Shiba Inu price is grappling with a critical support level in the daily timeframe as the SHIB burn rate spikes by 1000%. The meme coin has been facing downward pressure for some time now, with a death cross flashing on its price chart. Nevertheless, SHIB technical analysis shows traders are neutral to bullish in the short to mid-term. A break past certain key levels will confirm a bullish reversal for the crypto asset.

Traders Neutral to Bullish on Shiba Inu Price

Bitcoin price recently experienced volatility, rising to $61,000 and then dropping to $58,000. The crypto market also felt the impact of the erratic price movements as the total crypto market cap dropped 0.3% over the last day.

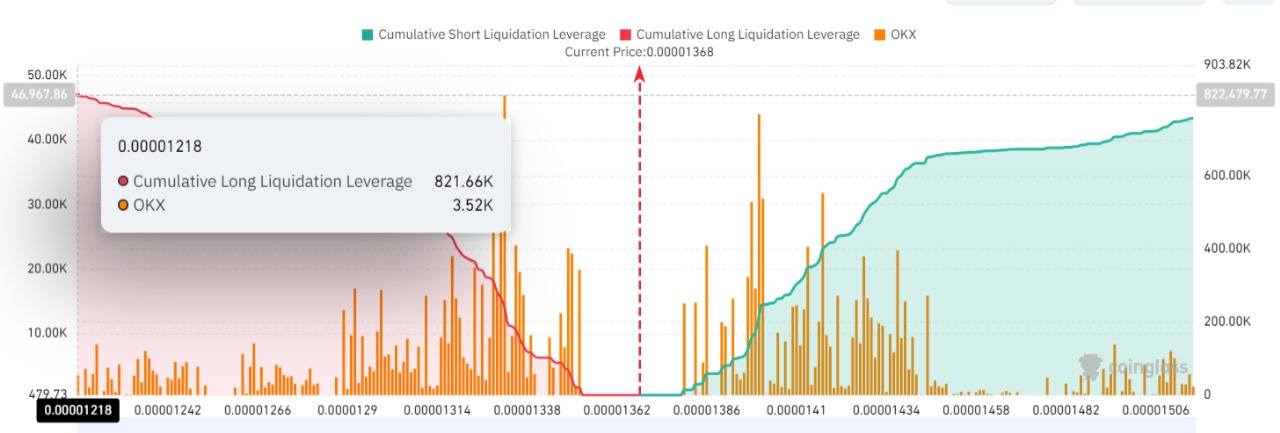

Nevertheless, Shiba Inu traders are net long on the asset, as Coinglass futures trading data reveals that Cumulative Long Liquidation Leverages were slightly higher than the Shorts. This slight imbalance reveals an indecision in the market as traders remain unsure of the Shiba Inu next move.

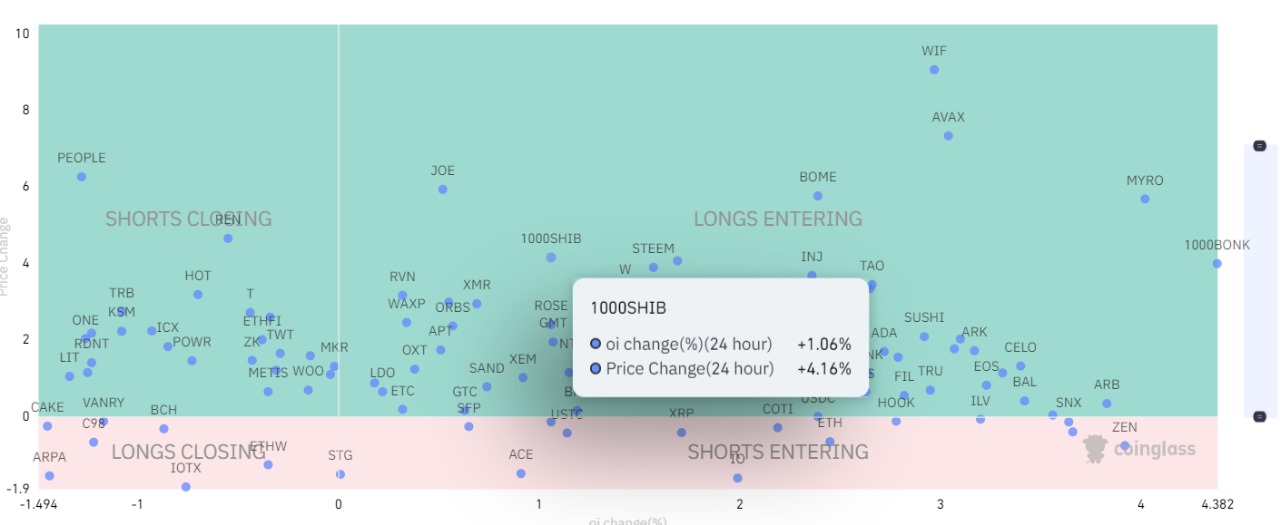

According to Coinglass, the SHIB open interest (OI) increased by 1.06% over the last 24 hours, as did Shiba Inu price. This concurrent rise in these metrics suggests that traders are opening more Long positions, which means that even though they are unsure of the next move, most of them are biased toward a bullish sentiment.

Shiba Inu price prediction shows the asset is at a critical juncture in its price chart. A weakness in the market may result in a catastrophic drop, but if bulls continue adding to the buying pressure, the SHIB price may rise higher.

Can SHIB Price Surge 24% With Hiked Token Burns?

The Shiba Inu chart shows a bearish “Death Cross” where the 50-day EMA crosses below the 200-day EMA. This indicates a long-term bearish trend, typically suggesting further downside pressure.

Despite the bearish Death Cross, there is a short-term recovery as SHIB is attempting to bounce from the support zone around $0.00001000.

Shiba Inu price will likely experience resistance around $0.00001571 and $0.00001794

The Stochastic RSI is currently in an overbought zone (with values of 86.30 and 80.64). This indicates that SHIB price is currently overbought, which could lead to a potential pullback in the short term.

Given the overbought Stochastic RSI and low volume, we can expect a pullback before SHIB attempts to break through the $0.00001571 resistance level.

Given the presence of the Death Cross and the overall bearish trend, it might be wise to remain cautious and avoid long-term positions unless there is a clear breakout above $0.00001794 with strong volume.

If the SHIB price fails to hold the $0.00001300 support, it may show traders are becoming bearish, causing the price to drop to $0.00000998. A breakdown below this level could lead to a further decline.

Frequently Asked Questions (FAQs)

A “Death Cross” is when the 50-day EMA crosses below the 200-day EMA, signaling a long-term bearish trend. For Shiba Inu, this indicates potential downside, but a short-term recovery is possible if key support holds.

Given the presence of the Death Cross and the overall bearish trend, it may be wise to remain cautious with long-term positions.

A 24% surge is possible, especially with the increased token burns, it is contingent on breaking through key resistance levels and maintaining buying pressure. Traders should closely monitor the price action and market sentiment.

Related Articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/shiba-inu-price-analysis-key-levels-to-watch-for-amid-bitcoin-volatility/

✓ Share: