- Ripple unlocked 1 billion XRP tokens worth $559.9 million

- XRP has depreciated significantly over the last 30 days

Over the course of August, XRP lost much of its value on the price charts. In fact, at the time of writing, the altcoin was down 8.16% on the monthly charts to trade at $0.5569.

The month of August saw XRP experience extreme volatility, with the altcoin dropping to a local low of $0.43. However, XRP soon recovered to hit a local high of $0.64. Alas, this wasn’t to last as the crypto lost its gains once again.

On the back of such inconsistent price action, Ripple is in the news today after its latest series of XRP token unlocks.

Ripple’s 1 billion XRP Token Unlock

According to a popular whale transaction tracker on X, Ripple pushed through three consecutive unlocks totaling 1 billion XRP tokens. Based on the market value, these tokens were worth $559.9 million on the price charts.

The latest unlock was done in a batch of three different transactions, with one worth 500k XRP and the other two worth 300k and 200k.

“500,000,000 #XRP (280,008,999 USD) unlocked from escrow at unknown wallet.”

The latest unlock has left investors worried about subsequent price drops. Historically, these scheduled unlocks negatively affect XRP prices. For instance, in June, Ripple offloaded 200 million tokens, and the altcoin dropped by 9.25% to trade at $0.475.

XRP’s price also fell during August’s unlocks, with the altcoin falling to $0.56 from $0.65.

Since January 2024, Ripple has released over 2.02 billion XRP tokens from its treasury worth $1.15 billion.

During this period, prices have registered losses in four out of eight months after each unlock. XRP only recorded gains in February and July after unlocks, while seeing some very neutral market responses other 2 months.

Therefore, based on historical data, XRP’s price doesn’t always have a fruitful relationship with these regular token unlocks.

What do the charts say?

AMBCrypto’s analysis revealed that XRP has been at the end of a sustained downward trajectory over the last 7 days.

Source: Tradingview

For starters, the altcoin’s Chaikin Money Flow (CMF) had a reading of -0.02.

This seemed to suggest that XRP may be seeing some selling pressure – A bearish market sentiment as holders might be closing their positions.

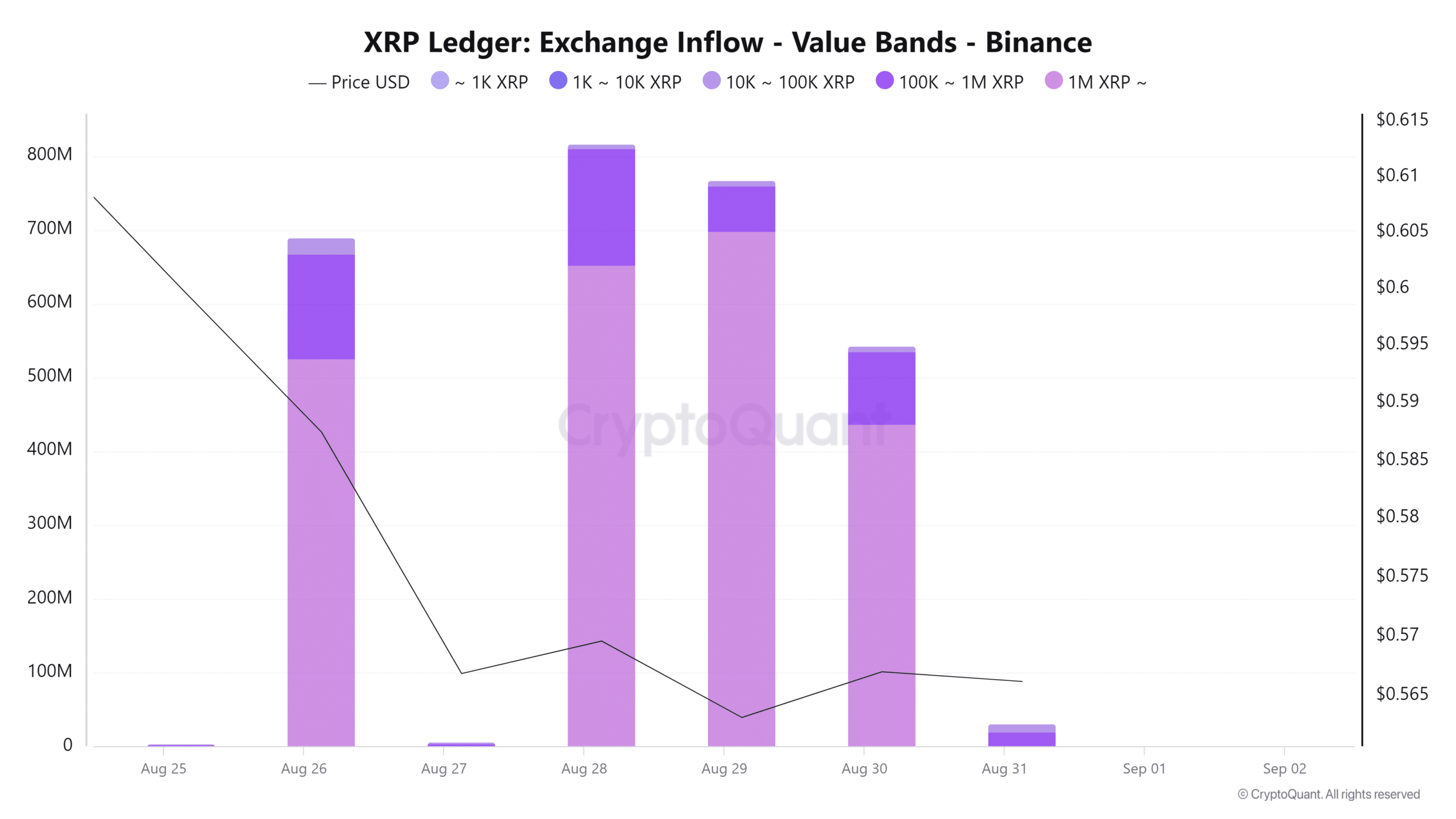

Source: Cryptoquant

Additionally, our analysis of Cryptoquant highlighted exchange inflow value bands being dominated by high inflows.

This is a sign that XRP has seen significant movements by whales lately. These large inflows into exchanges imply whales may be preparing to sell, which could lead to downward price pressure.

