- An ETH address from the ICO era was activated.

- ETH’s price could surpass $4,000 if demand continues to increase.

For the first time since April 2022, the price of Ethereum [ETH] climbed past $3,200. The value meant that ETH has registered an amazing 10.28% increase over the last seven days.

However, the events of the last 24 hours have been so interesting that the total crypto market cap was only inches away from hitting $2.20 trillion.

AMBCrypto’s assessment of the market showed that several other unexpected events filled the ecosystem. One of these involved a dormant pre-mine Ethereum address which held 238 ETH.

Pre-mining is associated with Initial Coin Offerings (ICO). It serves as a way to reward early investors, founders, and developers of a project.

The awakening offers ETH calm

According to a post from Whale Alert, the aforementioned address has been activated. This was the first time it came to life after almost nine years of inactivity.

Source: X

At press time, AMBCrypto could not confirm if the activation was to sell or to move the assets to another secured wallet. If the owner decides to book profit, the sale might not significantly affect ETH’s price.

However, if the action was only to move, ETH’s bullish momentum might also not react to the development.

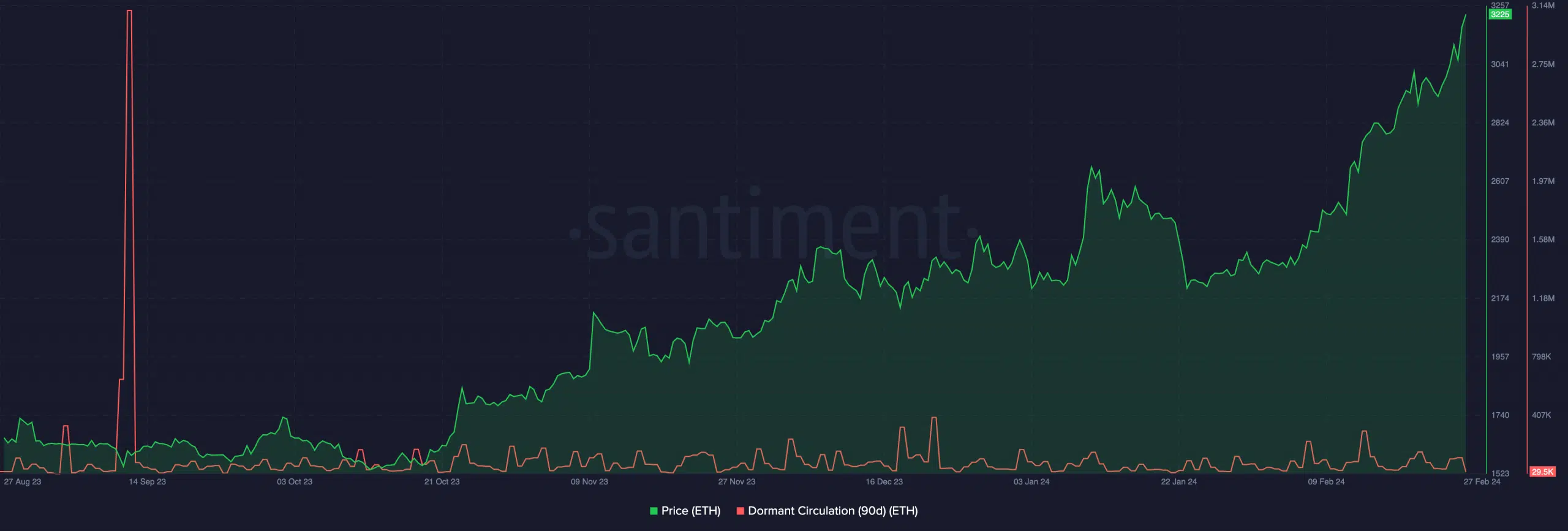

In the meantime, we decided to check if other old wallets were waking up as well. To do that, we employed Santiment’s Dormant Circulation metric. As of this writing, the 90-day Dormant Circulation was down to 29,500. This number suggests that a few aged wallets were activating their accounts.

In terms of the price action, this could imply that ETH might not face significant selling pressure. Should this be the case, bullish sentiment alongside increasing buying could fuel the price increase to $3,500.

In a highly bullish scenario, ETH could hit $4,000 in some weeks.

