- MATIC’s Open Interest jumped by over 15% in the last 24 hours, indicating growing interest from investors.

- If MATIC’s price falls to $0.442, nearly $6.77 million worth of long positions will be liquidated.

The current market sentiment is quite bearish following the significant Bitcoin [BTC] transaction at Mt. Gox and the recent all-time high in the price of gold.

Amid this market downturn, on the 21st of August, Polygon [MATIC] experienced a strong bullish breakout of the consolidation zone and the descending trendline.

Major breakout in MATIC

Based on the historical price momentum, MATIC was consolidating within a tight range for over 14 days.

Additionally, since March 2024, it has been in a continuous downtrend and has formed a descending trendline where it consistently faced resistance.

Source: TradingView

With this recent breakout of the trendline, MATIC has cleared a significant barrier. Thus, there is a high possibility it could rise over 20% to $0.575 level, or even higher, based on the market situation.

Bullish sentiment

With the recent breakout, MATIC looks bullish.

According to the on-chain analytic firm CoinGlass, MATIC’s Open Interest has jumped by over 15%, in the last 24 hours, indicating growing interest from investors and traders following the breakout.

During the same period, traders’ long-leverage positions are significantly higher than short-leverage positions, indicating bulls betting more heavily than bears.

However, MATIC’s daily active addresses have continuously risen for the last seven days, according to an on-chain analytic firm IntoTheBlock.

This growing daily active address could be a key factor behind the recent breakout. Additionally, the new adoption rate is also rising along with the price.

MATIC’s price performance

At press time, most of the cryptocurrencies are struggling to gain momentum, whereas MATIC was trading near $0.4725 and has experienced a price surge of over 7.5% in the last 24 hours.

Meanwhile, its trading volume has increased by 31% during the same period, indicating higher participation from traders.

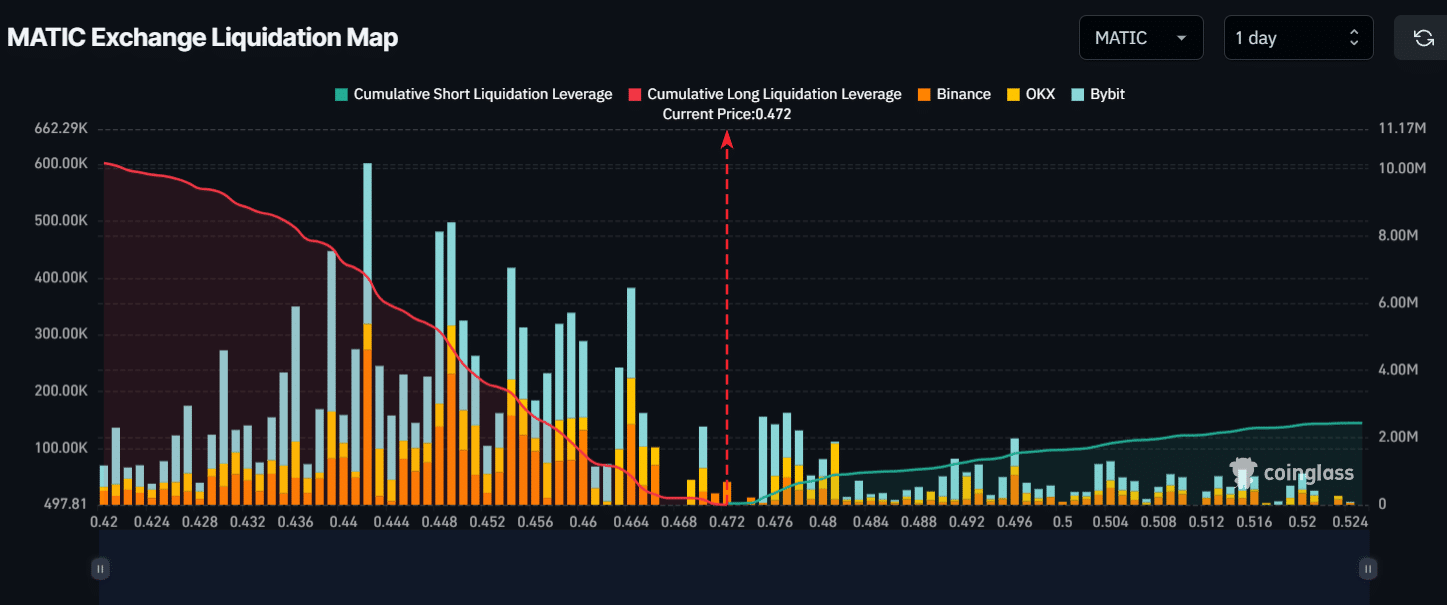

As of now, the two major liquidation levels are near $0.442 on the lower side and $0.496 on the higher side, according to Coinglass, at these levels traders are highly leveraged.

