Ethereum (ETH) price has bounced 23% from the August 5 low of $2,111, signaling a strong buying pressure. This recent run-up can be attributed to Bitcoin (BTC) price rally and institutions, whales buying ETH coupled with the recent US CPI data release.

Ethereum Price Market Movers: ETH Whales Accumulate, Gas Fees Plummet, ETF Notes Outflows

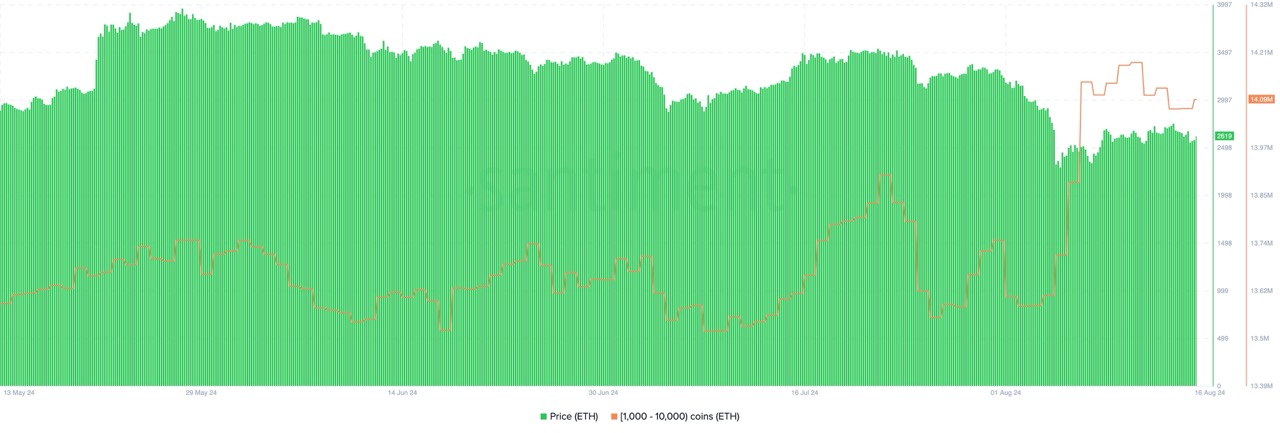

- According to data from Santiment, Ethereum whale addresses holding 1,000 to 10,000 ETH have accumulated 510,000 tokens since August 3 and currently hold 14.09 million Ether tokens.

- The median Ethereum network gas fees dropped below 2 gwei on August 10, marking a five-year low. This development shows retail investors are less active on the blockchain than when the market rallied. During a bear market, a sudden crash causes many investors to capitulate from losses while others go into capital preservation mode, which could serve as a sign of a potential price bottom.

- While the above two points are bullish developments for Ethereum, spot Ether ETF flows are suggested otherwise, with a net outflow of $39.21 million on August 15. Since approval, the spot ETF has seen a cumulative outflow of -$405.11 million.

- On August 15, Exchange Nasdaq ISE filed notices to withdraw its proposal to list and trade spot Ether and Bitcoin ETFs on the US Securities and Exchange Commission (SEC). This development from Nasdaq follows similar withdrawals of listing and trading of spot Ether and Bitcoin proposals.

ETH Price Analysis: Ethereum Bulls Plan Recovery Rally

Ethereum price hovers above the $2,618 support level. A decisive flip above this level with a daily candlestick close will signal the presence of bulls. Such a development will open the path for ETH price to trigger a 10% rally to the next daily resistance level of $2,886. In some cases, if the buying pressure remains high, Ether could revisit the $3,000 psychological level.

The Relative Strength Index (RSI) and Awesome Oscillator are below their respective mean levels of 50 and 0, respectively. But both the momentum indicators show signs of waning bearish momentum, often spotted during the reversal of a downtrend.

Furthermore, the spike in whale accumulation coupled with the daily active address uptick on August 16 suggests that investors were interested in Ethereum price on the recent dip.

While the uptrend is not yet sealed in stone, investors need to be aware of a sudden crash in Ether that could be driven by macroeconomic uncertainty. In such a case, Ethereum Price Prediction forecasts a rejection at $2,618, which could trigger a 16% correction to $2,190. This move could put the recovery rally in jeopardy.

Frequently Asked Questions (FAQs)

If Ethereum price can cover $2,618 resistance, ETH could attempt a recovery rally tor retest $3,000.

The median Ethereum network gas fee has dropped below 2 gwei, a five-year low.

Ether whales have accumulated 510,000 ETH tokens since August 3.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/ethereum-price-analysis-whales-buy-500k-eth-3000-next/

✓ Share: