- MATIC has surged 12.5% at press time, with analysts predicting a potential 450% rally.

- Despite growing investor interest, MATIC’s overbought RSI suggested possible short-term risks.

Polygon [MATIC] has had a challenging year, underperforming compared to its peers among the top cryptocurrencies by market capitalization.

Though many major assets have seen impressive gains, with some surging over 100% YTD, MATIC declined by 3.5% during the same period.

However, recent developments suggested a potential shift in momentum. Over the past day, MATIC has experienced a significant price increase of 12.5%, bringing its press time trading price to $0.5303.

This spike was particularly notable given the token’s recent lows, where it traded below $0.400 earlier this month.

MATIC: 450% rise coming?

The recent price movement has caught the attention of analysts. One prominent crypto analyst, Javon Marks, recently shared his optimistic outlook for MATIC on X (formerly Twitter).

Marks pointed out that MATIC was beginning to show “major strength” and suggested that the token could be on the verge of a substantial rally.

The altcoin could potentially climb towards new all-time highs, with a possible increase of over 450% from its press time levels.

Source: Javon Marks/X

This bullish sentiment was further supported by the chart shared by Marks, which showed MATIC forming a broadening wedge pattern.

This technical formation is often considered a bullish continuation pattern, indicating that MATIC could be poised for a significant upward movement.

Fundamental analysis

To understand whether MATIC is truly positioned for a significant rally, AMBCrypto assessed its underlying fundamentals.

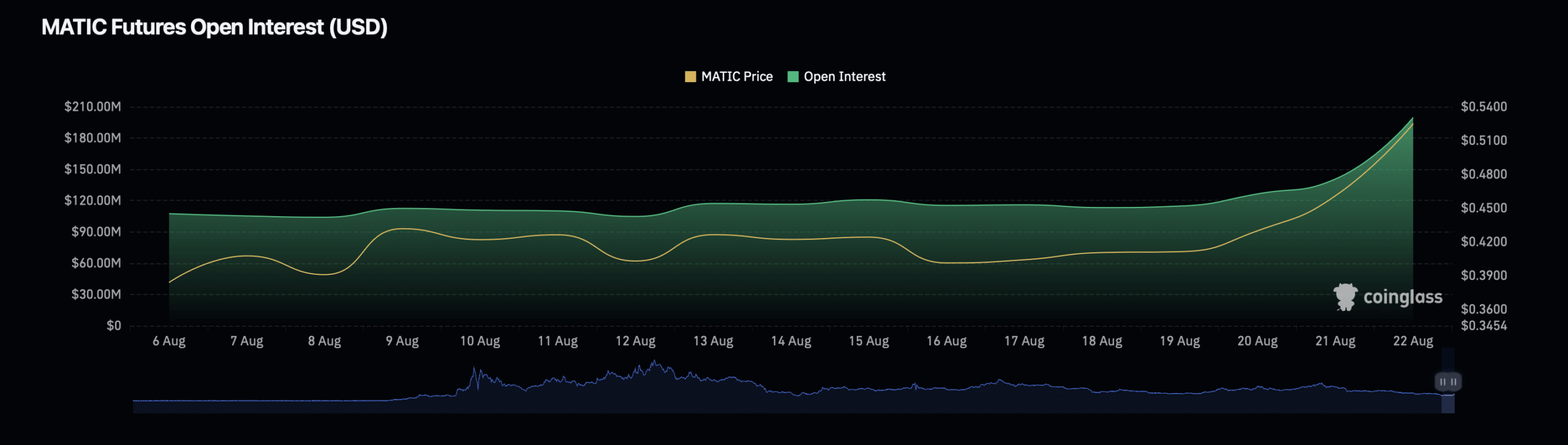

One such level is the surge in Open Interest, which refers to the total number of outstanding derivative contracts for the asset.

According to data from Coinglass, MATIC’s Open Interest has increased by nearly 40% over the past day, reaching a press time valuation of $209.39 million.

Alongside this, the Open Interest volume has also seen a substantial rise of 216%, now valued at $1.30 billion.

Source: Coinglass

This increase in Open Interest and volume suggested growing investor interest and participation in MATIC’s market.

When Open Interest rises alongside price, it often indicates that new capital is flowing into the market, which can lead to further price appreciation.

However, it’s worth noting that while increasing Open Interest can be a bullish signal, it can also lead to heightened volatility, especially if traders are heavily leveraged.

This means that while the potential for further gains exists, there is also an increased risk of sharp price movements in either direction.

