- BlackRock holds more ETH than the Ethereum Foundation now

- BlackRock’s ETHA now on track to hit $1B mark in net inflows

BlackRock has maintained its dominance in the Ethereum [ETH] ETF space, similar to its remarkable performance in U.S spot Bitcoin [BTC] ETFs. In fact, the firm’s ETH holdings have reached figures of 318k, surpassing even the Ethereum Foundation’s 308k coins.

Source: Kairos Research

BlackRock eyes $1B net inflows – Will ETH’s price follow?

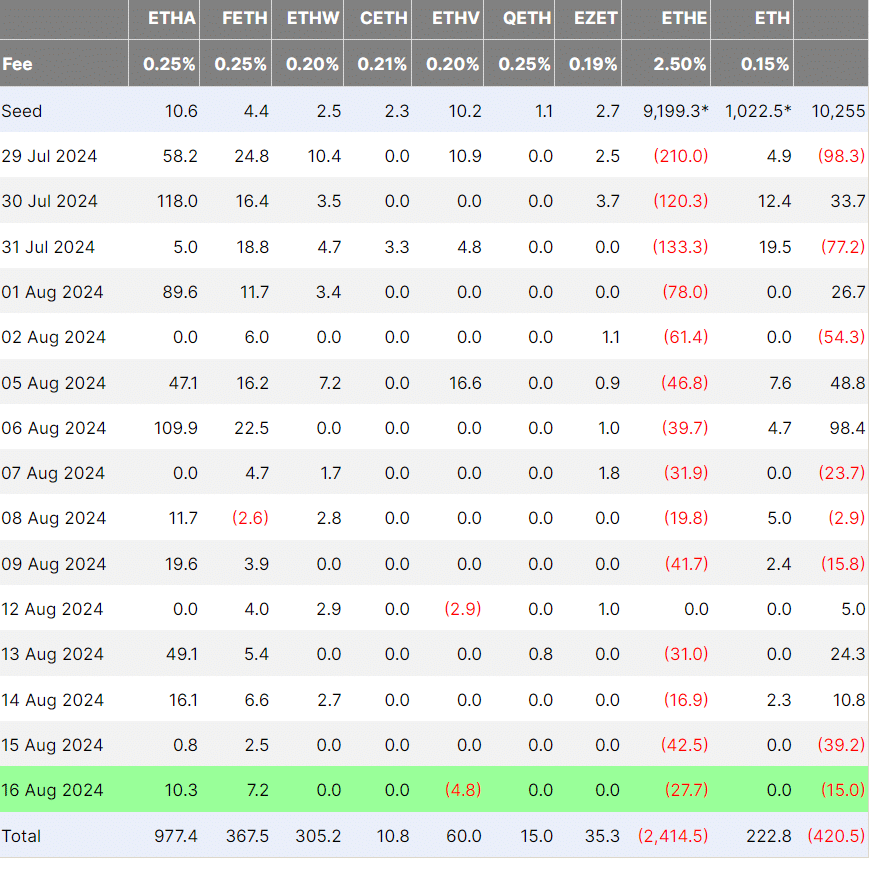

Besides flipping Ethereum Foundation in its ETH holdings, BlackRock could soon cross the $1 billion net inflows mark. As of 16 August, the firm’s ETHA product had a total of $977 million in net flows and was the only product above $500M.

This performance was achieved in less than a month.

Source: Farside Investors

Interestingly, the ETH ETFs saw net inflows towards the beginning of the week. As noted by Coinbase analysts in their weekly report recently, this can be interpreted as a positive catalyst for ETH’s price.

However, the analysts also said that the low network activity illustrated by the slump in ETH gas fees to a five-year low could complicate price recovery.

That being said, Ryan Lee, Chief Analyst at Bitget Research, told AMBCrypto that the slump in ETH gas fees could be a sign of ETH’s price bottom in the mid-term.

“Historically, every time ETH gas fees have dropped to rock bottom; it has often signalled a price bottom in the mid-term. ETH prices tend to strongly rebound after this cycle.”

Lee added that ETH’s gas fees slump is a positive, especially given the expected Fed rate cut in September.

“When this moment coincides with an interest rate cut cycle, the market’s wealth effect is full of possibilities. Therefore, we are maintaining a positive outlook on this news.”

As far as the altcoin’s price action is concerned, it has been range-bound between $2500 and $2750 throughout the week. Its indicators seemed to be flashing very mixed signals too.

Hence, the altcoin’s next price move might just depend on Bitcoin’s [BTC] next price direction on the charts.

Source: https://ambcrypto.com/ethereums-price-hits-a-mid-term-price-bottom-every-time-analyst/