- BTC has declined by 10% over the past 30 days, yet it was in declining bullish consolidation.

- An analyst eyed a new ATH, based on previous consolidation cycles.

Bitcoin [BTC], the largest cryptocurrency, has experienced a sharp decline over the last weeks. In fact, at press time, the king coin was trading at $57736 after recording a 9.58% decline in the past week.

The month of August saw the crypto experience an extremely volatile market. The period saw the crypto drop to a local low of $49k before making a moderate recovery.

Despite the recent decline, BTC is still 16.6% above its recent local low, consolidating in a declining yet bullish trend. Equally, it was 59.94% above the yearly low of $38505 recorded earlier this year.

These indicators and market behavior have left analysts predicting a repeat of a bull run 2.0 to a new record high. For instance, popular crypto analysts Mags eyes a new record high, citing historical cycles.

Market sentiment

In his analysis, Mags cited the previous two cycles with monthly consolidation, resulting in another bull run.

Based on the cycle analogy, after BTC hits a bottom and then a local top, a period of consolidation follows, which is later preceded by a strong bull run.

He shared his analysis through X (formerly Twitter), noting that,

“Bitcoin – Bull run 2.0 Incoming. The current monthly consolidation on BTC looks a lot like the previous cycle when the price surged all the way to its all-time high.”

Source: X

This argument points to the previous bull run, which resulted from months of consolidation.

Notably, consolidation plays a crucial role in stabilizing the markets. This period allows the market to absorb recent price action, thus preventing extreme volatility.

Also, it helps in the reduction of speculative pressure since short-term traders tend to close their positions.

With the entrants of long-term traders, investors start accumulating which gradually builds demand thus resulting in increased buying activity.

What Bitcoin’s charts suggest

Mags believed that another bull run was imminent for the king coin. The question is, what do other indicators show?

Source: CryptoQuant

For starters, Bitcoin’s long-term holder’s SOPR has averaged around one over the past seven days. When long-term holders’ spent output profit ratio remains around one, it suggests crypto is sold at a cost basis.

This shows market consolidation, with long-term holders neither in profit nor losses. Such a scenario makes long-term holders continue holding to wait for profitable sales in the future.

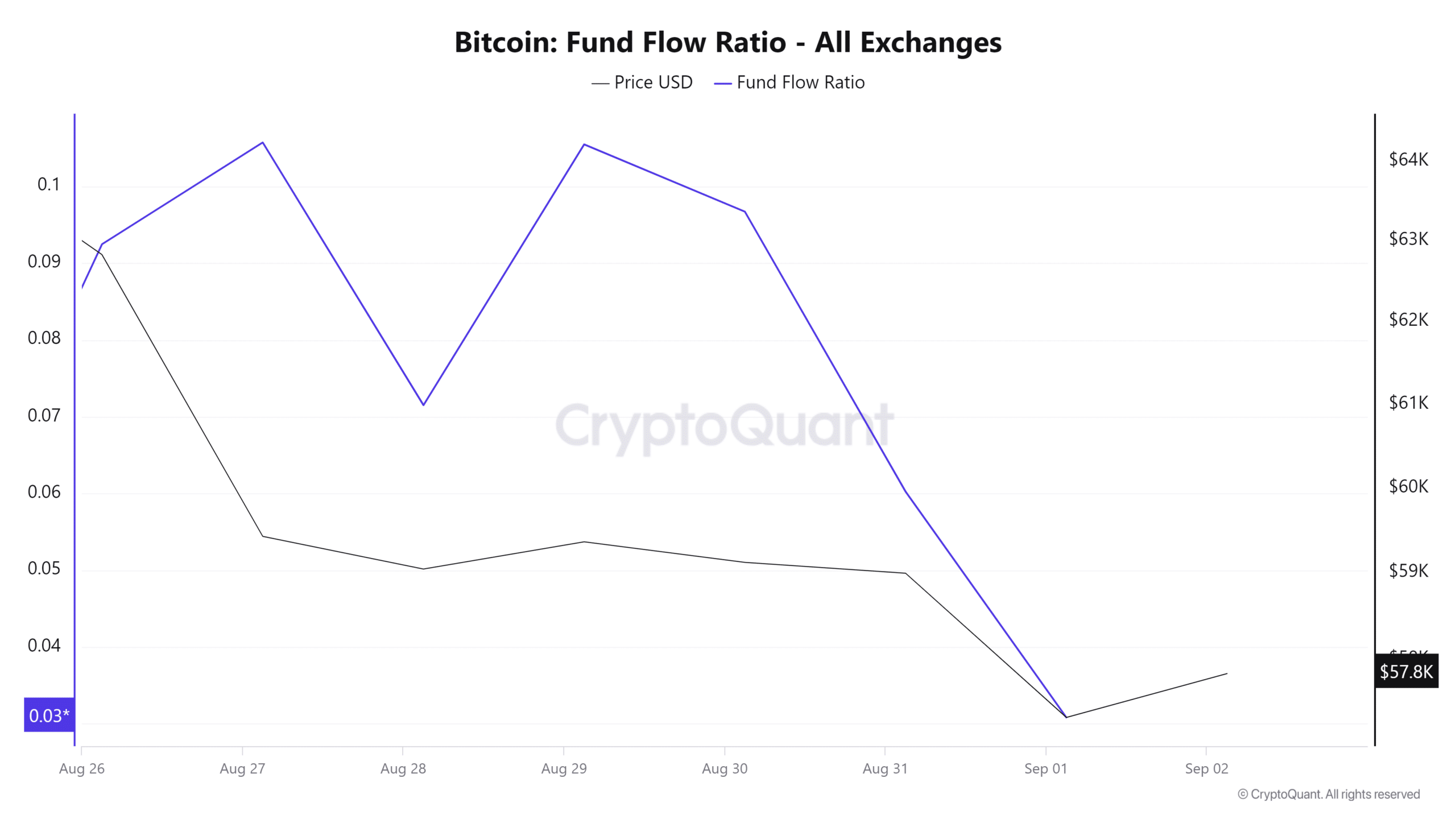

Source: CryptoQuant

Additionally, the fund flow ratio has been consistently below 1 over the past seven days. This means that more BTC has been withdrawn from exchanges, rather than being deposited.

