Finding a reliable CFD broker in today’s crowded market can be challenging. With so many platforms claiming to offer top-notch features and robust security, it’s hard to know which ones truly deliver on their promises.

XS.com has emerged as a strong contender, offering a comprehensive suite of features, advanced trading tools, and rigorous security protocols. But how does it really measure up?

In this review, we’ll take an in-depth look at XS.com’s offerings, from its security measures and customer support to its trading conditions and others.

Whether you’re a beginner or an experienced trader, this guide will provide all the insights you need to decide if XS.com is the right platform for you.

Let’s dive in!

What is XS.com?

XS.com is a global multi-asset broker that was founded in Australia in 2010. It offers a wide range of financial instruments, including forex, stocks, indices, metals, commodities, cryptocurrencies, futures, and energy.

Operating under the XS Group, a multinational fintech and financial services provider, XS.com has established itself as a leader in online trading.

The XS Group has entities regulated and authorized in various countries, ensuring compliance and security for its clients worldwide. However, it’s important to note that the broker does not operate in the USA, Iran, or North Korea.

Since its inception (as a liquidity provider), XS.com has continuously innovated and expanded its services to meet the changing needs of its customers. This dedication to excellence has earned the company numerous industry awards, such as Broker of the Year, Best Partnership Programs, Best Multi-Asset Broker, and Most Secure Broker.

These recognitions highlight XS.com’s commitment to offering top-notch trading services and a safe trading environment.

