- XRP’s potential rise above $0.57 could help the price lean toward $0.65.

- Two oscillators pointed towards increasing downward momentum.

“Buy!” That is what a leading indicator has signaled on the Ripple [XRP] weekly chart. However, analyst Ali Martinez noted that the climb could only happen if XRP closes above $0.57.

According to Martinez, the Tom DeMark (TD) Sequential flashed a buy signal for the token, which could push the price toward $0.63, or even higher at $0.65.

However, failure to close above $0.57 could invalidate the thesis. The TD Sequential identifies price turning points by gauging trend exhaustion.

In XRP’s case, it seemed that the sellers had become tired, and a bullish price reversal was likely.

Source: X

Is there light at the end of the tunnel?

At press time, XRP’s price changed hands at $0.54. On a Year-To-Date (YTD) basis, a 14.31% decrease.

AMBCrypto discovered that this price action has affected the sentiment market participants have toward the token.

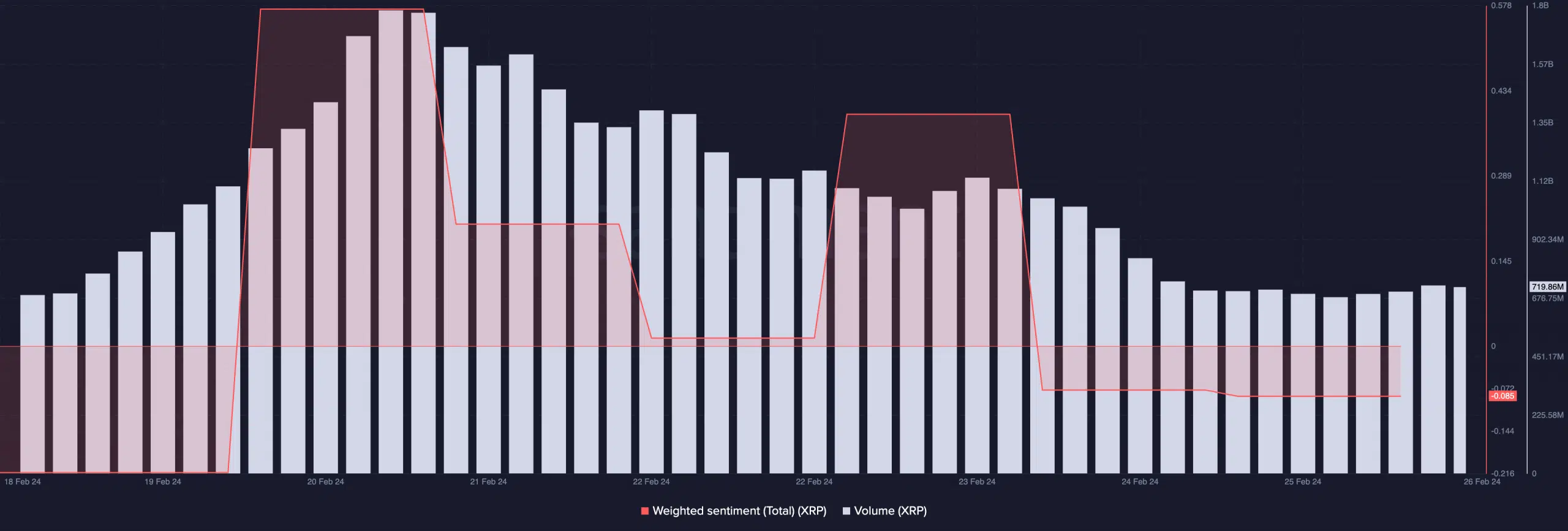

According to our on-chain analysis using Santiment, we observed that the Weighted Sentiment was -0.085.

The Weighted Sentiment spikes when the vast majority of messages about an asset are positive. On the other hand, a negative reading of the metric suggests that most messages are not optimistic.

For XRP, it was the latter. Needless to say, one cannot fault the participants for holding a negative view about the cryptocurrency.

For example, if you compare XRP’s performance with others in the top 10, you would realize that has had one of the worst performances this year. But that could change soon.

Another metric AMBCrypto looked at was the volume. As of this writing, XRP’s volume had dropped to 720.14 million, suggesting that interest in the token had decreased.

However, when put side by side with the price action, this decline could be beneficial.

Source: Santiment

A rising volume and decreasing or stalling price might imply that a further decline is on the way. But if the volume declines alongside the price, it means that the strength pushing the value downwards is getting weak.

Consequently, this could trigger a bullish reversal that possibly leads to higher prices.

The potential jump is not hurdle-free

From the technical point of view, XRP could face resistance at $0.55. But if bulls successfully breach the area, then the price could climb an extra 16.92%.

If this is the case, XRP could hit $0.62 over the coming week. However, indications from the Relative Strength Index (RSI) showed that the potential rise could be challenging.

At press time, the RSI reading was 48.95. This suggested that buyers’ authority in the market had diminished and sellers had taken the baton.

Should the reading continue to drop, XRP’s price might follow. But if the token does not drop below the $0.50 support, then the bullish thesis might not be invalidated.

Source: TradingView

In addition, the Awesome Oscillator (AO) was also negative, indicating increasing downward momentum. So, sellers might get exhausted again.

Read Ripple’s [XRP] Price Prediction 2024-2025

Should this be the case, bulls might capitalize on the fatigue and push XRP toward $0.57.

If bulls are fortunate enough to achieve this, then the price could try to hit $0.63. Otherwise, XRP might continue trading between $0.52 and $0.55.

Source: https://ambcrypto.com/xrp-eyes-0-65-but-it-needs-to-cross-a-major-level-first/