- Bitcoin maintains strength above key level despite signs of potential downside.

- Shorts face the sharp edge of the knife as price sustains in the $58k range.

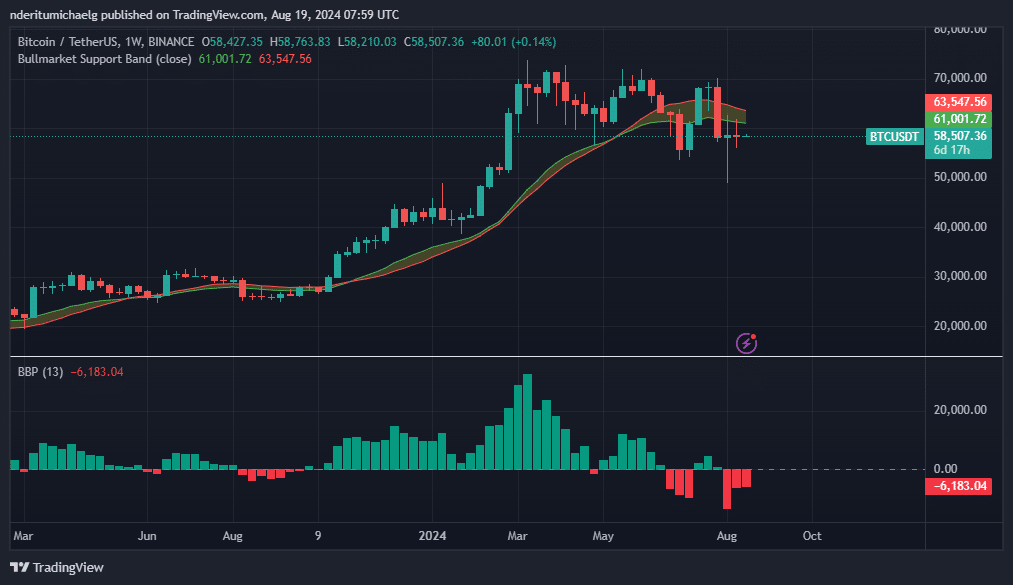

Bitcoin [BTC] just closed another week below its bullish market support band on the 1-week time frame. Consequently, more traders are turning bearish, but despite this, things have been quite rocky for leveraged shorts traders.

Although Bitcoin made a recovery attempt after its crash earlier this year, weak bullish momentum triggered more bearish sentiments.

Meanwhile, the price has been stuck in a narrow range evident in the weekly timeframe. On top of that, Bitcoin’s price remained below bullish support band, fueling more bearish speculation.

Source: TradingView

The Bitcoin bull market support band inversion is just one of the bearish signals suggesting more potential downside ahead. Short traders have been doubling down on their positions.

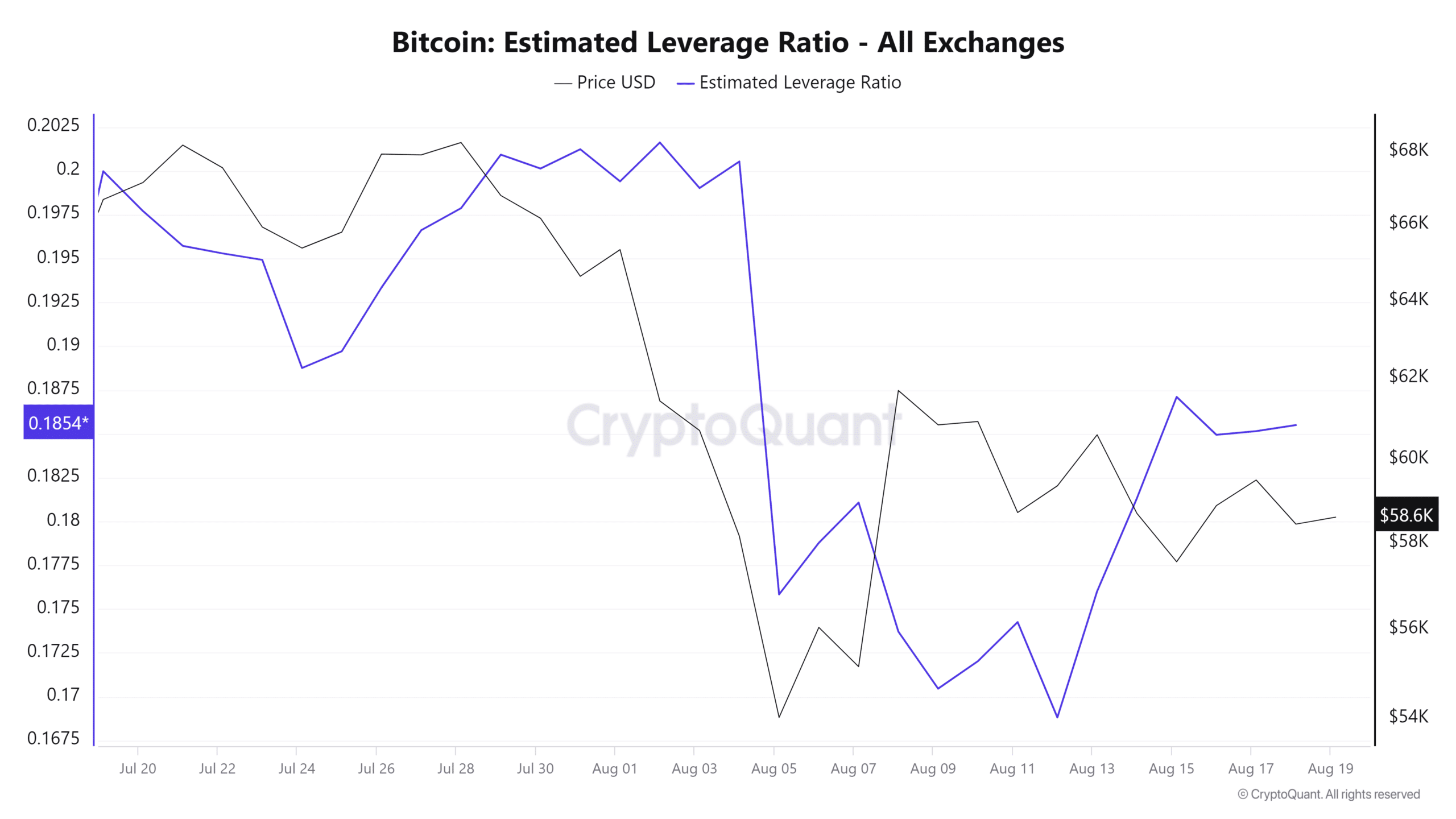

Appetite for leverage has been on the rise for the last week or so. This is evident in the estimated leverage ratio which bottomed out on 12 August. This suggests that the market anticipates more volatility in the coming days.

Source: CryptoQuant

The number of Bitcoin leveraged shorts have been growing, with the expectations of more price weakness. However, BTC’s price action appears to be putting on a show of strength against the downside near the $58,000 price range.

Recent findings revealed that over $1.65 billion worth of leveraged shorts were recently liquidated.

Despite these findings, the number of shorts liquidations were still low compared to what we observed earlier this month. But the most important question on most Bitcoin holders’ minds is whether the cryptocurrency will continue to drop.

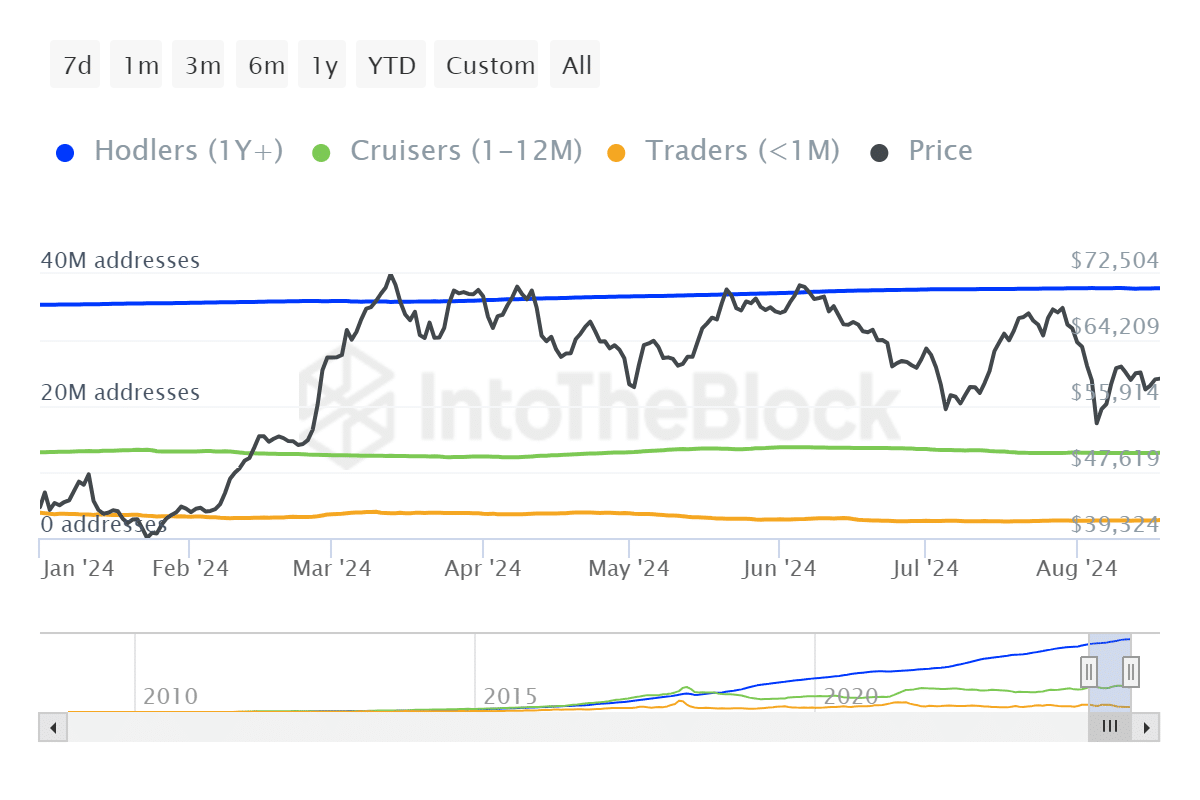

Several key observations to note. The narrow price range suggests that Bitcoin holders are still opting to hold on to their coins.

Bitcoin ownership stats by time held reveals that whales continue to HODL. For example, the number of whales HODLing BTC on a YTD time frame grew from 35.33 million addresses to 37.88 million addresses as of the latest stats.

Source: IntoTheBlock

Whales holding on to Bitcoin is a good sign because they have a significant impact on the market collectively. However, the same data also indicates that the retail class of holders have declined during the same period.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A potential reason for the above could be that the higher cost of living and market uncertainty may have forced retail holders to sell.

Meanwhile, whales opting to HODL suggests long term bullish expectations remain strong despite short-term headwinds. Every dip so far has been accompanied by robust accumulation, which has shielded Bitcoin from more downside.

Source: https://ambcrypto.com/bitcoin-narrow-range-wreaks-havoc-shorts-and-leverage-traders-reeling/