XS Trading Platform: Features

Multiple Account Types

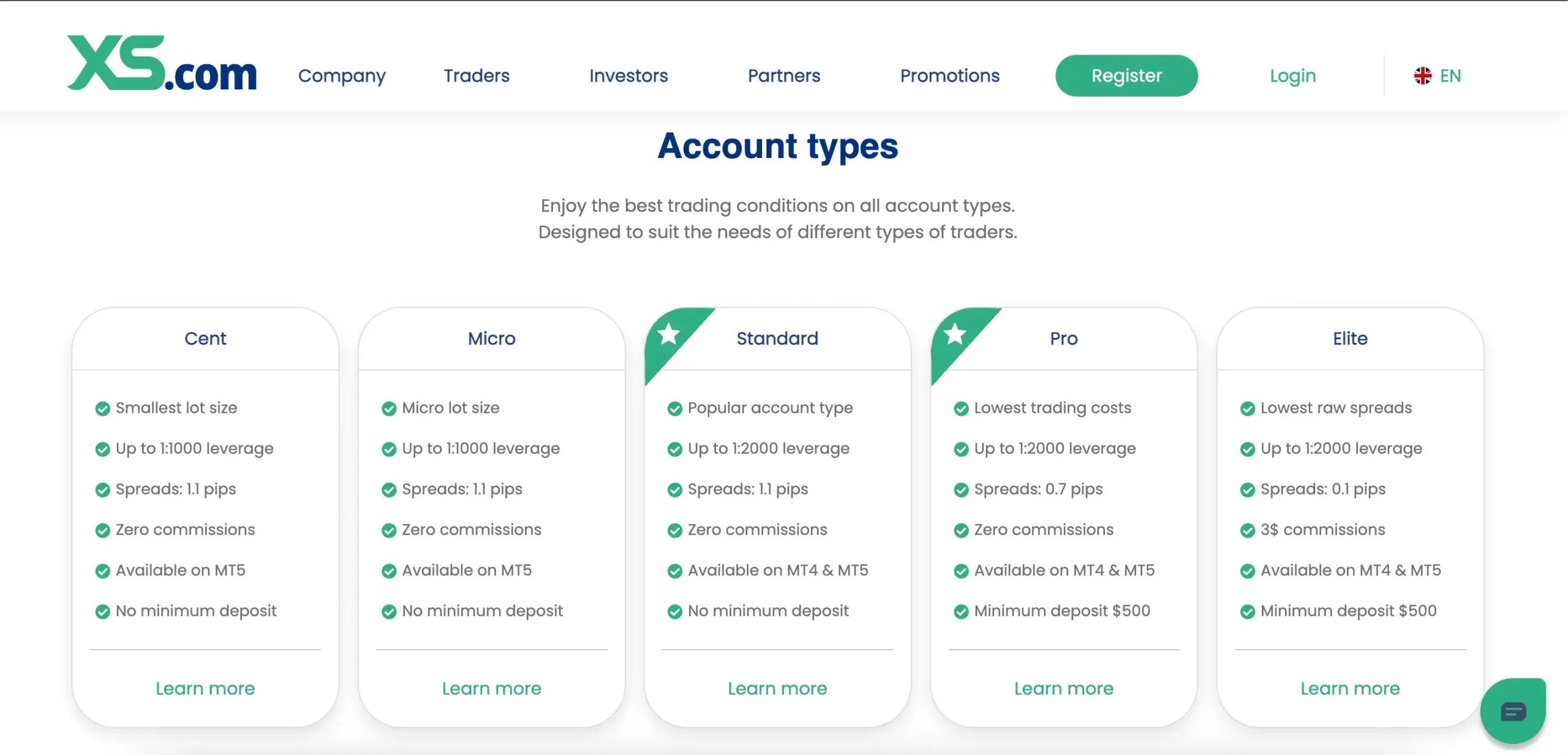

XS offers a variety of account types to meet different trading needs and preferences.

- Preferred Accounts – These accounts are great for beginners and smaller traders. They offer low spreads and no commissions. The Cent Account is ideal for those just starting out, while the Standard and Micro Accounts provide more flexibility and varied trading sizes.

- Professional Accounts – Aimed at experienced traders and high-net-worth individuals, these accounts come with tighter spreads and extra benefits. The Elite Account features low commissions, the Pro Account offers a balanced approach, and the VIP Account is tailored for exclusive trading needs with commission-based pricing.

XS Mastercard and Mobile App

XS offers a smooth financial experience with its prepaid Mastercard and mobile app. You can easily transfer funds between your XS wallet and the card, making it simple to handle both online and offline transactions.

The mobile app allows you to track your transactions conveniently and integrates seamlessly with the XS client portal for effortless fund management.

Multiple Asset Classes

XS provides a broad selection of tradable assets, enabling traders to diversify their portfolios effectively. The platform offers access to various asset classes, including shares, where traders can engage with CFDs on international stocks from leading companies like Amazon, Alibaba, and Apple.

It also features indices, allowing traders to access major global indices such as the Dow Jones, NASDAQ, S&P 500, and FTSE 100.

In the realm of commodities, XS.com offers trading in metals like gold, silver, platinum, and palladium, as well as energy commodities such as Brent Crude Oil, WTI Crude Oil, and Natural Gas.

The platform provides options for those interested in cryptocurrencies to trade popular digital assets like Bitcoin, Ethereum, and Litecoin.

Forex traders can also buy and sell various currency pairs, including minor, major, and exotic pairs. Additionally, traders can access a variety of other commodities such as cocoa, coffee, copper, corn, cotton, soybean, sugar, and wheat. The platform also supports Futures trading, offering CFDs on Futures across multiple markets.

Insurance Program

XS.com prioritizes client security with its Civil Liability Insurance Program, underwritten by Lloyd’s of London. This program provides an extra layer of protection, covering losses exceeding USD 10,000 up to a substantial USD 5,000,000 against fraud, negligence, and other potential risks. Importantly, this comprehensive insurance is offered at no extra cost to clients, providing peace of mind and confidence in their trading journey.

Dynamic Leverage Model

XS also features a dynamic leverage model, allowing traders to tailor their experience with leverage levels up to 1:2000. This system adjusts leverage based on trading volume, ensuring a balanced approach to risk management. As trade volume increases, leverage is gradually reduced, catering to both conservative and aggressive traders and enabling them to optimize their trading strategies.

