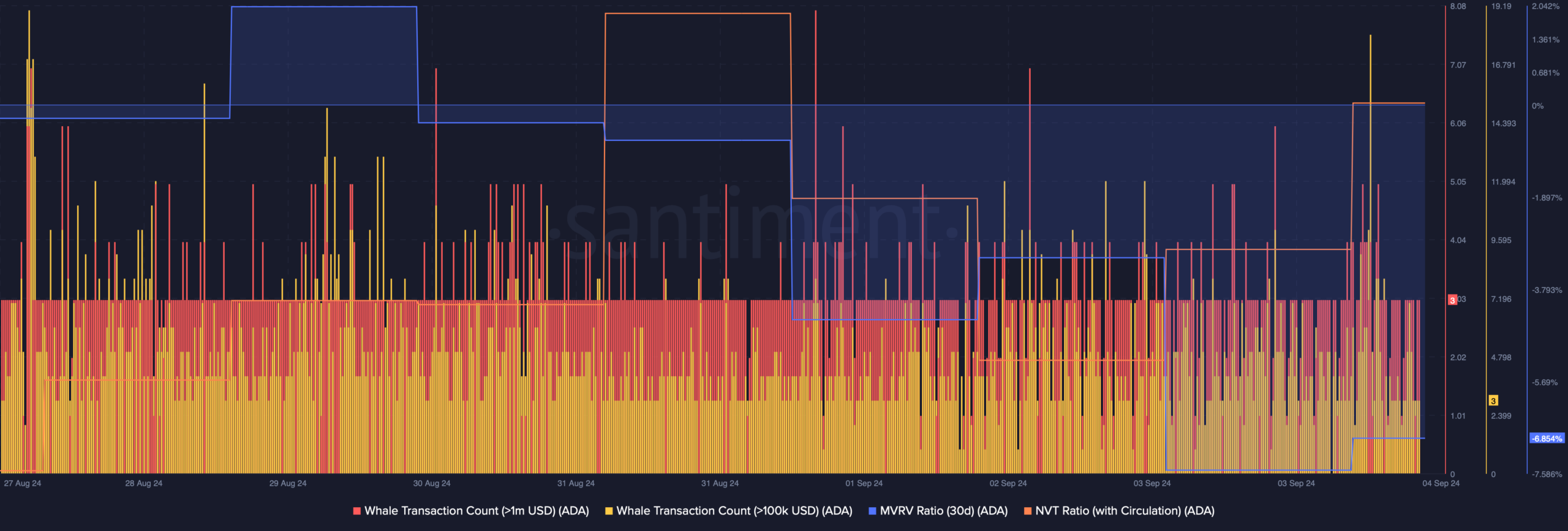

AMBCrypto then checked ADA’s on-chain data to find whether they hint at a breakout or more days of consolidation. As per our analysis of Santiment’s data, Cardano’s MVRV ratio registered a decline.

Its NVT ratio registered an uptick, signaling that the token was overvalued.

On top of that, ADA’s whale transactions increased. However, this might not be a positive signal, as most of these transactions might have been related to sell-offs, as reported by AMBCrypto earlier.

Source: Santiment

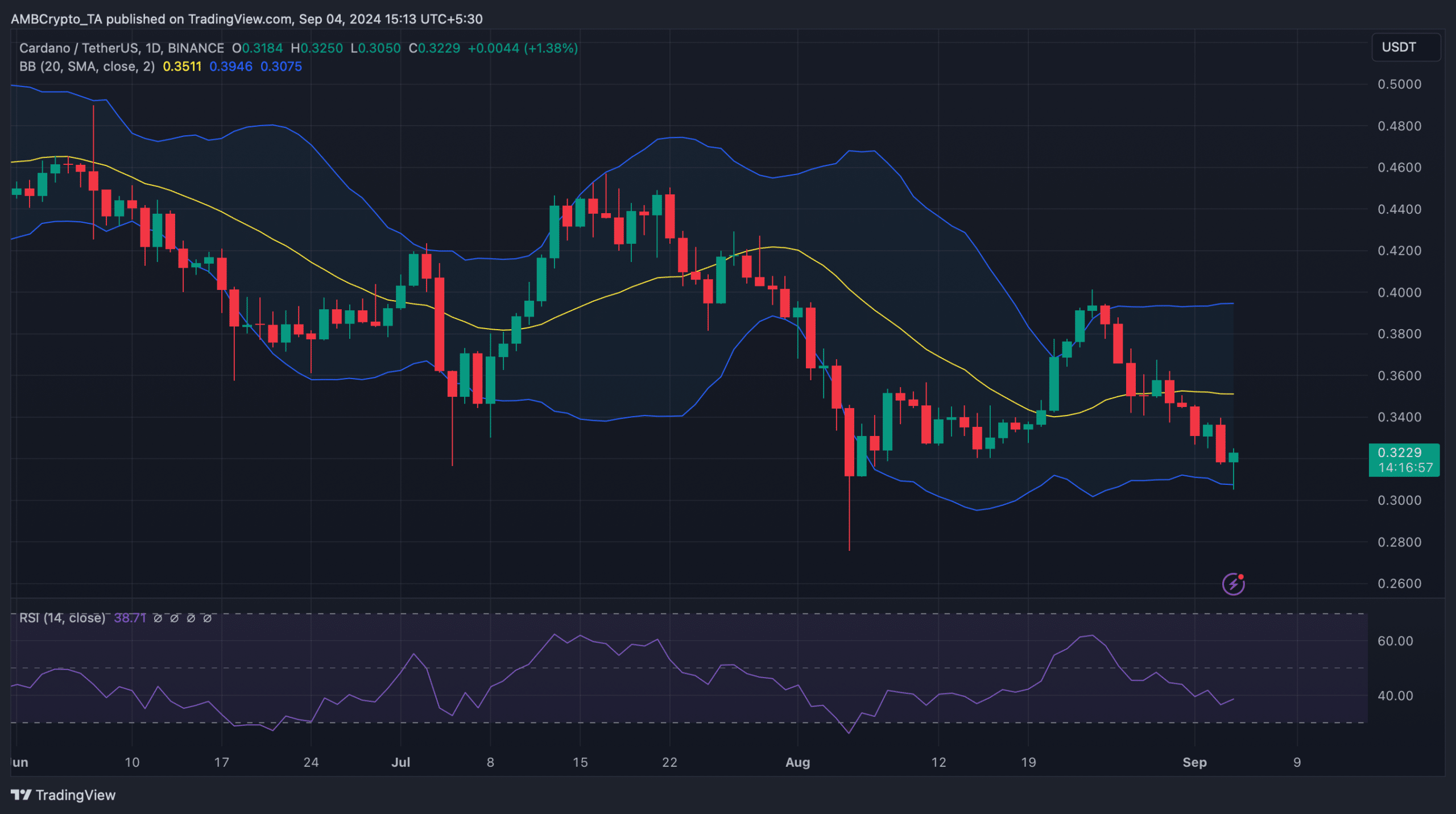

We then checked the token’s daily chart to see what market indicators suggested. The token’s price touched the lower limit of the Bollinger Bands, which often results in price increases.

Is your portfolio green? Check out the ADA Profit Calculator

Additionally, the Relative Strength Index (RSI) registered an uptick, hinting at a price hike.

Source: TradingView

AMBCrypto’s analysis of Hyblock Capital’s data revealed that if ADA turns bullish, then it might first target $0.34. However, if the bears continue to dominate, then Cardano might plummet to $0.30 in the short term.

Source: Hyblock Capital

Source: https://ambcrypto.com/cardano-dips-after-chang-hard-fork-how-soon-can-ada-recover/