This is a bullish signal, indicating investors are moving their crypto off exchanges for long-term holding, thus reducing supply available for immediate sell.

Such moves reduce selling pressure and increase demand, which in turn helps in trend reversal.

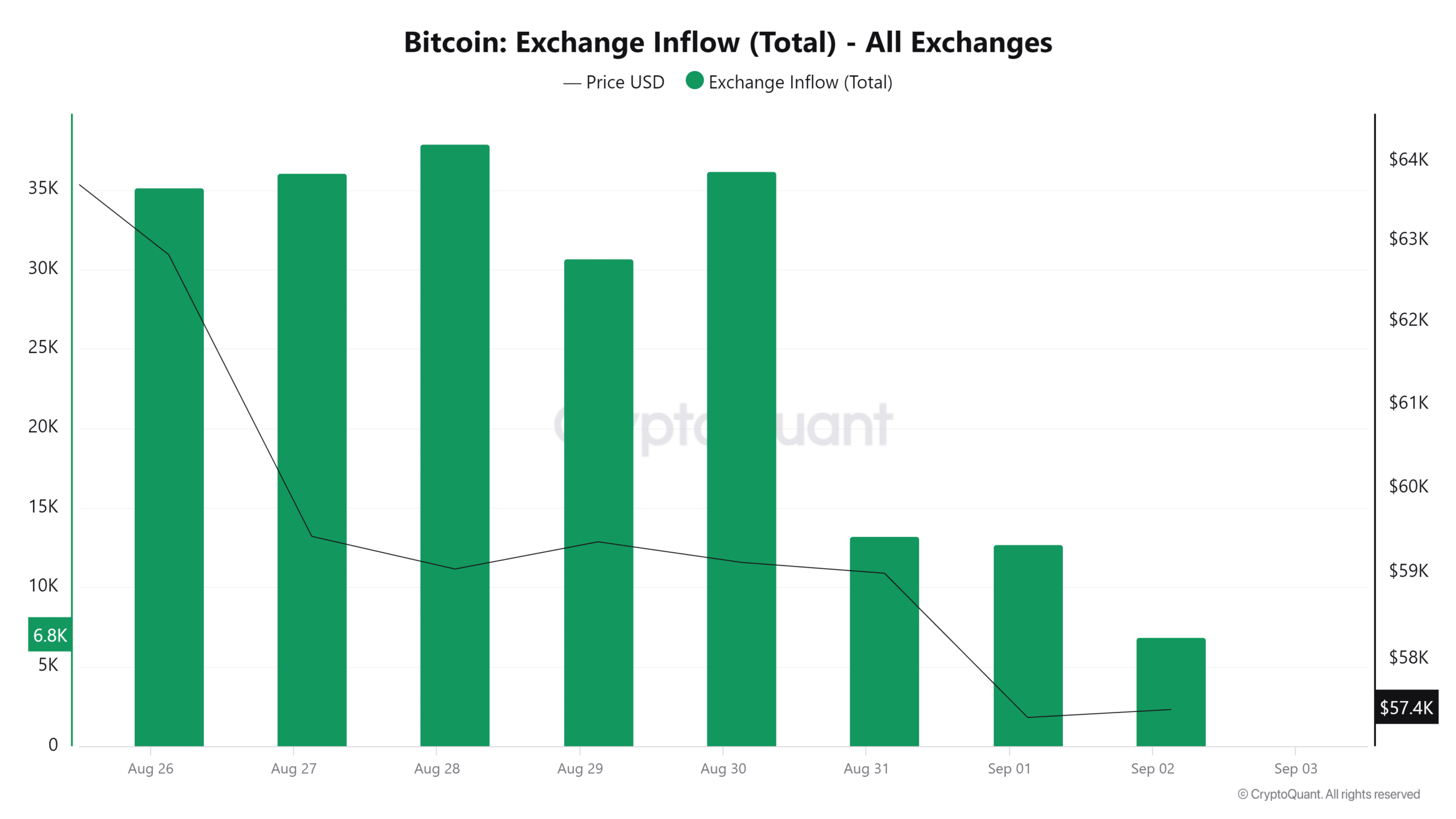

Source: Cryptoquant

Finally, BTC exchange inflow has reduced over the past three days, from a weekly high of 37899.7 to a low of 6869. Such a decline in exchange inflow indicates holding behavior, as investors anticipate higher prices.

This market sentiment reduces selling activity, which is bullish as fewer coins are readily available for trade.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Although BTC has declined over the past 30 days, it’s in declining but a bullish consolidation. With increased market indecision, investors are turning to hold, thus reducing supply.

Such accumulation behavior leads to reduced supply and an increase in demand, which allows bulls to reclaim the markets. This will lead to BTC breaking out above the $61159 resistance level, potentially towards $70k.

Source: https://ambcrypto.com/bitcoin-in-a-consolidation-phase-this-signals-a-bull-run-analyst-believes/