KiloEx is a new decentralized derivatives exchange that received funding from Binance Labs in the MVB VI program. Today, let’s join Coincu to learn details about the project through this KiloEx Review article.

What is KiloEx?

KiloEx is a decentralized perpetual exchange (DEX) platform on BNB Chain ecosystem, offering traders a seamless experience and a plethora of financial products. Unlike traditional exchanges, KiloEx operates without the need for user identity verification, prioritizing security and privacy for its users.

One of the standout features of KiloEx is its focus on user experience. The platform boasts a user-friendly interface and trading mechanism, making it accessible even to novice traders. Moreover, KiloEx incentivizes user participation through innovative features such as copy-trading, trading mining, and trading competitions, fostering a dynamic and engaging trading environment.

In addition to its emphasis on user experience, KiloEx stands out for its diverse range of trading assets and flexible trading methods. Traders can access a wide variety of assets, including foreign exchange, catering to the diverse needs of its user base. Furthermore, KiloEx distinguishes itself with relatively low transaction fees, aiming to minimize costs for its users and enhance their overall trading experience.

Read more: Kinza Finance Review: Breakthrough Lending Platform With Model ve(3,3)

KiloEx components

KiloEx has notable improvements compared to its counterparts such as dYdX or GMX. Central to its success is the implementation of the Peer to Pool operating model, distinguishing it from traditional trading systems.

The Peer to Pool operating model adopted by KiloEx introduces two distinct user components into the platform ecosystem:

Unlike traditional trading platforms, KiloEx actively involves liquidity providers who play a crucial role in maintaining the platform’s liquidity pool.

By contributing liquidity to the platform, these participants facilitate smooth and uninterrupted trading activities. In return for their services, liquidity providers earn profits from transaction fees, thereby incentivizing their continued engagement with the platform.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Traders

The traders who conduct transactions on the platform are referred to as the “core” of the exchanges. Traders can open trading positions on KiloEx and invite friends to trade with them in order to share benefits. Traders can also use the “stop loss” and “take profit” functions in the event that they are unable to constantly monitor the market price and their trading position in order to prevent loss.

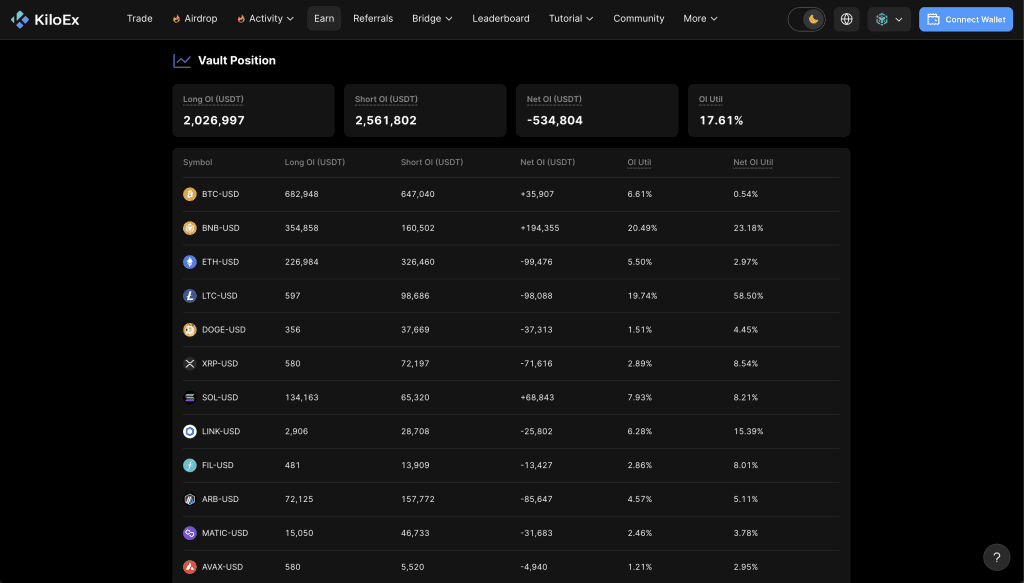

Liquidity Providers (LPs)

LPs play a crucial role in facilitating transactions and are rewarded with a portion of the platform’s earnings.

Users can opt to contribute liquidity in USDT and receive flexible interest rates, measured in Annual Percentage Yield (APY). Upon depositing USDT into the vault, users receive kUSDT tokens, representing their contribution to the liquidity pool.

The vault serves as a trading partner for transactions conducted on the platform. When traders realize profits, the winnings are sourced from the vault. Conversely, losses incurred by traders are absorbed by the vault.

In exchange for its services, the vault receives various fees, including trading fees, commission fees, and borrowing fees for long/short transactions. These fees are distributed proportionally among kUSDT holders, ensuring fair compensation for liquidity provision. It’s worth noting that converting kUSDT back to USDT may take up to 24 hours, providing users with flexibility in managing their liquidity positions.

Highlights of KiloEx

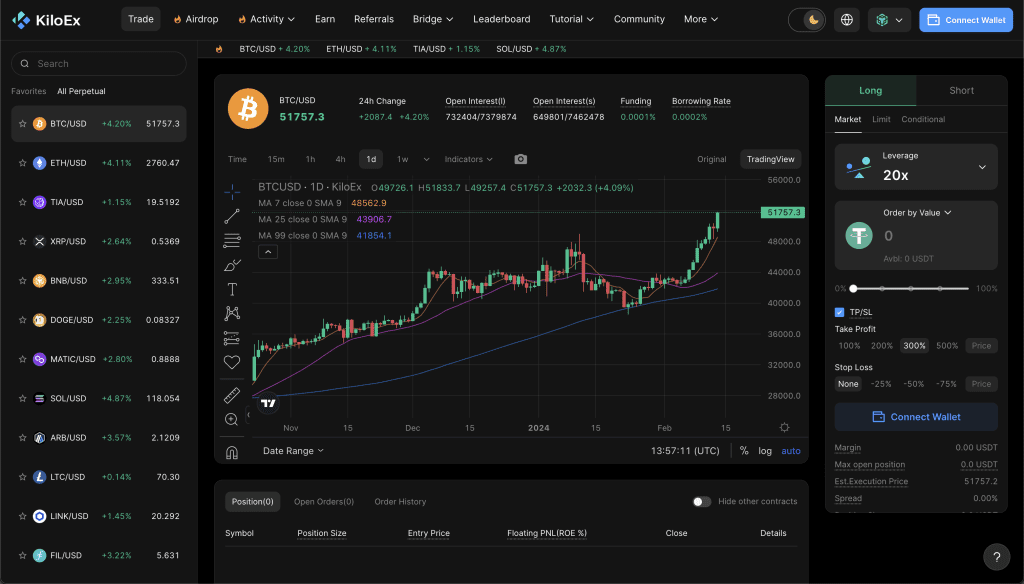

User-Friendly Interface

The significance of a user-friendly interface cannot be overstated in the realm of trading platforms. KiloEx recognizes this imperative and prides itself on offering users a seamless and intuitive interface that simplifies navigation and enhances accessibility. By prioritizing user experience, KiloEx ensures that even novice traders can swiftly acclimate to the platform, enabling them to execute transactions with ease and confidence.

Lightning-Fast Order Matching Speeds

Utilizing cutting-edge technology, KiloEx DEX boasts lightning-fast order matching speeds that set it apart from its competitors. Through its innovative Peer to Pool operating model, the platform facilitates rapid liquidity provision and order matching, ensuring that users can execute transactions swiftly and efficiently. This high-speed functionality not only expedites trading processes but also minimizes latency, thereby optimizing trading outcomes for users.

Moreover, KiloEx offers a range of flexible trading methods to cater to diverse investor preferences. Whether trading by market or by limit, users have the freedom to choose the approach that best aligns with their individual needs and objectives.

Low Transaction Fees

A standout feature of KiloEx DEX is its remarkably low transaction fees, setting it apart from its counterparts. While most trading platforms levy hefty charges, KiloEx bucks the trend by charging a mere 0.1% per transaction. This substantial reduction in fees translates into tangible benefits for users, enabling them to save on transaction costs and bolster their profits.

The significance of low transaction fees extends beyond mere cost-saving. It levels the playing field for investors, facilitating more flexible trading strategies without the burden of exorbitant fees. Novice traders find solace in the accessibility offered by KiloEx, where they can explore the intricacies of financial markets without fear of incurring steep expenses.

Moreover, seasoned investors stand to gain substantially from the reduced transaction costs. Capitalizing on these savings, they can optimize their profits through both short-term trades and long-term investment endeavors. KiloEx’s commitment to affordability underscores its dedication to fostering a fair and equitable trading environment, earning the trust of users and instilling confidence in the platform’s integrity.

Diverse Asset Trading

Another key highlight of KiloEx DEX is its expansive support for a myriad of assets, ranging from cryptocurrencies to foreign exchange and commodities. This unparalleled versatility empowers users to diversify their investment portfolios and seize a multitude of investment opportunities.

The flexibility offered by KiloEx in trading various asset classes amplifies the potential for profit generation and risk mitigation. By diversifying their portfolios, users can adeptly navigate market fluctuations and capitalize on emerging investment prospects. This strategic approach not only enhances profitability but also fortifies resilience against market volatility.

Furthermore, KiloEx’s provision of access to diverse investment avenues signifies a significant advantage for users. By facilitating trading across multiple asset types, the platform fosters a conducive environment for learning and exploration. Users can expand their knowledge and expertise by delving into different financial markets, thereby enriching their investment journey.