Swap-Free Accounts

XS supports inclusivity by offering Swap-Free (Islamic) accounts that adhere to Shariah law. These accounts eliminate swap or rollover fees, allowing traders who follow Islamic principles to fully participate in the market without compromising their beliefs.

XS Trading Platform: Security

XS.com is dedicated to ensuring a secure trading environment by employing extensive security measures.

The platform uses advanced encryption techniques to protect all data, preventing unauthorized access and ensuring that personal and financial information remains secure. This encryption is applied across their websites and applications, forming the backbone of their data protection strategy.

To further enhance security, XS.com offers two-factor authentication, which adds an extra layer of protection beyond the usual password requirement. Additionally, XS.com enforces strict password policies, requiring passwords to meet specific complexity and length criteria, which helps prevent unauthorized access.

Regular external security audits are a key component of XS.com’s security strategy. These audits assess and improve security systems, ensure compliance with industry regulations, and adapt to new security threats.

Moreover, XS takes steps to protect client funds by keeping them in separate accounts with reputable financial institutions. This segregation ensures that clients’ assets are safeguarded even if the company faces financial challenges.

XS Trading Platform: Regulatory Compliance

As we discovered, XS Group strongly emphasizes regulatory compliance across all its operations, ensuring that its clients are well-protected and that its business practices meet the highest ethical standards.

That’s why the XS Group is regulated by several financial authorities worldwide, which helps them adhere to strict industry standards and provides their clients with additional protection and confidence. Each XS Group entity is authorized and regulated by a leading financial authority in its respective region.

Here’s an overview of their key regulatory bodies:

- Seychelles – Financial Services Authority (FSA): XS Ltd, with license number SD089, operates under Seychelles’ FSA. The FSA is responsible for licensing, monitoring, and enforcing regulations within the non-bank financial sector.

- Australia – Australian Securities and Investments Commission (ASIC): XS Prime Ltd, holding license number 374409, is regulated by ASIC, the primary authority in Australia overseeing registered companies, financial markets, and financial service providers.

- Cyprus – Cyprus Securities and Exchange Commission (CySEC): XS Markets Ltd, under license number 412/22, falls under the regulatory supervision of CySEC, which oversees investment services in Cyprus.

- Labuan, Malaysia – Financial Services Authority of Labuan (LFSA): XS Finance Ltd, with license number MB/21/0081, is authorized by the LFSA, the governing body that oversees the Labuan International Business and Financial Centre (Labuan IBFC).

- South Africa – Financial Sector Conduct Authority (FSCA): XS ZA (Pty) Ltd, with FSP number 53199, is regulated by the FSCA, which ensures market conduct, efficiency, and integrity within South Africa’s financial markets.

XS Group is transparent about its regulatory status. Their website provides detailed information about each entity’s registration details, license numbers, and links to the relevant regulatory body’s website.

Additionally, as they are regulatory compliance, they offer investor compensation schemes, though the specific details depend on the XS entity a specific user is dealing with.

XS Trading Platform: Deposits and Withdrawals

Deposits

XS.com offers a variety of funding methods, allowing traders to choose the most convenient option for their needs. The platform supports bank transfers, Visa/MasterCard, Skrill, and Neteller with relatively low minimum deposits and prompt processing times.

Minimum deposits and processing times:

- Bank Transfer: $300 minimum deposit, unlimited maximum, 1–7 working days processing, EUR, USD, GBP accepted.

- Visa/MasterCard: $20 minimum deposit, $25,000 maximum, instant processing, EUR, USD, GBP accepted.

- Skrill: $15 minimum deposit, $15,000 maximum, instant processing, EUR, USD, GBP accepted.

- Neteller: $15 minimum deposit, $15,000 maximum, instant processing, EUR, USD, GBP accepted.

The deposit options at XS.com are competitive, with the $15 minimum deposit on Skrill and Neteller being particularly advantageous for traders looking to start with a smaller investment.

