- SUI flipped BTC, TON and confirmed a falling wedge breakout on the charts

- SUI’s open interest and trading volume rose, tapping into a $113 billion lottery industry

SUI Network is rapidly gaining attention from traders and investors due to its impressive transaction speed, which is ten times faster than Solana’s.

In fact, as Joshua Orhue noted on X, SUI is now referred to as the “Solana killer” for its growing adoption. This has pushed it into third place in total value locked (TVL) among non-EVM chains

At the time of writing, SUI’s TVL had surpassed $600 million, overtaking Toncoin at $542 million and Bitcoin [BTC] at $516 million.

Source: Joshua Orhue/X

Solana led the charts with $4.9 billion, followed by Hyperliquid with $717.28 million. SUI’s rise is a sign of its increasing influence in the cryptocurrency market, making it a strong contender among non-EVM platforms.

On the price front, SUI Network confirmed a breakout on the daily timeframe, signaling a potential rally. The price, at press time, seemed to be targeting the $1.16 resistance level. A close above the same could lead to a new all-time high on the charts.

SUI also broke out of a falling wedge pattern and retested the breakout, confirming a bullish trend. The overall bias remained long though, with expectations of further upside movement.

Source: TradingView

SUI Futures Open Interest on the rise

SUI has been gaining significant attention from investors, with Open Interest hitting $179.72 million too. This hike highlights the strong demand for the asset, especially after showing signs of strength on the daily timeframe.

Growing interest and positive momentum could push SUI’s price to a new high, potentially before the year ends – A sign of the market’s confidence in its continued upward trend.

Source: Coinglass

Volume to market cap ratio analysis

At the time of writing, SUI’s market cap stood at $2.2 billion, with a trading volume of $167 million, giving it a volume-to-market cap ratio of 7.68%. This ratio pointed to sufficient liquidity in the market.

The total and max supply of SUI are both capped at 10 billion tokens, while the circulating supply, at press time, was 2.6 billion. The fully diluted market cap, which accounts for the total possible supply, was valued at $8.5 billion.

Source: DefiLlama

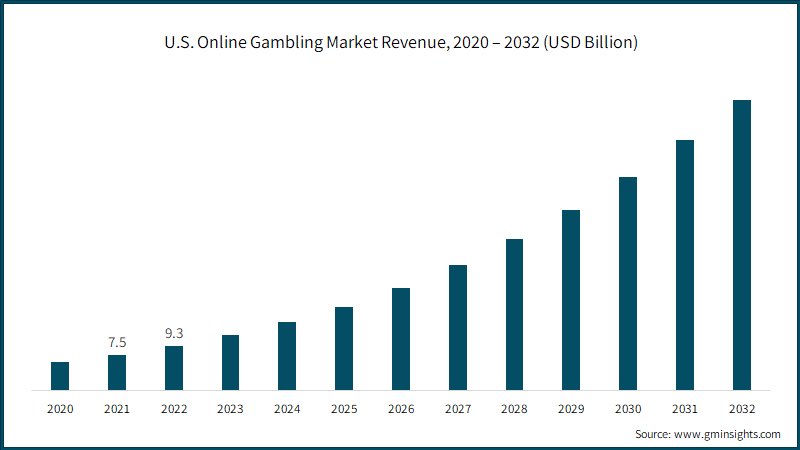

That’s not all though. SUI Network introduced the first fully decentralized on-chain casino and lottery – Doubleup_app – Making it the first Layer 1 blockchain globally to do so.

Here, it’s worth pointing out that the casino industry in the U.S generated approximately $67 billion in 2023, while the lottery industry brought in around $113 billion.

By tapping into these lucrative industries, SUI’s on-chain casino aims to generate significant revenue that could enhance the network’s development and potentially drive up the price of SUI tokens.

Source: gminsights.com

Source: https://ambcrypto.com/how-sui-network-flipped-bitcoin-toncoin-to-potentially-tap-into-this-113b-market/