KiloEx products

Currently KiloEx is focusing on developing the following products:

Derivatives and Perpetual Exchanges

KiloEx DEX is ramping up its support for derivatives and perpetual exchanges. While leverage trading for forex and stocks is not yet implemented, the exchange remains steadfast in its focus on cryptocurrency trading. Currently, KiloEx boasts support for 10 trading pairs, including popular cryptocurrencies such as Ethereum (ETH), Bitcoin (BTC), and Dogecoin (DOGE).

However, the exchange plans to expand its array of trading pairs in the near future. Notably, KiloEx allows users to trade with leverage levels ranging from 2x to a maximum of 100x. Transaction fees incurred on the platform are converted into USDT and subsequently used to incentivize liquidity providers, reward $xKILO holders, and contribute to the ecosystem development fund.

Liquidity Provider Program

KiloEx empowers users to participate as liquidity providers (LPs), fostering a robust market for digital asset trading. LPs contribute assets to a shared pool via smart contracts on the KiloEx platform and earn a share of the trading fees collected by the exchange.

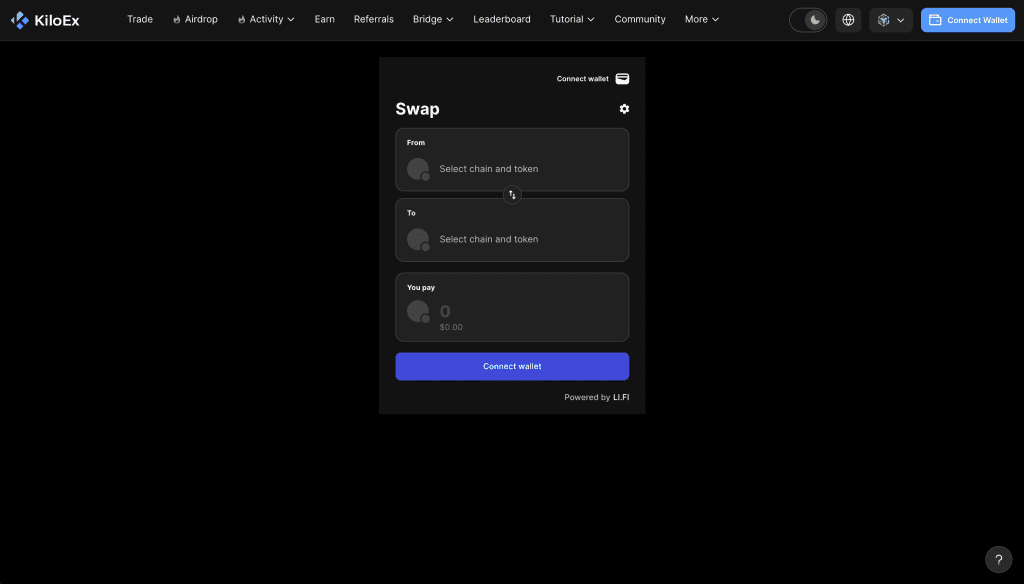

Bridge Integration

In a bid to facilitate seamless asset transfers, KiloEx is integrating Stargate’s bridge technology. This integration enables users to transfer assets across multiple chains, including Ethereum, Binance Smart Chain (BNB), Polygon, Avalanche, and others.

By connecting their wallets, users can effortlessly transfer assets between supported chains. Upon initiating a transaction, users are redirected to Stargate to complete the transaction. This feature streamlines the asset transfer process and expands trading options for users, akin to KiloEx serving as an aggregator of liquidity from third-party sources.