Source: Coinglass

If the market sentiment remains the same and MATIC’s price rises to the $0.496 level, nearly $1.52 million worth of short positions will be liquidated.

Conversely, if sentiment changes and the price falls to the $0.442 level, nearly $6.77 million worth of long positions will be liquidated.

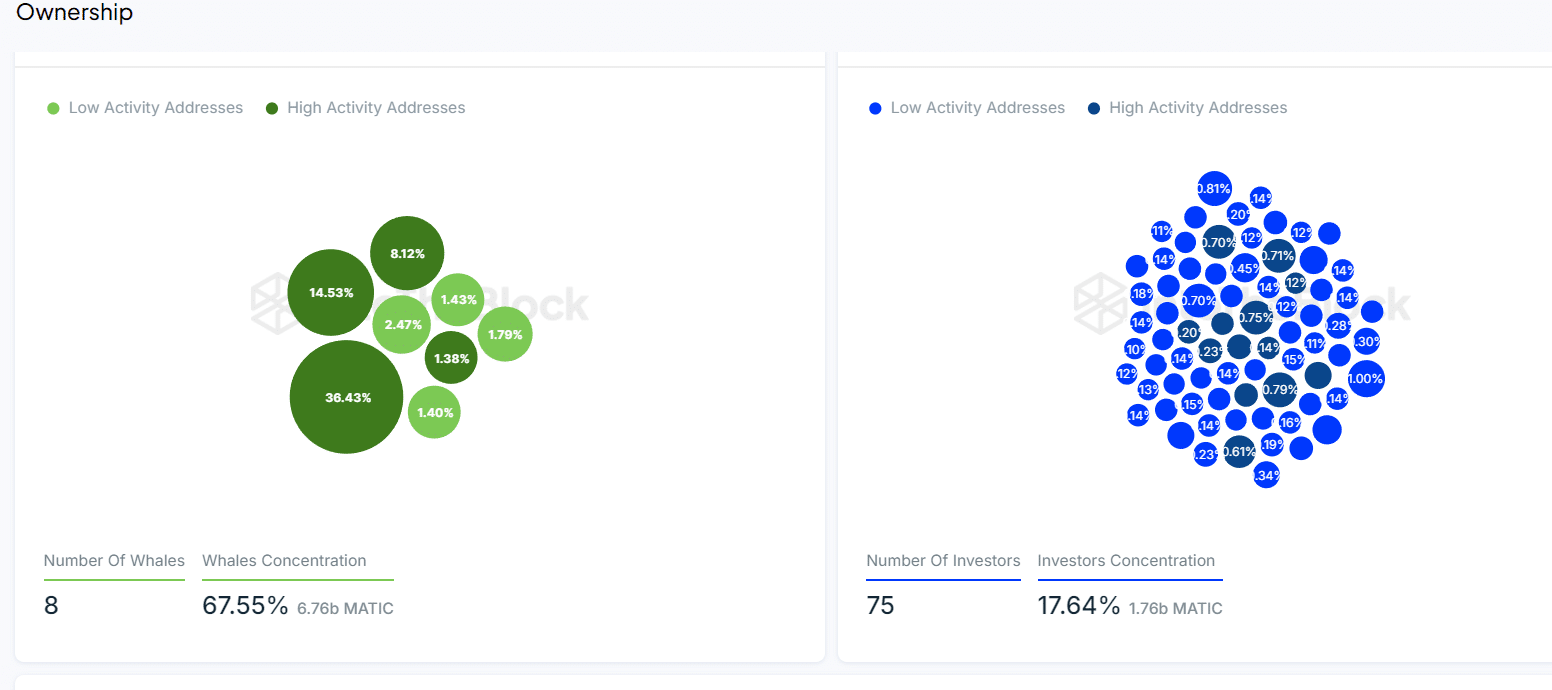

Whale concentrations in MATIC are significantly high, making price manipulation more likely.

Read Polygon’s [MATIC] Price Prediction 2024-25

According to the data, just eight whales hold a substantial 67.55% of the total supply, while 75 sharks control over 17.64%. In contrast, only 14.8% of the total supply is in the hands of retail investors.

Source: IntoTheBlock

This data suggests that price manipulation in MATIC is relatively easy.

Source: https://ambcrypto.com/matic-could-rise-20-despite-bearish-sentiments-heres-how/