In recent weeks, Cardano price has faced intense selling pressure amid widespread concerns about the future of the US economy despite easing inflation. If the Fed moves ahead with the expected rate cut in September, it will appease investors, likely stabilizing the ADA price and supporting recovery.

Meanwhile, the hype around the Chang hard fork upgrade has failed to elicit the anticipated price volatility. Bitcoin’s price volatility on August 14 caused ADA’s price to slide lower; however, the asset quickly recovered. Cardano’s spot trading data reveal bearish sentiment on the asset, which is further exacerbated by a stagnant user base.

Mixed Indicators Affecting Cardano Price

The ADA price dropped by 1.1% in the last 24 hours to trade at $0.337. Despite the drop, ADA performs well against Bitcoin (BTC), gaining 3.8% against the number one crypto. This increase against BTC runs across the market, with XRP price gaining 2.8% and Solana price rising 4.3% against the asset.

A deeper look at Cardano’s network state and traders’ behavior reveals the asset is in bad shape. Despite the talk around the launch of the Chang hard fork, the numbers do not look good.

According to IntoTheBlock, the number of active addresses with balances has hovered around 4.45 million for over a year, reflecting the network’s stagnant state.

Cardano’s number of addresses with a balance has hovered around 4.45 million for over a year. Here’s what’s going on👇

During the last cycle, Cardano experienced significant growth, positioned as a strong alternative to Ethereum. However, in the current cycle, the network faces… pic.twitter.com/WJrnAP8FQZ

— IntoTheBlock (@intotheblock) August 13, 2024

IntoTheBlock found that despite this stagnant metric, the number of long-term holders was at an all-time high, holding over 40% of the total ADA supply. This shows a high confidence in the network, which is potentially bullish for the price.

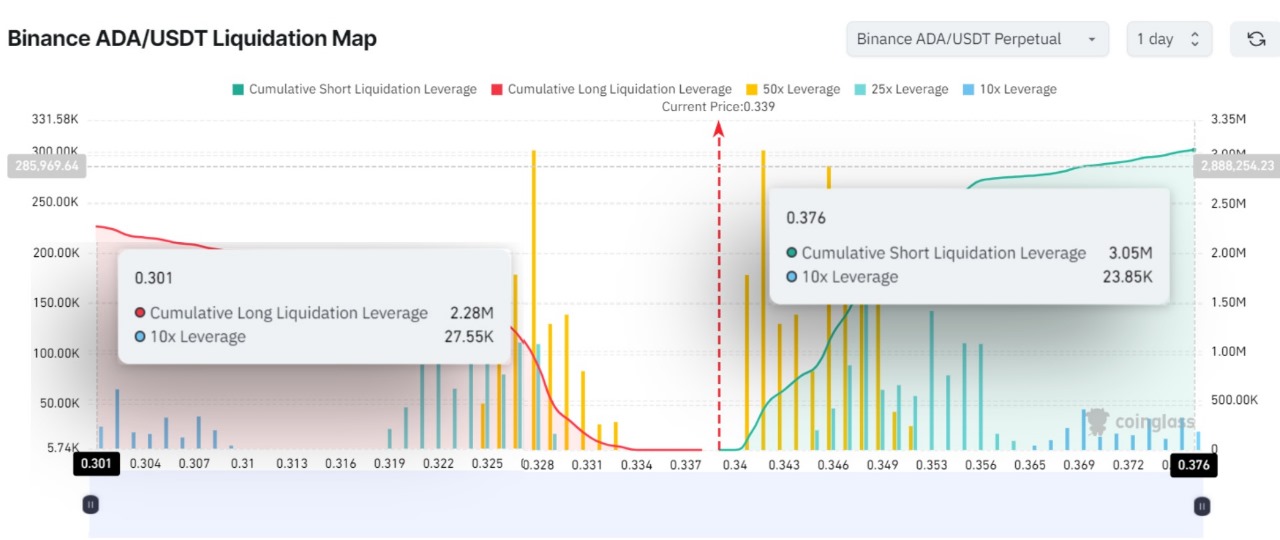

On the other hand, traders feel differently about the ADA price, as Coinglass Liquidation Map data shows more bearish sentiment. The cumulative long liquidation leverage was $2.28 million, lower than the cumulative short liquidation leverage at $3.05 million on August 14. This imbalance shows that bearish sentiment dominates the market as traders anticipate further downside potential for the Cardano price.

The higher number of Shorts indicates that traders are betting on ADA price to decline in the short term, potentially driven by bearish sentiment surrounding the U.S. government moving Bitcoin from the Silk Road wallet.

Further, this assessment is supported by the fact that the current price of ADA remains close to the key resistance level of $0.34, where significant selling pressure has been observed.

ADA Price Forecast: All Eyes On $0.3

Cardano price is currently in a downtrend, with immediate support likely around $0.31 and the key psychological level of $0.3. The narrowing Bollinger Bands suggest a period of reduced volatility, which could lead to a breakout from the rising channel and a significant expansion of these bands.

The Moving Average Convergence Divergence (MACD) indicator is negative, signaling bearish momentum. While a crossover of the MACD line above the signal line could indicate a potential bullish move, this has not yet materialized. Additionally, the Chaikin Money Flow (CMF) indicator shows mild buying pressure at 0.08, but it’s not strong enough to signal a reversal.

In summary, despite a 21% gain in the last two weeks, Cardano faces downward pressure due to bearish trader sentiment and stagnant network growth. This could push the price down to the $0.3 level, which may present a potential buy zone for a rebound.

Frequently Asked Questions (FAQs)

Cardano’s price is influenced by several factors, including the failure of the Chang hard fork to generate anticipated volatility, Bitcoin’s recent price movements, and mixed trading sentiments. Despite some positive indicators, bearish sentiment and stagnant user growth are significant concerns.

No, the number of addresses with a balance has remained stagnant for over a year, reflecting limited growth in user engagement on the network.

According to the Sharpe ratio, ADA is currently considered an unfavorable and risky investment, with the potential for a 10% crash if bearish sentiment prevails.

Related Articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/is-ada-a-dead-coin-cardano-price-struggles-uphill/

✓ Share: