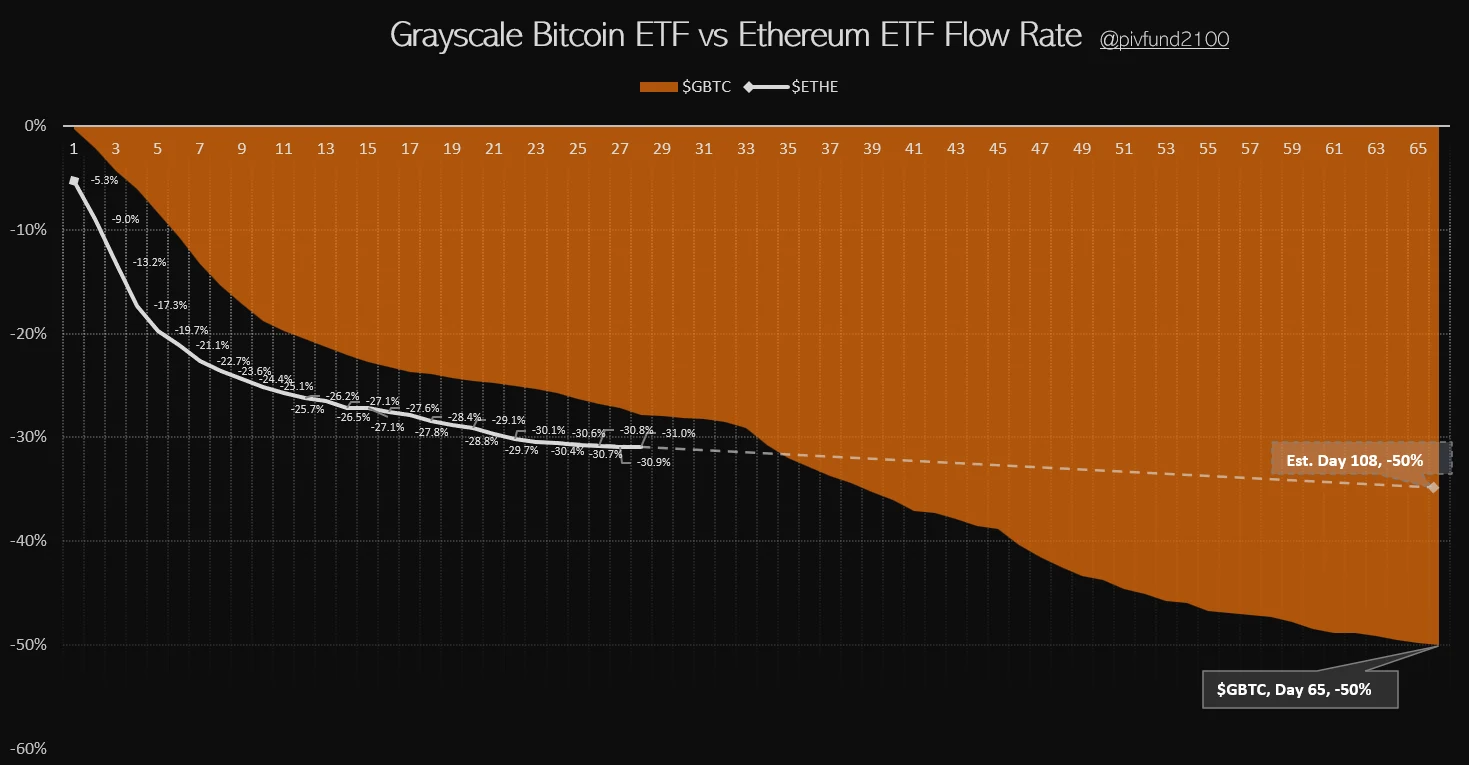

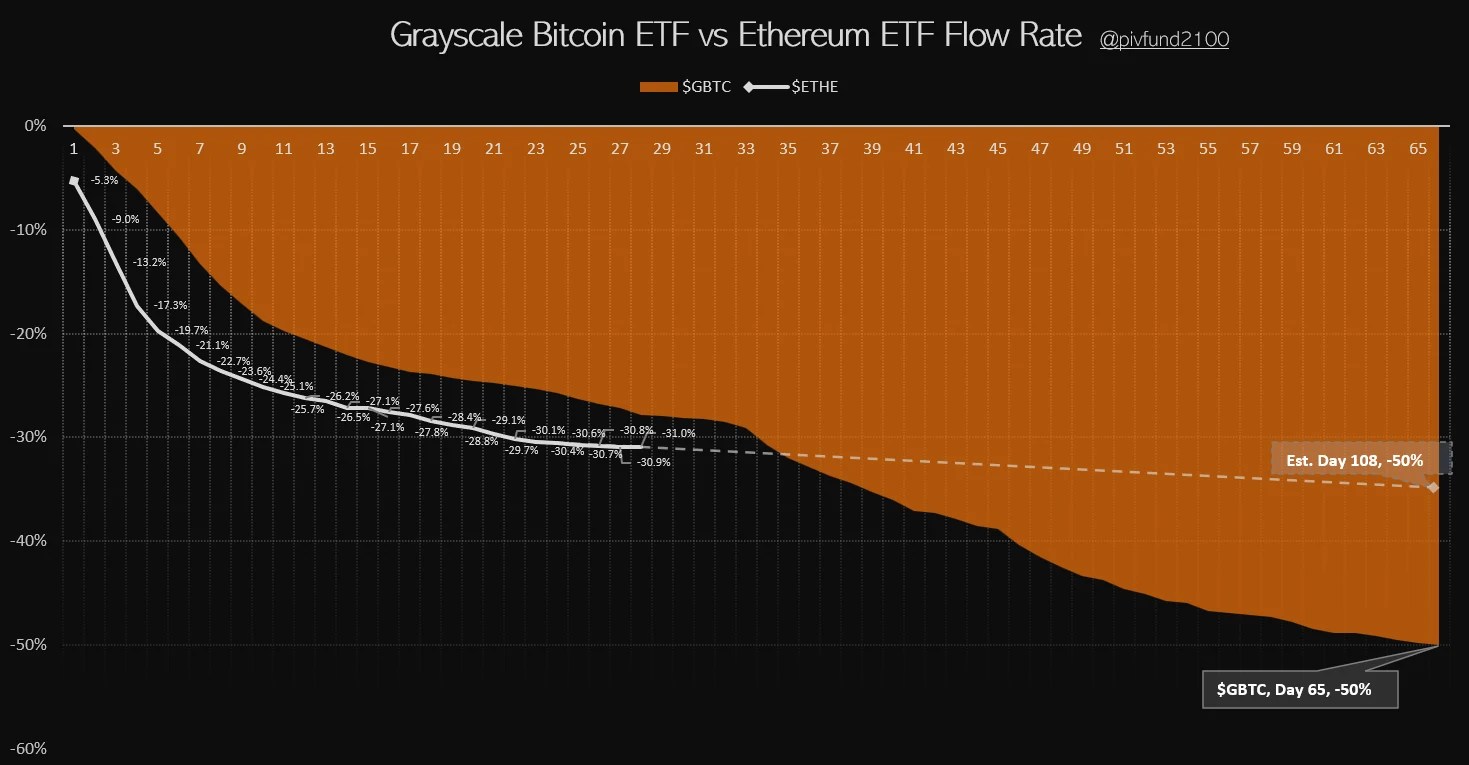

ETH ETF continues to witness hurdles as ETH managed by Grayscale ETHE has decreased by 31% in 28 trading days, and ETHE had a net outflow of $5.35 million yesterday, on August 29. Trader T has estimated on X, that that ETHE will outflow 50% within 108 days (November 20), but the market is not active at present and the trading volume is extremely low.

8/29 Grayscale Ether ETF $ETHE net flow: $ -5.35 million

– 31% decrease in ETH under management in 28 trading days

– Est. -50% in 108 days (Nov. 20)

– Inactive market, trade volume is extremely low https://t.co/JSmOyoNTRi pic.twitter.com/rqgftvHUVI— Trader T (@pivfund2100) August 30, 2024

As for overall ETH ETFs outflow on August 29, it was reported at $1.77M. Grayscale mini ETH had a net inflow of US$3.6 million. The total net assets has been amounting to $7.03Billion, which is 2.30% of Ethereum Market Cap.

Grayscale ETH ETFs have seen constant outflows as opportunistic traders who purchased ETHE shares at a discount are realizing a profit on their trades and selling them off, as reported in our July-August report. Thus, once the outflow is balanced, ETH ETFs can witness prolonged flows over time.

When it comes to Bitcoin ETFs, Grayscale GBTC had a net outflow of US$22.7 million yesterday, Bitwise’s BITB had a net outflow of US$8.1 million, and ARK’s ARKB had a net inflow of US$5.3 million. Bitcoin ETFs saw a daily net outflow of 56.54M as of August 29.

At the time of publishing, BlackRock’s ETF’s data remains out of date.

Also Read: Franklin Templeton Files for Crypto Index ETF with SEC Approval

Source: https://www.cryptonewsz.com/grayscale-ethe-etf-outflow-50-by-november20/