Withdrawals

XS.com provides several withdrawal methods, including bank transfer, Visa/MasterCard, Skrill, and Neteller. Each method has its own minimum withdrawal limits and processing times.

Minimum withdrawals and processing times:

- Bank Transfer: $250 minimum withdrawal, unlimited maximum, 1–7 working days processing, EUR, USD, GBP accepted

- Visa/MasterCard: $5 minimum withdrawal, $25,000 maximum, 7–10 working days processing, EUR, USD, GBP accepted

- Skrill: $50 minimum withdrawal, $15,000 maximum, 1 business day processing, EUR, USD, GBP accepted

- Neteller: $15 minimum withdrawal, $2,500 maximum, instant processing, EUR, USD, GBP accepted

XS.com does not charge withdrawal fees, making it a cost-effective option for traders. However, be aware of the processing times, especially for Visa/MasterCard withdrawals, which can take up to 7–10 working days.

XS Trading Platform: Accessibility

XS strongly commits to inclusivity and accessibility by offering its services in over 11 languages.

This multilingual approach greatly expands the platform’s appeal to a global audience, making it easier for traders from diverse linguistic backgrounds to navigate and use its features comfortably.

In addition, the platform’s multilingual support further reinforces this dedication. By providing customer support in multiple languages, XS ensures that traders can receive assistance and address inquiries in their native language, enhancing their overall trading experience.

XS Trading Platform: Customer Support

As mentioned, XS.com offers multilingual customer support in English, French, Spanish, Arabic, Portuguese, Traditional Chinese, Korean, Thai, Japanese, and more.

Additionally, XS provides exceptional customer service through various channels, including live chat, email, and phone. The company is committed to assisting traders with any questions or concerns and creating a supportive trading community.

To evaluate their support efficiency, we tested their live chat feature. Impressively, we were connected with an agent in 30 seconds, and they resolved our issue quickly.

So, we can consider that XS truly excels in this aspect.

XS Trading Platforms: Pros and Cons

XS Pros

- XS.com offers many tradable assets, including forex, stocks, indices, metals, commodities, and cryptocurrencies.

- Operates under multiple regulatory bodies like ASIC and CySEC, ensuring client protection and compliance.

- Implements high-level encryption, two-factor authentication, and regular security audits to protect user data and funds.

- Offers dynamic leverage up to 1:2000, allowing traders to adjust based on their trading style.

- Provides swap-free (Islamic) accounts that adhere to Shariah law.

- Available in over 11 languages, making it accessible to a global audience.

- Additional protection with insurance coverage up to USD 5,000,000 through Lloyd’s of London.

- Provides quick and effective live chat, email, and phone support, ensuring traders receive timely assistance.

XS Cons

- A $300 minimum deposit for bank transfers might be too high for some traders.

- Visa/MasterCard withdrawals can take 7–10 working days, which is longer than other methods.

- Withdrawal fees may apply from time to time depending on the account type.

- Some methods have lower withdrawal limits, which might not suit traders needing to withdraw large amounts.

At the time of writing, XS.com can be considered a good and legitimate platform backed by multiple regulatory authorities that ensure client protection and compliance with industry standards.

With a strong regulatory framework, advanced security measures, and a diverse range of tradable assets, it provides a robust platform for both novice and experienced traders.

Additionally, XS.com’s commitment to inclusivity through multilingual support and its client-first approach, evidenced by no fees for deposits and withdrawals, further enhance its appeal. However, the higher minimum deposit for bank transfers and slower withdrawal times for certain methods may be a drawback for some users.

Remember that, as always, it’s important to do your own research (DYOR) before making any investment decisions.

* The information in this article and the links provided are for general information purposes only

and should not constitute any financial or investment advice. We advise you to do your own research

or consult a professional before making financial decisions. Please acknowledge that we are not

responsible for any loss caused by any information present on this website.

Source: https://coindoo.com/xs-com-review/