- Solana is tipped for a substantial fall after the recent observation that the SOL/BTC pair imitates the ETH/BTC pair.

- Another analyst expects SOL to rise to $400-$500 in the short term and proceed to hit $1000 in the long term.

Solana (SOL) is opposing a severe “bearish wind” to maintain its support above $140 after joining the broad market in a mini-rally that only lasted a day.

According to our data, SOL is trading at $146, declining by 0.52% in the last 24 hours and surging by 1.62% in the last seven days. Previously, SOL declined by 4.5% in just 24 hours to trade at $147 from its weekly high of $162. The SOL/BTC pair fell from its week’s opening high of $0.0025359 to $0.0024544. According to an analyst, things could worsen as the bearish trend continues for some time.

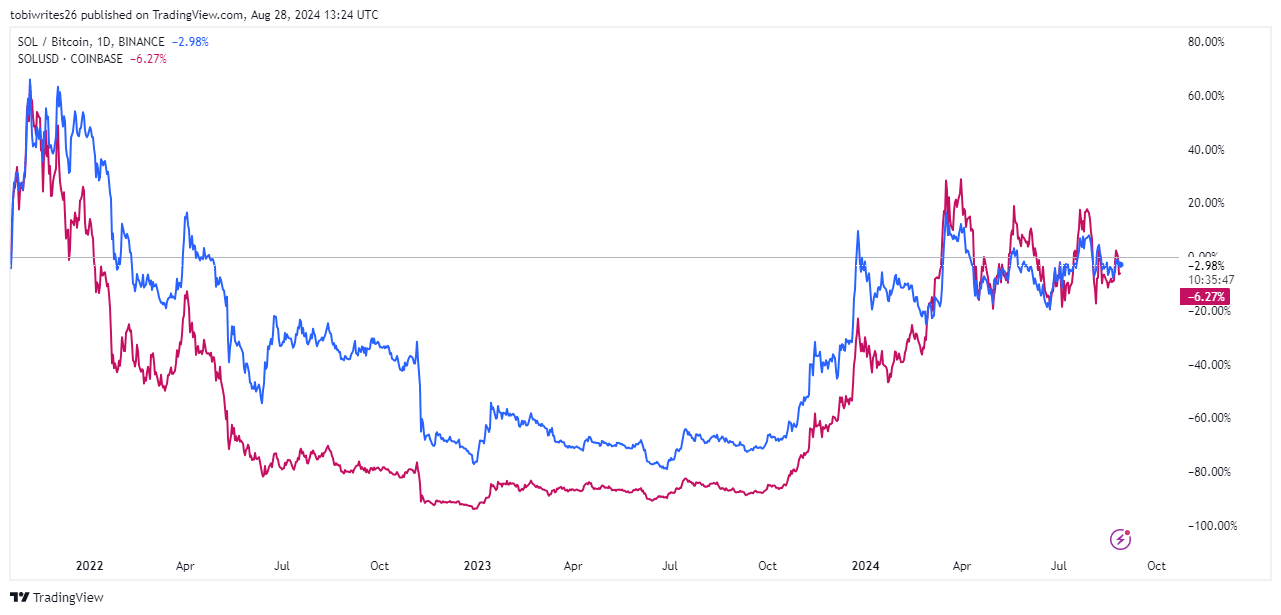

Subjecting the SOL/BTC pair to technical analysis, crypto trader Benjamin Cowen observed two main reasons investors must follow the SOL price cautiously. The first is the huge historical similarity with the movement of ETH/BTC. The next is the correlation between the SOL/BTC pair and the rest of the pairs.

The Historical Imitation

After the all-time high price of ETH/BTC in 2017, the asset plummeted 90% before embarking on another 500% bull run.

Based on the SOL/BTC chart, there was a replication as the pair suffered 90% after achieving an all-time high in 2021, followed by a 500% surge. According to the analyst, there is a huge possibility that the pair will suffer a massive decline before the year ends. However, there would be a long-term recovery followed by another fall.

If SOL/BTC continues to follow ETH/BTC then it will get a correction before EOY, and then bounce into 2025, before dropping again in 2026.

Our analysis of the SOL/USD pair and the SOL/BTC pair shows a direct correlation in periods of lows and highs. This is evident in the Trading view chart below.

Analysts Present Different Views on Solana (SOL) Price Movement

Despite the supporting data, there is a chance of the SOL/BTC pair defying this prediction to commence a short-term explosive run. In this case, all other pairs could join in the rally.

Contrary to Cowen’s prediction, an X user identified as Jelle has predicted a short-term rally for SOL to $450-$600 in this cycle. In the long term, Jelle expects the asset to hit $1000. His prediction was based on the fact that the asset has consolidated within the $120-$210 range for the past six months. Similarly, analyst Kingpin Crypto believes the current cycle could be a long-term continuation.

Our market analysis indicates that the indicators slightly favor Cowen’s prediction. According to the stochastic oscillator – an indicator used to determine whether an asset has been overbought or oversold, SOL was found around the 81.4 mark. This shows that SOL is currently overbought and could decline extensively.

Solana’s open interest has also risen in the past few weeks, with the figure currently “sitting at almost $2 billion.” This is a 55% increase from the August 5 figure during the market crash. According to analysts, this surge could catalyze price volatility and a considerable move in either direction.

Recommended for you:

No spam, no lies, only insights. You can unsubscribe at any time.

Source: https://www.crypto-news-flash.com/watch-out-solana-traders-2-reasons-why-the-sol-btc-pair-is-a-must-track/?utm_source=rss&utm_medium=rss&utm_campaign=watch-out-solana-traders-2-reasons-why-the-sol-btc-pair-is-a-must-track