- SEI has gained 14.1% in the past week, with analysts predicting a potential breakout and significant rally.

- Rising Open Interest and increased development activity suggested strong investor confidence, though caution is advised.

Sei [SEI], a rising asset in the cryptocurrency market, has been gaining significant attention due to its price performance over the past week.

The asset has seen a 14.1% increase during this period, with its upward momentum continuing into the past 24 hours.

As of the time of writing, SEI has surged by an additional 7.9%, bringing its press time trading price to $0.3118.

This sustained price increase has sparked discussions among the crypto community about SEI’s potential for further gains, especially as technical indicators begin to align with bullish expectations.

$1 on the horizon?

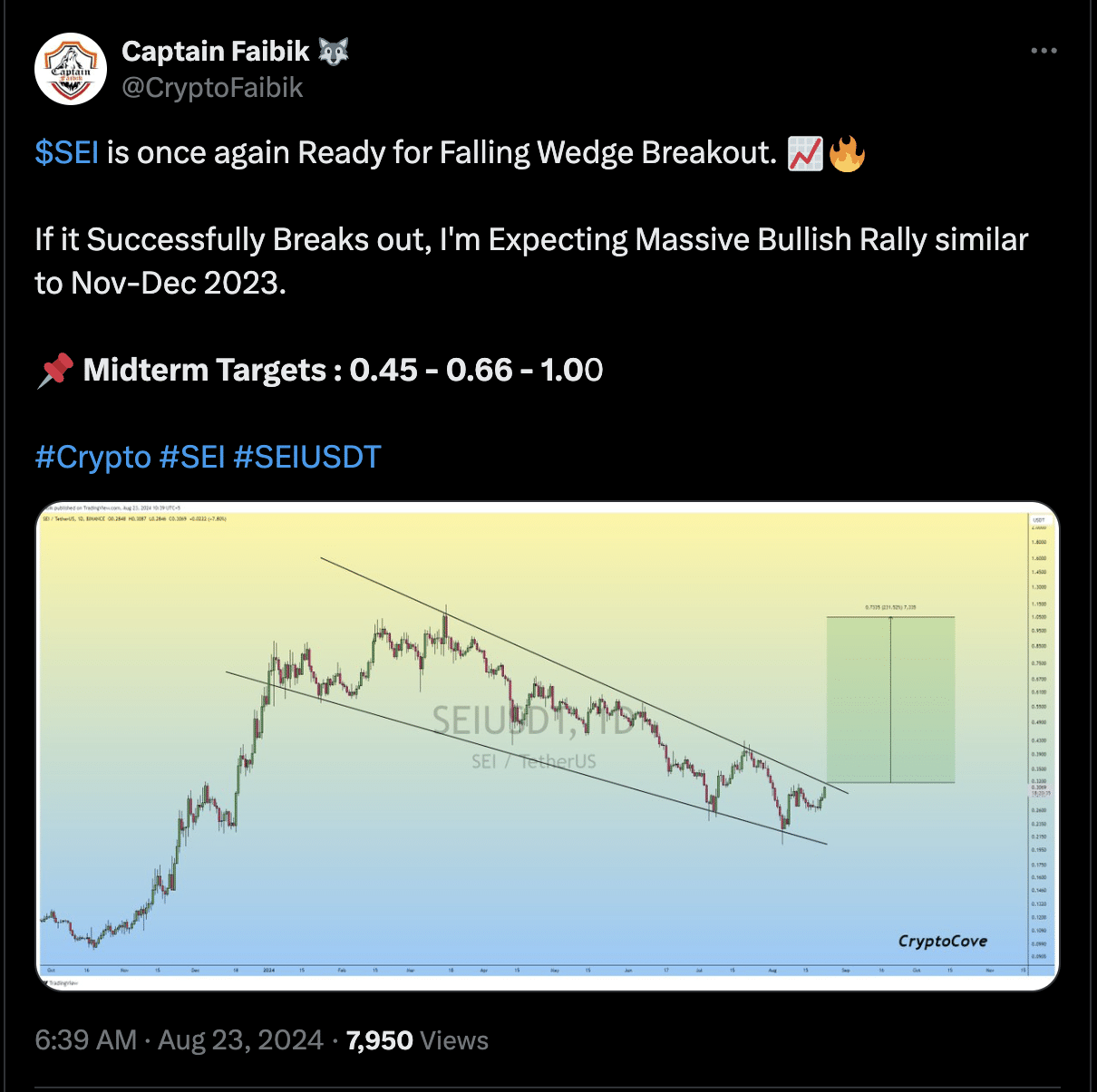

Crypto analyst Captain Faibik shared his technical outlook on SEI via X (formerly Twitter), highlighting that SEI appeared to be gearing up for a falling wedge breakout — often a bullish signal.

