News of recently leaked financial reports of Telegram have shown the instant messaging service to be a loss-making venture. In 2023, Telegram generated $342.5 million in revenue, but it did so by posting an operational loss of $108 million.

What’s interesting is that a significant portion of that revenue came from Toncoin(deemed as an Integrated wallet in the report). With the arrest of Telegram CEO Pavel Durov, questions have arisen about the reliance on the TON ecosystem to fuel financial sustainability.

A former Director of Institutional Growth shed light on the leaked Telegram financials addressing the negative stories around it. His analysis provides insights into how this integration shapes the future of both the platform and the cryptocurrency.

As a Strategic Advisor of @ton_society and former Director of Institutional Growth at TON Foundation, below is my quick take on the leaked financials of Telegram and Financial Times’ reporting.

— Justin (@maverickqe) September 2, 2024

Justin highlights TON’s importance to Telegram

Revenue Composition

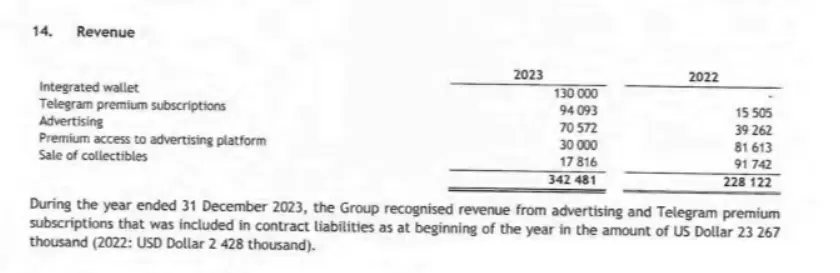

According to the report, $130 million was generated through integrated wallets, while Telegram premium subscription accounted for only $94 million of that revenue. Approximately 40% of Telegram’s 2023 revenue came from TON-related activities.

Recognition of TON be Telegram

Telegram recognizes Toncoins as non-cash considerations in its revenue disclosures by measuring them at fair value upon receipt. This practice underscores the platform’s increasing reliance on TON transactions. It has now been upgraded to broader ecosystem coins like Hamster Kombat, DOGS, Notcoin, and more.

Multi-year Agreement for Integration

In September 2023, Telegram and The Open Network (TON) Foundation signed a multi-year agreement to integrate the Telegram Wallet. An on-chain transfer of 285 million TON was made, which amounts to around $1.5 billion at current exchange rates.

Financial Reporting might not be accurate

Since Telegram’s operational cash flow is so heavily dependent on TON and the price of TON fluctuates massively, it might not be accurately reported. A revaluation of these digital assets with the current market rates will impact the company’s balance sheets and may not be fully reflected in its P&L statements.

Web3 Monetization as a form of resistance

Telegram’s move toward Web3 monetization provides resistance against central authority crackdowns. This decentralized revenue model, unlike traditional social media strategies, avoids the pitfalls of data collection and ad-driven monetization. In light of Durov’s arrest and how Telegram faces criticisms from many governments, an alternate revenue channel like this is essential.

Symbiotic Relationship

Telegram’s success is increasingly tied to TON’s growth, making their relationship more symbiotic. TON’s success is now crucial for the messaging platform’s long-term existence. New projects on the TON ecosystem, like DOGS and Hamster Kombat, further solidify this relationship as they increase traction on the app and the increased traction results in more revenue for Telegram.

Is Telegram’s future tied to TON’s growth?

Telegram’s leaked financial report, coupled with Justin’s analysis, shows its dependency on TON. It is important to note that these financial reports are from 2023. In 2024, Telegram’s revenue from “Integrated Wallets” will be much higher than 2023’s 40%. Additionally, the decentralized nature of these revenue streams offers Telegram a buffer against regulatory and operational challenges.

Independent social media platforms are notoriously hard to scale. We can see Elon Musk struggle with X’s revenue and valuation. If Telegram can get out of its financial troubles through TON, Elon Musk can certainly have a new use case to launch a new X cryptocurrency to monetize the ecosystem.

Also Read: Vitalik Buterin Unlocks 1.26M Starknet Token Worth $469k

Source: https://www.cryptonewsz.com/critical-role-of-ton-in-telegrams-monetization/