- WIF saw a dramatic whale accumulation, marking the second major move in just a week.

- Despite the surge in whale activity, WIF’s road to recovery still seems distant.

A prominent dogwifhat [WIF] whale has re-entered the spotlight after a month of inactivity. This marked the second time in the past week that whales have engaged in accumulation.

With this new acquisition, the whale continued to signal strong belief in the token’s potential. However, can the memecoin withstand the current market volatility and surge higher? AMBCrypto investigates.

Whale accumulation falls short for WIF recovery

Despite recent market downturns, WIF has experienced a notable 11% increase over the past week. On the 24th of August, the coin approached the $2 resistance, but subsequently fell back.

According to Lookonchain, a major whale deposited 700K WIF, worth $1.25M into MarginFi and borrowed 197K USDC to buy an extra 110K WIF. The whale now holds 3.3M WIF, valued at $5.94M.

Surprisingly, despite this significant whale activity, dogwifhat has not shown a corresponding positive impact and is currently moving closer to its previous support level of $1.316.

Prompted by this uncertainty, AMBCrypto examined exchange activities and discovered the following insights.

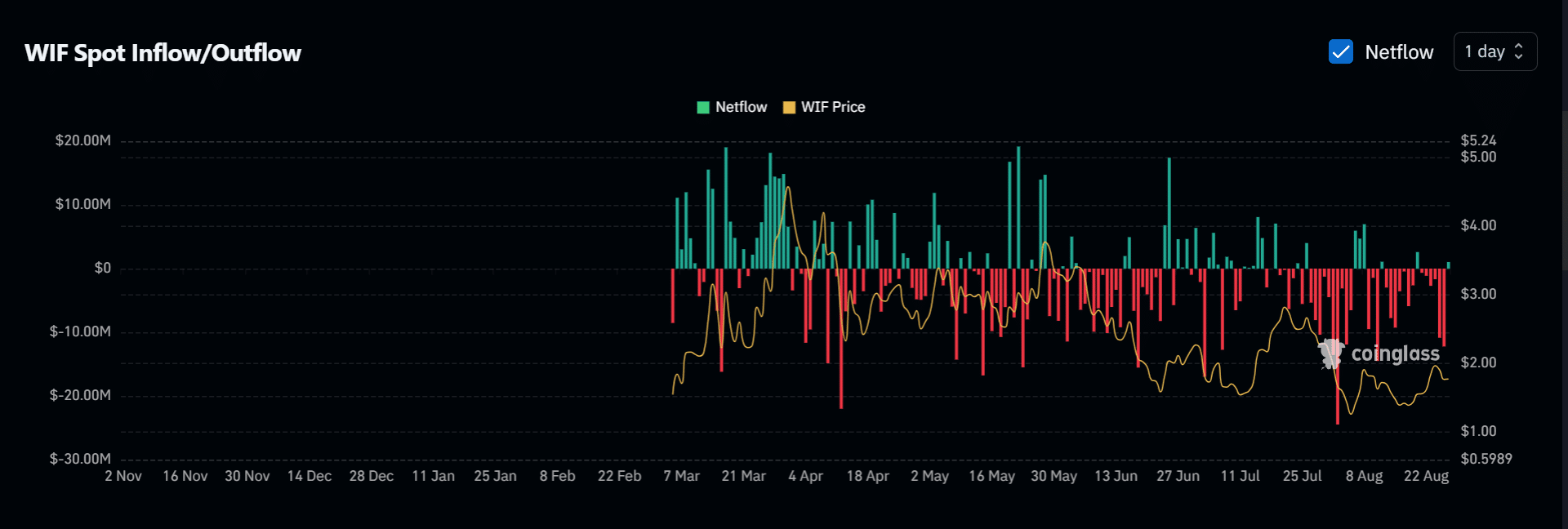

Source: Coinglass

Contrary to popular belief, when WIF experienced a notable price increase, reaching its ATH on the 31st of March, it was actually accompanied by a large inflow of WIF into exchanges.

In other words, speculative traders and whales were buying WIF, which helped absorb the selling pressure from the influx of tokens into the exchanges.

On the other hand, recent activity has shown a trend of negative net flows, suggesting that investors are holding onto their WIF rather than selling it.

Despite this, the market volatility overshadowed the whale’s accumulation efforts, causing the price to decline.

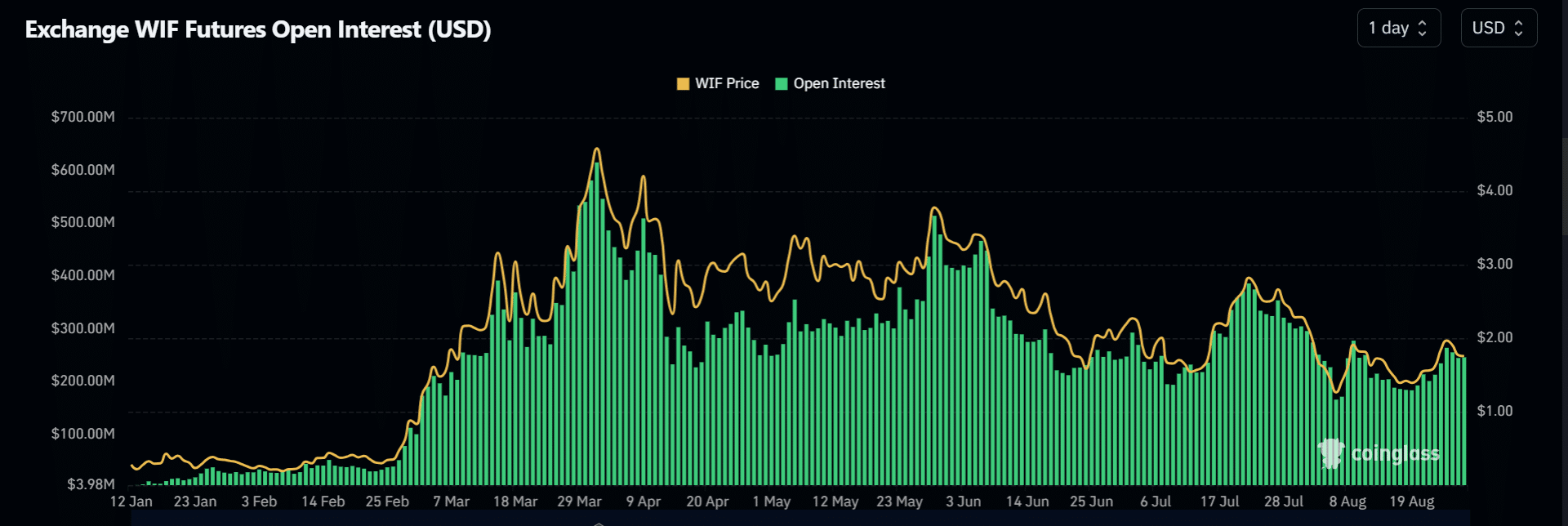

Source: Coinglass

As mentioned earlier, futures traders also played a part in pushing WIF closer to $4.60 during the early April rally. At that time, Open Interest also reached an all-time high (ATH) of $615.16 million.

This highlighted the significant involvement of leveraged positions and speculative trading, which contributed to the price surge.

However, since the recent downturn in dogwifhat, open interest has declined from $265 million on August 25 to $246 million at press time, indicating lack of confidence in WIF’s future prospects.

In short, the efforts of whales to accumulate more WIF could be deemed insufficient by larger market trends. So, does it?

dogwifhat rebound unlikely

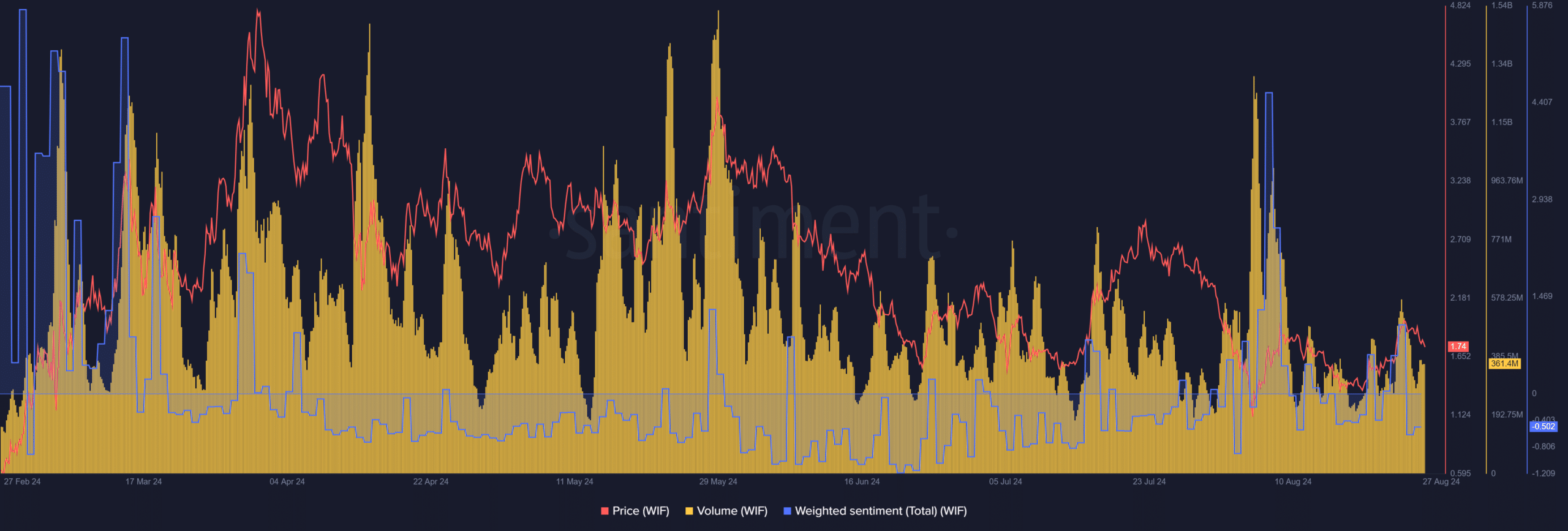

Source : Santiment

Compared to early volumes, there has been a significant plunge, dropping even below the levels seen in early August, when dogwifhat faced one of its worst price downturn.

At press time, the total volume stood at $365 million, a decline of 31% from $532.66 million on the 24th of August.

The drop in volume suggested reduced market activity or interest, a trend further highlighted by the declining open interest.

Is your portfolio green? Check out the WIF Profit Calculator

While all this is enough to shatter bullish hopes, the Weighted Sentiment has also shifted from positive to negative, indicating a potential change in market outlook.

Put simply, the ongoing market trend does not support a dogwifhat rebound anytime soon. AMBCrypto also notes that these trends have overshadowed the recent whale accumulation efforts.

Source: https://ambcrypto.com/dogwifhat-struggles-despite-whale-moves-why-wif-has-a-tough-road-ahead/