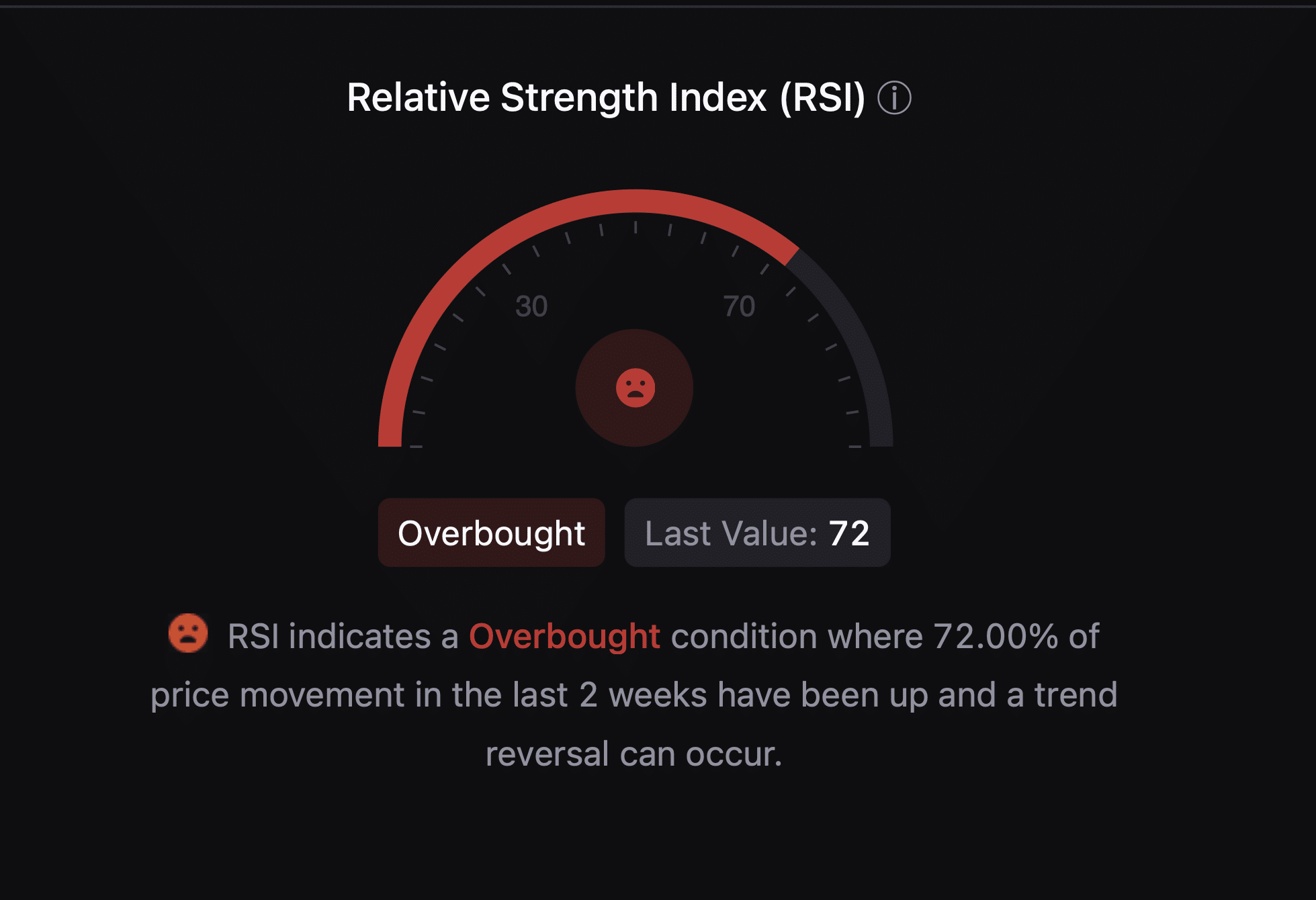

Another critical metric to consider is the Relative Strength Index (RSI), which measures the speed and change of price movements.

An RSI value above 70 typically indicates that an asset is overbought, while a value below 30 suggests it is oversold.

According to data from CryptoQuant, MATIC’s RSI was 72 at press time, signaling that the token is in overbought territory.

Source: CryptoQuant

Is your portfolio green? Check out the MATIC Profit Calculator

Traders often use the RSI as a signal to assess whether an asset is overextended and may be due for a correction.

In the case of MATIC, the overbought RSI suggests that while the token has seen strong gain, there may be short-term pressure on the price if traders begin to take profits.

Source: https://ambcrypto.com/will-matic-skyrocket-450-yes-say-analysts-but-not-before/