A falling wedge occurs when an asset’s price forms a converging channel, sloping downwards, but with a decreasing rate of decline.

This pattern typically signals a potential reversal in trend, suggesting that the asset might be preparing for a significant upward movement once it breaks out of the wedge.

According to Faibik, if SEI successfully breaks out of this pattern, it could trigger a massive bullish rally, potentially mirroring the substantial gains seen during the November-December 2023 period.

Faibik has set midterm targets for SEI at $0.45, $0.66, and $1.00, indicating a strong belief in the asset’s potential for further growth.

Source: Captain Faibik on X

Is SEI ready for the surge?

SEI’s fundamentals were signaling mixed signals for the asset’s trajectory.

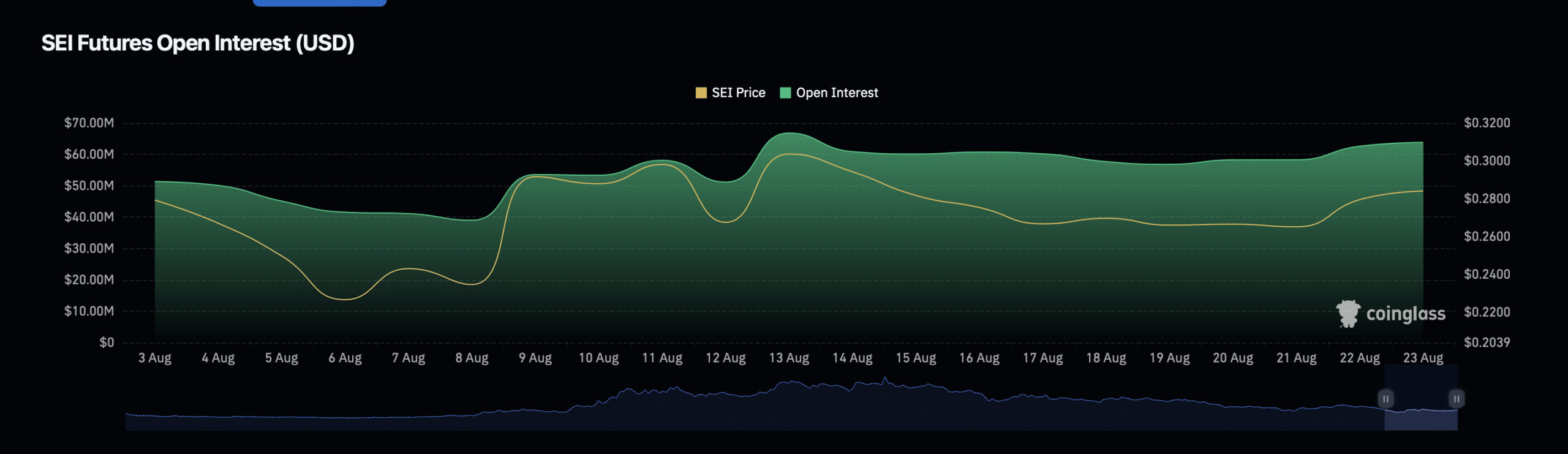

For instance, SEI’s Open Interest, which refers to the total number of outstanding derivative contracts for the asset, showed that over the past 24 hours, the asset’s Open Interest has increased by 14.55%, reaching a valuation of $76.47 million.

Source: Coinglass

This rise in Open Interest suggests that there is growing investor interest in SEI, with more traders opening positions in anticipation of future price movements.

However, it is also worth noting that SEI’s Open Interest volume has declined by nearly 6% during the same period, dropping to a valuation of $118.26 million.

This decline in volume could indicate that while more positions are being opened, the overall trading activity is slowing down.

This divergence between rising Open Interest and declining volume can sometimes signal that the market is becoming cautious, potentially leading to increased volatility.

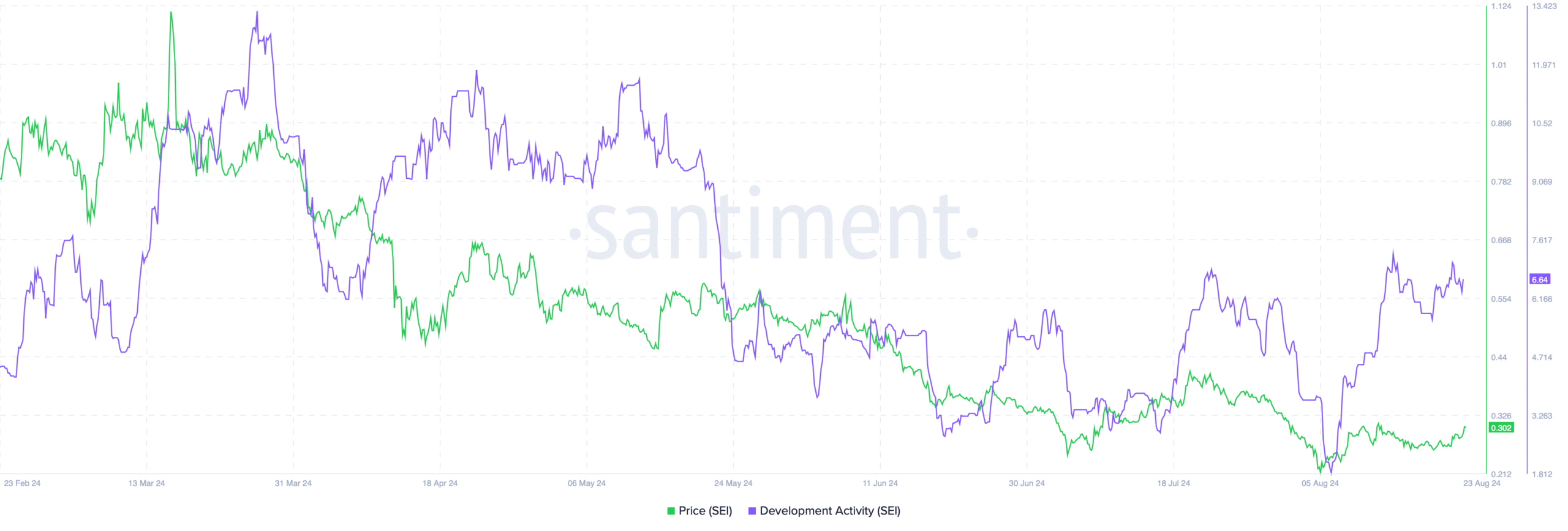

SEI’s development activity is another crucial factor to consider. According to data from Santiment, SEI’s development activity has seen a significant increase, rising from 2.8 in June to 6.64 as of press time.

Source: Santiment

Development activity reflects the level of innovation and progress being made within a project.

A higher development activity score indicates that the project’s team is actively working on improvements, which can enhance investor confidence and contribute to long-term price growth.

Read Sei’s [SEI] Price Prediction 2024–2025

For SEI, the increase in development activity suggests that the project is making strides in its technological and operational advancements.

This could be a positive sign for investors, as it indicates that the project is not only maintaining its momentum, but also building a strong foundation for future success.

Source: https://ambcrypto.com/will-sei-rally-to-1-yes-but-on-this-major-condition/