- LTC daily chart shows a falling channel pattern with a failed breakout above the 50-D EMA.

- Only 71 Litecoin addresses are profitable, with 97.19% of holders facing losses.

- Santiment reports a significant drop in smallholders, indicating a potential bull run.

With a bearish end to the last week, Litecoin registers a 2.28% drop, forming a bearish candle in the weekly chart. As the supply tidal shapes into the present week, Litecoin is down by 2.25% and is currently trading at $63.38.

The declining trend continues in the daily chart within a falling channel pattern as LTC fails to surpass the overhead trend line. A sudden increase in supply inflow, a morning star pattern, and a continuation candle resulted in a 5.40% drop in just two days.

The reversal also fails to surpass the declining 50-day EMA, which acts as a dynamic resistance. Failing to sustain dominance at the 23.60% Fibonacci level at $65.55, the LTC rises back to the support level at $61.88.

Currently, it is trading at $63.38, with an intraday growth of 0.60%, reflecting a bullish attempt at reversal. In the 4-hour chart, the bullish attempt gains more significance as the consolidation phase finds a bullish divergence in the RSI line.

As the Litecoin struggle teases a potential positive cycle, a double-bottom reversal could result in a bullish breakout.

With 71 Profitable Addresses, Will Litecoin Skyrocket?

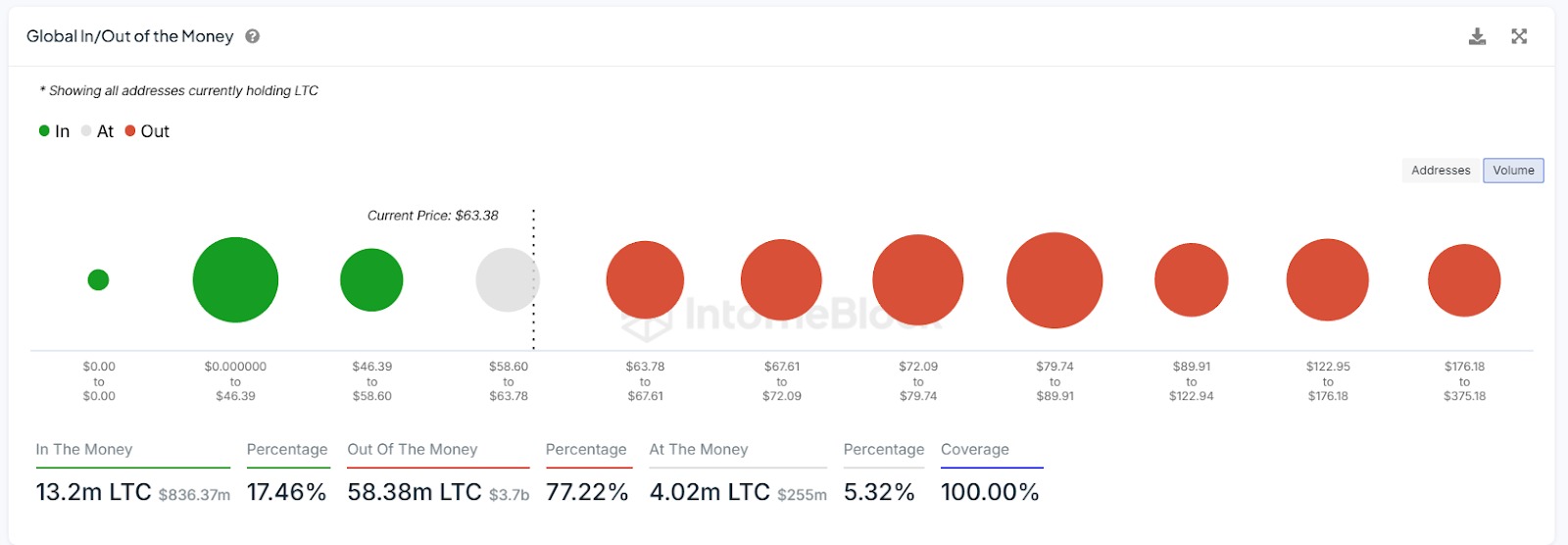

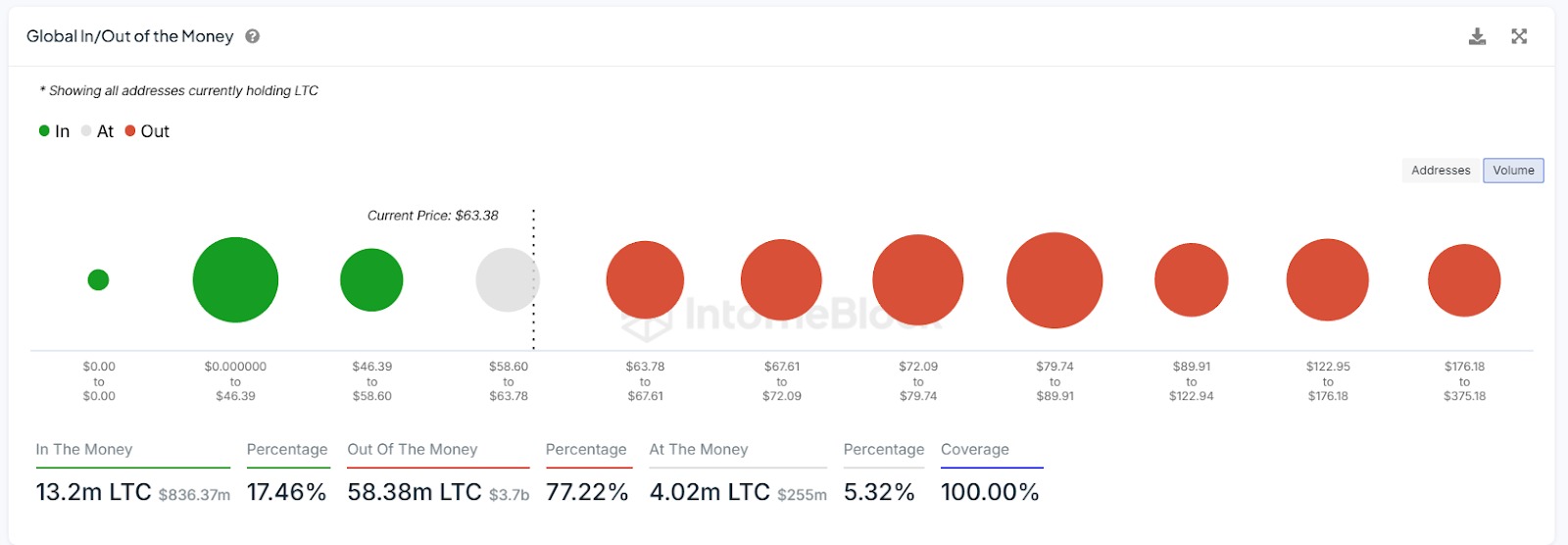

As Litecoin struggles to break through resistance, IntoTheBlock shows a notable shift in volume entering the in-the-money zone.

Currently, 13.2 million LTC tokens, valued at $836.37 million, represent 17.46% of the current supply and are “in the money.” In contrast, a massive part of 77.22% or 58.38 million Litecoins in current supply worth $3.7 billion remain “out of the money”.

Additionally, 5.32% of the supply, or 4.02 million Litecoins worth $255 million, is “at the money”. The at-the-money zone spans from $58.60 to $63.78.

Interestingly, only 71 addresses are profitable, meaning these addresses hold 13.2 million LTC in the money. Conversely, 90.1k addresses are out of the money, accounting for a staggering 97.19% of Litecoin holders facing losses at the current market price.

