Veteran trader Peter Brandt identifies $2,830 as a critical level for Ethereum (ETH), stating that the short-side trade is invalid if ETH moves above this threshold.

Despite the dovish sentiment expressed by Federal Reserve Chair Jerome Powell, the price of Ethereum (ETH) remains under pressure, with several analysts predicting further declines in September.

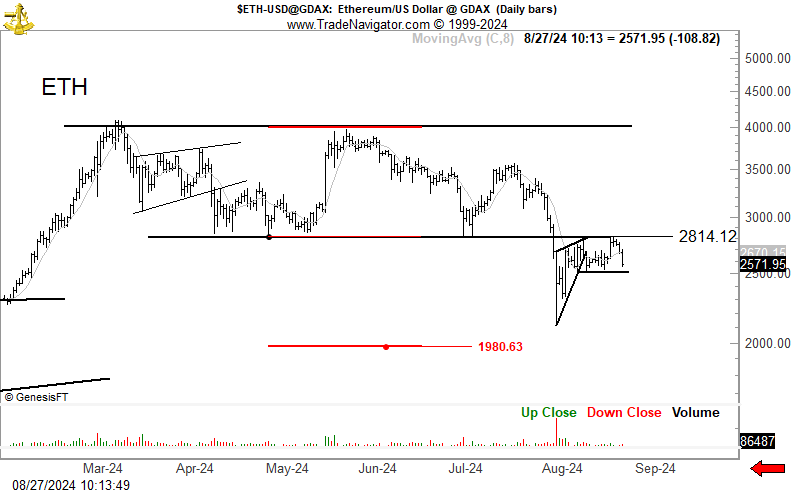

According to a recent analysis by prominent market analyst Peter Brandt, Ethereum is facing significant resistance at the $2,814 level. This level has been tested multiple times, and the current price action shows ETH hovering just below this critical threshold.

Brandt views ETH as a well-defined short-selling opportunity, suggesting that a break above $2,830 would invalidate this trade. Conversely, if selling pressure persists, Ethereum may experience a further decline towards the $1,980 support level.

In response to a user’s inquiry about the bearish outlook for Ethereum, Brandt attributed it to a straightforward imbalance in market sentiment: sellers are currently more motivated to sell than buyers are to buy.

On-Chain Data Confirms Selling Pressure

Supporting Brandt’s bearish outlook, IntoTheBlock’s netflow metrics for large ETH holders reveal sustained selling pressure on Ethereum. The negative netflow trend over the past few months indicates that large holders have been consistently offloading more ETH than they’ve been accumulating, reinforcing the notion of persistent selling activity.

Over the past 30 days, netflow decreased by 76.53%, further confirming that sellers have been more persistent in offloading their assets.

Furthermore, several prominent Ethereum whales have been offloading their holdings on centralized exchanges, particularly on Binance. Two significant transactions stand out: the Ethereum Foundation’s sale of 35,400 ETH, valued at approximately $95 million, and Jump Trading’s disposal of 88,900 ETH, worth around $276 million.

These substantial sales, coupled with other large transactions, have likely contributed to the recent downward pressure on ETH’s price.

Traders Remain Cautious

In a separate analysis, Michaël van de Poppe, founder of MN Consultancy, suggested that ETH could see a recovery if it breaks through the $2,550 level, potentially reaching $3,000. Yet, he advised traders to remain cautious and seek confirmation of any breakout before committing to new positions.

At press time, Ethereum has seen a 2.8% uptick in the last 24 hours, trading at $2,551.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/08/29/peter-brandt-ethereum-short-selling-opportunity-remains-valid-until-2830-breakout/?utm_source=rss&utm_medium=rss&utm_campaign=peter-brandt-ethereum-short-selling-opportunity-remains-valid-until-2830-breakout