Source: Santiment

Fading ETH right now could be a crime

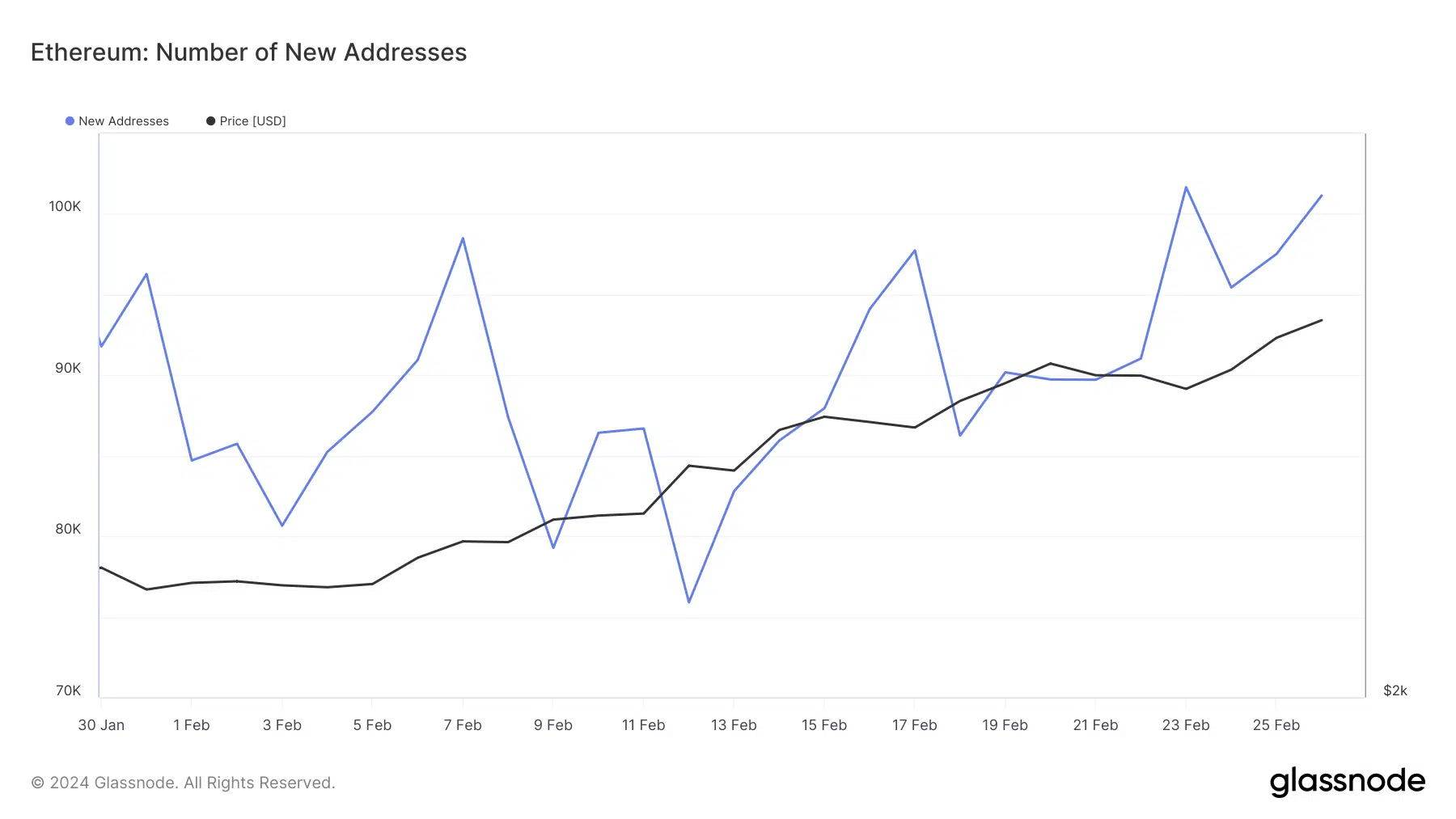

In 2023, we reported how addresses that held ETH in small numbers liquidated their holdings. During that time, the price of the second-largest cryptocurrency by market cap was a little over $2,000. But now the trend has reversed based on data acquired from Glassnode.

According to the on-chain analysis tool, the number of new addresses has increased compared to what it was in January. As of the 30th of January, the number of ETH new addresses was 96,272. Between that time and now, the metric experienced some ups and downs.

However, press time data showed that the number was 101,144. Growth in this metric suggests that retail demand for ETH has been impressive. The increase also serves as a sign of network growth which could improve the health of the project.

Source: Glassnode

Read Ethereum’s [ETH] Price Prediction 2024-2025

Going forward, a climb in this metric could improve ETH’s chances of hitting $4,000. If retail demand falls, the price could drop or stall for a while.

However, intense adoption of the Ethereum network could propel a new All-Time High (ATH) which seemed set to happen later this year

Source: https://ambcrypto.com/ethereum-rally-triggers-unexpected-events-in-24-hours-what-now/