Small Holders Jump The Litecoin Ship

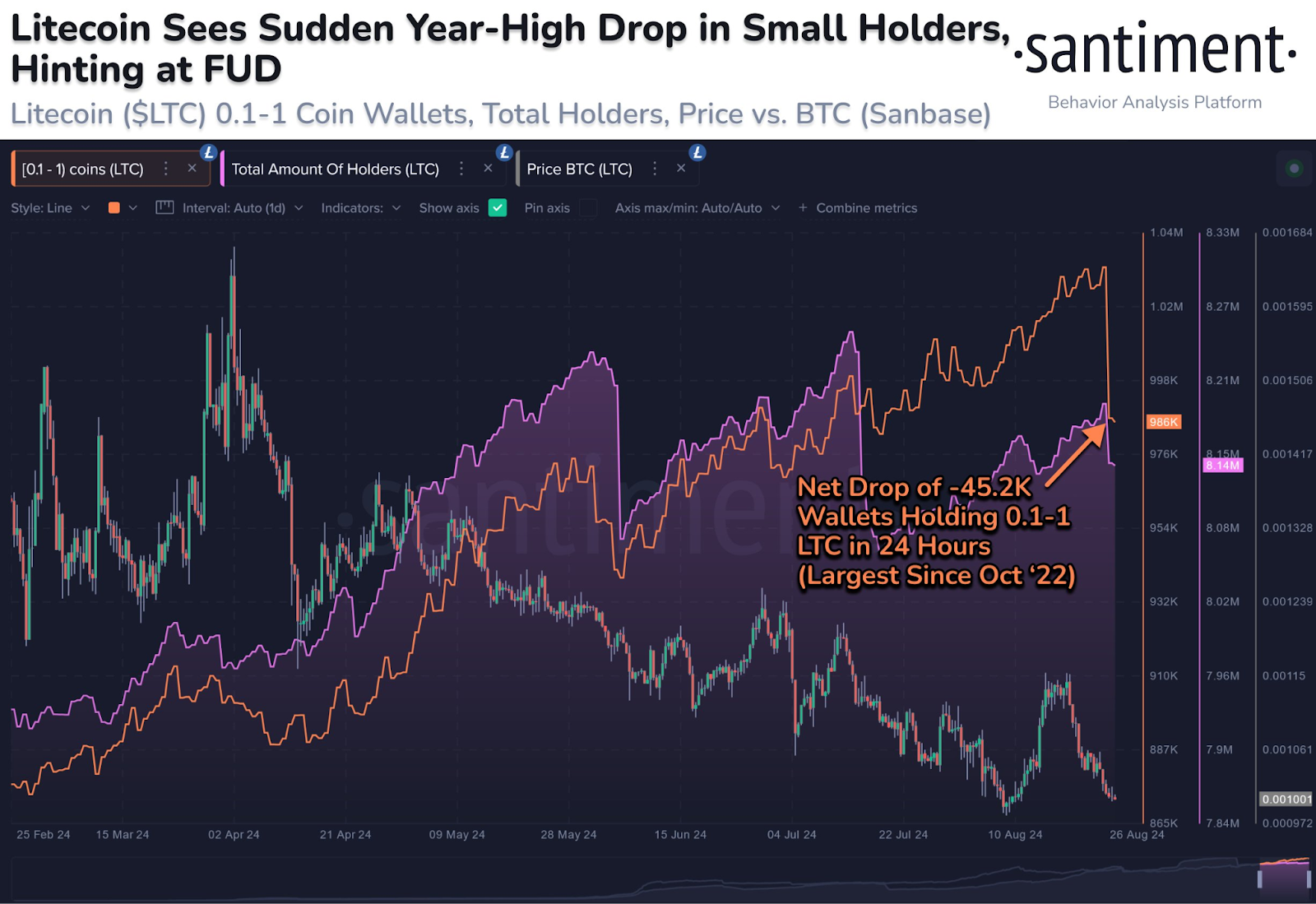

With a massive difference in profitable Holders, the shorthands are exiting the market at a quick pace. In a recent tweet, Santiment highlighted a sudden year-high drop in smallholders (0.1 to 1 Litecoin).

With a net drop of 45.2K Wallets Holding 0.1-1 LTC tokens in 24 hours, the smallholders took a mass exit. Successively, this is the largest drop witnessed in smallholder parties since October 2022, almost two years ago.

Will LTC Price Hit $100?

Despite the bearish packaging of the on-chain data, Litecoin is on the cusp of a potential bull run. Based on Santiment’s tweet, a drop in smallholders suggests a surge in LTC price as small fish impatiently jump ship before the bull run.

Further, despite Litecoin’s concentration, the recovery will put a significant part of the volume in “at the money stage.” This is based on the intotheblock data, which shows 7.09M Litecoins and 84.35K addresses in the $63.78 to $67.61 range.

In the price chart, the breakout of the overhead trendline or the 50-day EMA will siren a buy signal for sideline traders. Based on Fibonacci levels, the bulls can target 50% or 61.80% levels at $78 or $84 next month. By 2024 end, Litecoin might have to depend on the broader market recovery to extend the bull run to $100.

Source: https://coinpedia.org/price-analysis/top-reasons-why-litecoin-can-still-reach-100-in-2024/