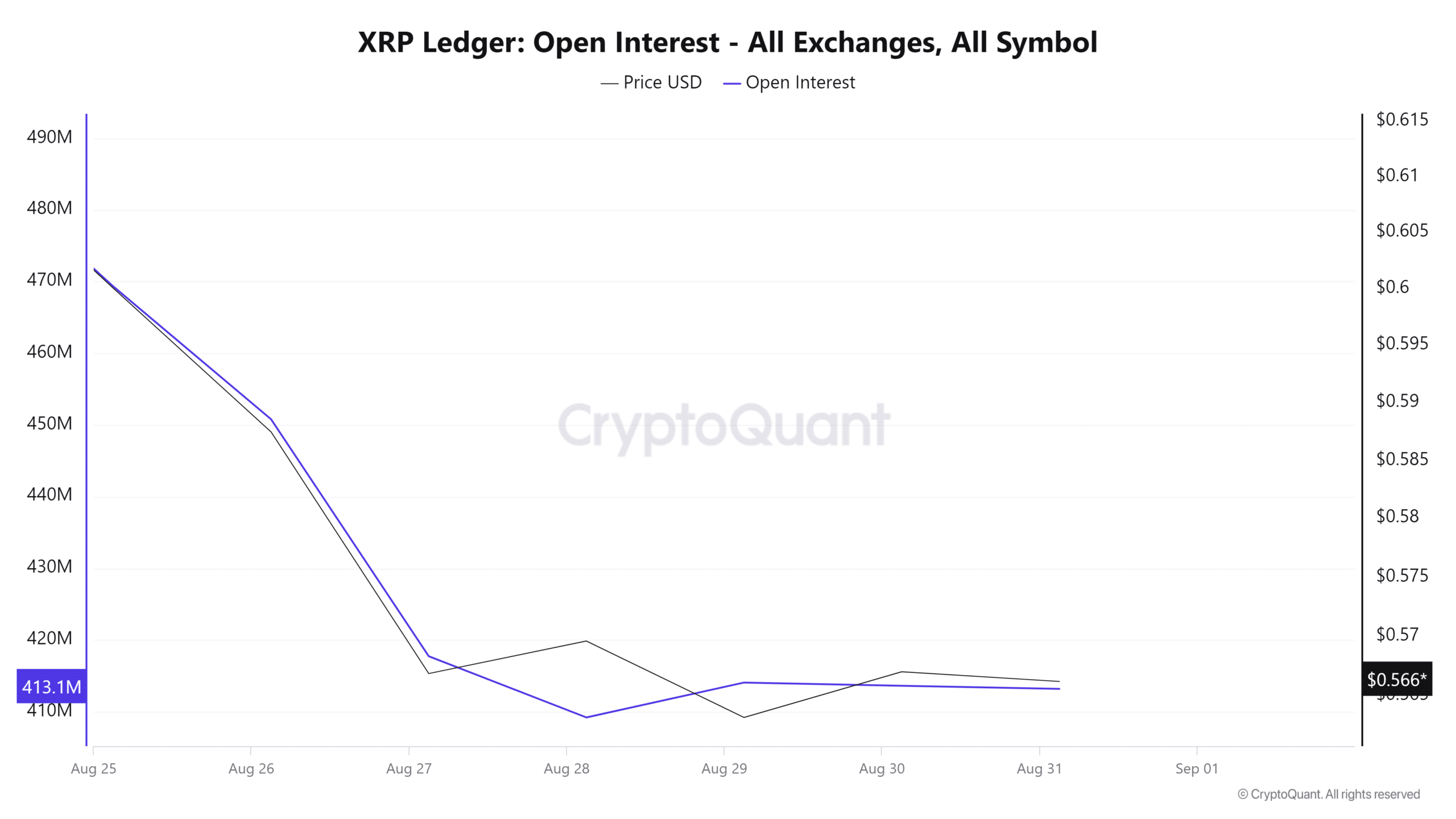

Source: Cryptoquant

Equally, Open Interest fell over the last 7 days.

OI declined from $469 million to $413 million, meaning that investors are closing their positions. When investors close their positions without opening new ones, it is a sign of negative market sentiment.

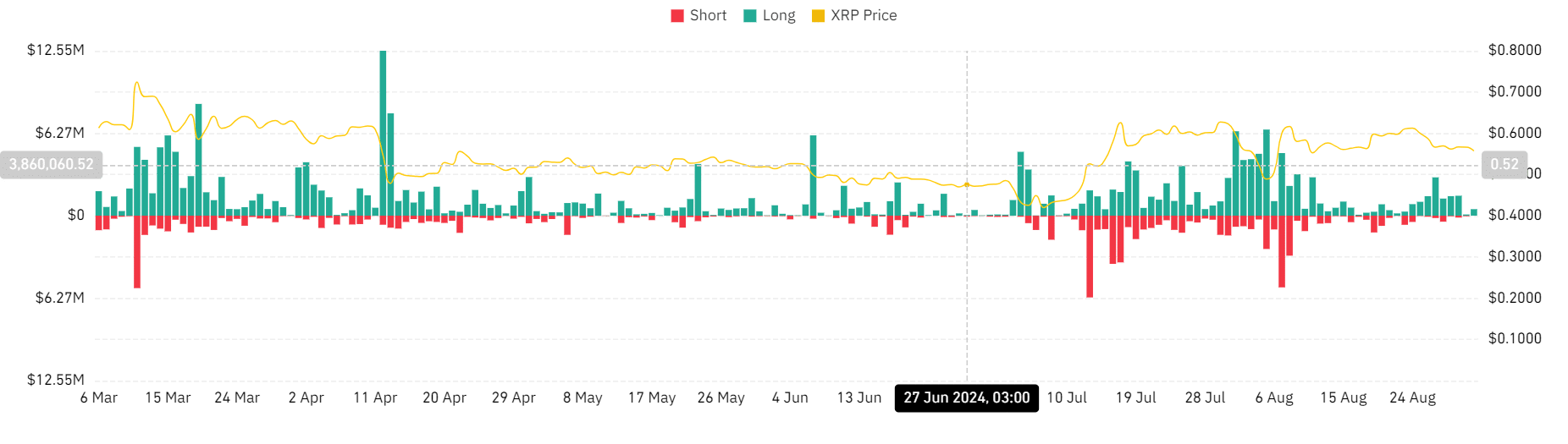

Source: Coinglass

Finally, long position liquidations have remained relatively high over the past week. At press time, Coinglass’s data showed $494k long positions liquidations and $10.98k for short positions. Simply put, investors betting on the market gaining are being forced out of their positions.

This is a bearish sentiment as they are unwilling to pay a premium to hold these positions, resulting in liquidations.

Based on past performances and in light of the prevailing bearish market sentiment, the altcoin risks a decline to the local support level of $0.43.

Source: https://ambcrypto.com/will-xrp-fall-to-0-43-after-ripples-unlocking-of-tokens-worth-559m/