Ethereum (ETH) price steadied last week’s uptrend above $2,700 despite resistance at $2,800 standing in the way. It appeared to mirror Bitcoin (BTC) price struggles to reclaim $64,000 support. However, the long-term outlook of Ethereum is predominantly bullish as the network staking increases.

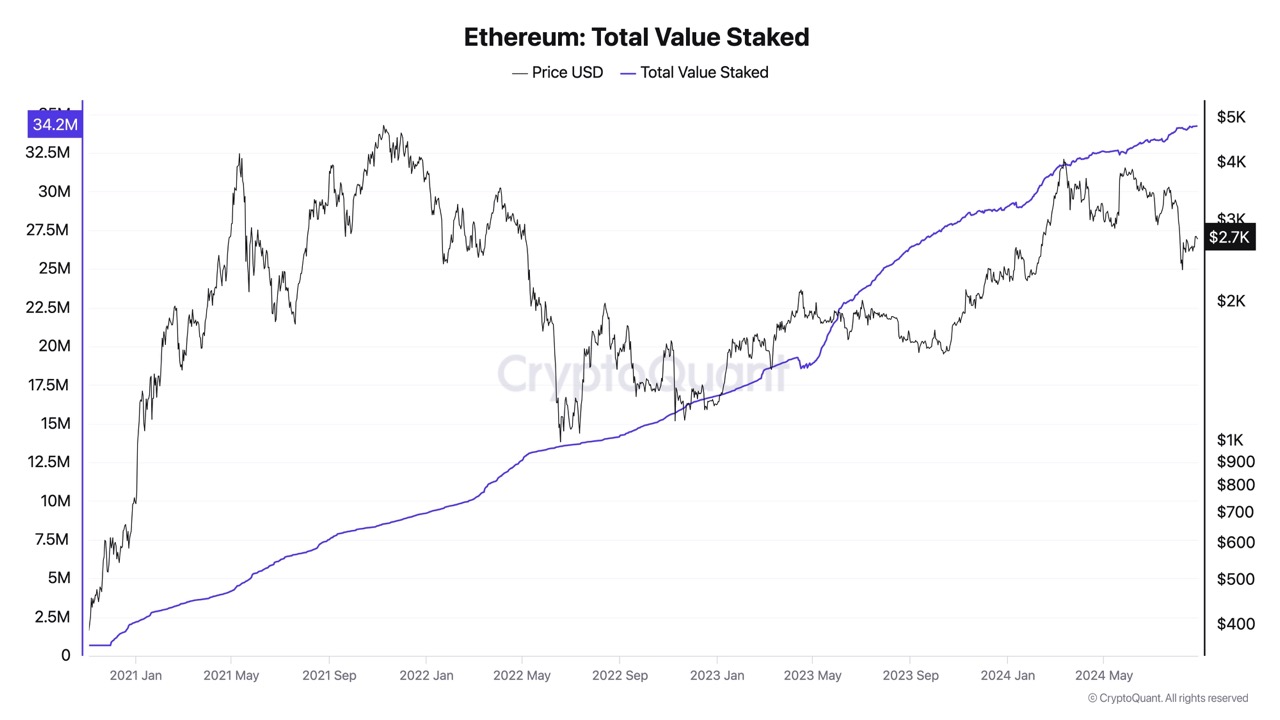

For example, the total number of ETH staked hit $34 million as of Monday, August 26, according to data from CryptoQuant. This massive supply of ETH locked for staking purposes shows that investors are willing to hold ether for long. Since Ethereum’s market value has not reflected these bullish fundamental developments, many traders ignore ETH in the short term.

However, one development that could change this neutral-to-bearish outlook is if Ether price flips the $3,000 psychological level.

Ethereum Price Analysis: ETH Bulls Struggle

Ethereum price is currently trading at $2,26 after bouncing off the $2,618 support level. This bullish development can be attributed to BTC’s recent thrust above the $60,000 psychological level. Now, ether faces a significant challenge as Bitcoin moves sideways – a continuation of the uptrend or a retracement to key levels. Ideally, a bounce off the $2,618 support level will be a good move from sidelined investors’ perspective. However, continuing the uptrend toward the resistance confluence around $3,000 could trigger panic buying and propel ETH much higher. Regardless, ETH must flip the key psychological level mentioned above to embark on a directional move.

If successful, ETH price could trigger a rally toward the $3,352 to $3,497 resistance zone. In some cases, Ethereum price forecasts a retest the $3,500 hurdle, bringing the total gain to nearly 30%.

Supporting this bullish outlook in Ethereum price is Santiment’s Whale Transaction Count metric. This indicator shows no large upticks in transactions worth $100,000 or $1,000,000, denoting that the whales are not looking to book profits yet.

Additionally, the Network Realized Profit/Loss (NPL) indicator noted a huge uptick last Friday, denoting some investors booked profits on the rally. While this outlook is not entirely bullish, it does denote that short-term investors could be done booking profits and are unlikely to add headwinds should ether climb higher.

Will ETH Price Hit ATH in 2024?

According to the Polymarket data, 77% of the betters believe Ethereum price will not hit an all-time high (ATH) in 2024. Alternatively, 21% expect ether to cross $4,868 in the fourth quarter of 2024.

While the technical and on-chain data points to a bullish outlook for Ethereum price, investors need to closely monitor Bitcoin price for sudden reversals. If ETH slips below the $2,618 support level and flips it into a resistance level, it will invalidate the bullish thesis. Such a development could see Etheruem price crash by 4% before sidelined buyers consider stepping in.

Frequently Asked Questions (FAQs)

The Ethereum price is currently trading at $2,260, facing a significant challenge to flip the $3,000 psychological level and embark on a directional move.

The ETH Whale Transaction Count metric shows no large upticks in transactions worth $100,000 or $1,000,000, indicating that whales are not looking to book profits yet.

According to Polymarket data, 77% of betters believe Ether will not hit an ATH in 2024, while 21% expect it to cross $4,868 in the fourth quarter of 2024.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/can-ethereum-price-hit-5000-as-staked-eth-hits-ath/

✓ Share: