- Can Aave break $152 level after coming close with a $148 touch?

- Aave’s fundamental are in support of a bullish cycle.

Aave’s [AAVE] open-source protocol for creating non-custodial liquidity markets, has seen its token experience significant gains, surging over 30% in the last 30 days as per CoinMarketCap as at press time.

This price action reflects strong market interest, especially as Aave’s price now hovers around the $130 range, a highly traded volume zone.

Aave’s price action appears poised for further upward movement breaking the $152 level following a touch on the $148 price level.

This bullish momentum is supported by a higher high formation after breaking daily consolidation, indicating that the Aave’s price is likely to move higher.

Source: TradingView

Aave has demonstrated remarkable strength on the weekly, closing with over 75% gains in the past 3 weeks.

This surge brings AAVE close to its weekly resistance level. The current week’s price action suggests that Aave could close above $153, paving the way for a potential rally to $300 by October 2024.

While the price has experienced a slight decline this week, it aligns with the formation of a weekly low before a bullish close, reinforcing the positive outlook for Aave’s price moving higher.

Source: TradingView

Aave’s macroeconomics looking good…

Fundamentally, Aave’s long-term prospects look strong. The protocol recently became the first lending platform to surpass $200 million in market size and $100 million in Total Value Locked (TVL) on the Base chain.

Additionally, the Aave DAO has launched the “Endless Summer” program, offering $100,000 monthly in USDC rewards to Aave users.

Source: Aave Protocol

This initiative further strengthens community engagement and positions Aave as a leading player in the decentralized finance (DeFi) space.

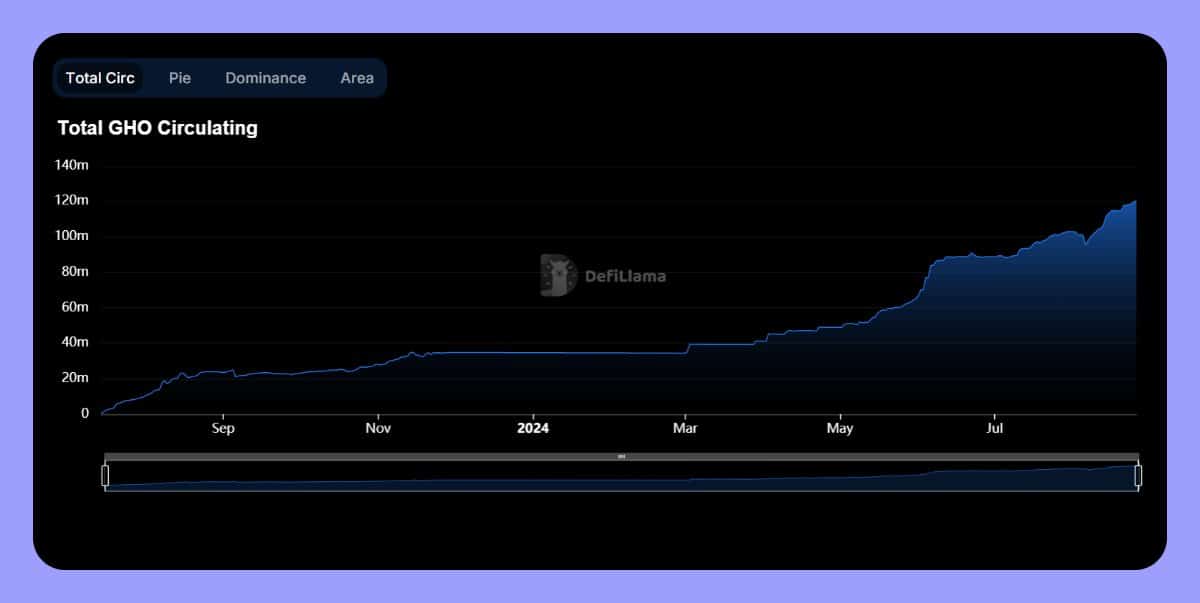

Another bullish development for Aave is the introduction of the GHO Stability Module Proposal. This module aims to maintain the stability of GHO, Aave’s flagship stablecoin, during periods of high demand.

By leveraging a USDC surplus from BlackRock’s BUIDL, which holds over $500 million in assets, the module seeks to generate additional yield opportunities while providing a hedge against DeFi market fluctuations.

Source: X

The integration with BlackRock’s BUIDL infrastructure is expected to enhance Aave’s offerings, contributing to a higher price trajectory.

Impact of 1:1 swaps between USDC and GHO

The GHO Stability Module also includes 1:1 swaps between USDC and GHO, enabling seamless user experiences with instant conversions.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

Swap fees will accumulate in GHO and pay monthly dividends in BUIDL, increasing activity within Aave’s [AAVE] ecosystem. As GHO adoption grows, so will Aave’s market presence, driving its price higher.

Source: DefiLlama

Aave’s strong market structure, combined with favorable macroeconomic factors, sets the stage for its price to rise even higher in the coming months.

Source: https://ambcrypto.com/aave-nears-152-breakout-can-it-surge-to-300-by-october/