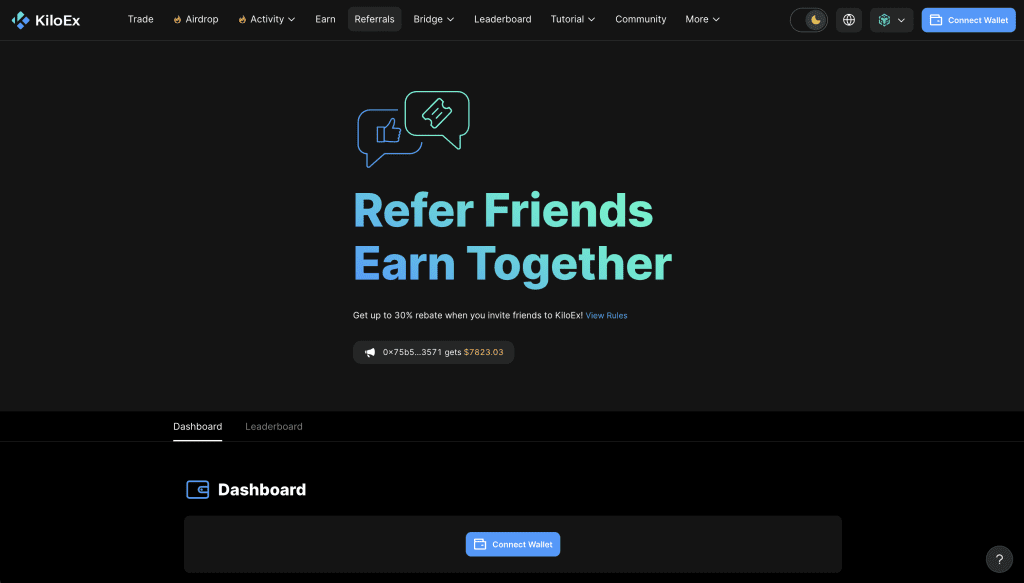

Referral Program

KiloEx presents a referral program, allowing users to earn rewards by referring friends and acquaintances to the platform. Participants in the referral program can enjoy fee discounts and cashback incentives.

Future Developments

While not currently active, KiloEx has outlined plans to introduce a copy-trading feature as part of its future development roadmap. This feature will enable users to replicate the trading strategies of successful traders on the platform.

Types of transaction fees on KiloEx

Commissions

One of the primary transaction fees on KiloEx DEX is the commission fee. Users incur commissions when opening and closing positions. The commission rate stands at a uniform 0.1% across all transactions. For instance, if

User A initiates a long position on ETH with a trading level of $100 and a leverage of 10x, they will be charged a commission fee by the platform, calculated as follows: $100 * 0.1% = $0.10. Upon closing the position, if the price of ETH has increased, resulting in the user’s position now being worth $1100 USDT, the closing commission would amount to $1100 * 0.1% = $1.10.

Execution Fee

Another fee users encounter is the execution fee, incurred with each transaction. This fee is utilized to cover network fees and varies depending on transaction times.

Funding Fee

KiloEx implements a funding fee, which is a periodic payment made to traders based on the disparity between the perpetual contract market price and the spot price. Traders either pay or receive this fee depending on their open positions. If a trader’s long position exceeds their short position, they are required to pay the funding fee, whereas short positions receive it.

Borrowing Fee

Users also encounter a borrowing fee when opening any long or short trading position on the platform. This fee is paid in full to the Vault, ensuring fair utilization of pool capacity and enabling traders to maintain prudent risk management by utilizing lower leverage.

KiloEx tokens

The ecosystem utility token ($KILO) and the KiloEx collateral token ($xKILO) are the focal points of the protocol. The total supply is $1 billion, with the first 3% determined by the token release event and airdrop to users on the whitelist.

KILO token key metrics

- Token name: KiloEx

- Ticker: KILO

- Token type: Utility token

- Contract: Not yet available (token has not officially launched yet)

- Total supply: 1000,000,000 KILO

KILO token allocation

- Ecosystem: 34% equivalent to 340,000,000 KILO.

- Airdrop: 10% equivalent to 100,000,000 KILO.

- Staking Reward: 10% equivalent to 100,000,000 KILO.

- Team: 20% equivalent to 200,000,000 KILO.

- Private Sale: 10% equivalent to 100,000,000 KILO.

- Strategic Investment: 10% equivalent to 100,000,000 KILO.

- Advisor: 5% equivalent to 50,000,000 KILO.

- Liquidity Provider: 1% equivalent to 10,000,000 KILO.

KILO token release schedule

KILO tokens will be distributed according to the following roadmap:

- Ecosystem: vesting within 4 years.

- Airdrop: 20% TGE, then vesting 20%/quarter.

- Staking Reward: Use for 4 years.

- Team: 1 year course, vesting within 3 years.

- Private Sale: 1 year course, vesting within 3 years..

- Strategic Investment: 1 year lock, vesting within 3 years.

- Advisor: 1 year course, vesting within 3 years..

- Liquidity Provider: 100% TGE.

Use Cases

xKILO serves as a conduit for revenue sharing and rewards, offering users lucrative opportunities within the platform ecosystem.

Created at a 1:1 ratio with KILO, the native token of the project, xKILO provides holders with exclusive benefits upon staking in the platform’s staking pool. By staking xKILO, users unlock revenue sharing privileges and receive rewards in both xKILO and USDT.

Transaction fees collected on the platform form the backbone of revenue distribution, with 40% allocated to the project’s ecosystem fund to fuel further development and growth. A significant portion, 30%, is earmarked for distribution among xKILO holders, incentivizing active participation and loyalty. The remaining 30% bolsters liquidity pools, ensuring robust market dynamics and enhanced trading experiences for users.

For users considering redeeming xKILO back to KILO, the process is streamlined yet flexible. Users have the option to choose the percentage of redemption, ranging from 50% to 100%, and select a redemption period spanning from 15 days to 6 months. This empowers users with control over their token holdings while providing liquidity options tailored to their individual preferences and investment strategies.

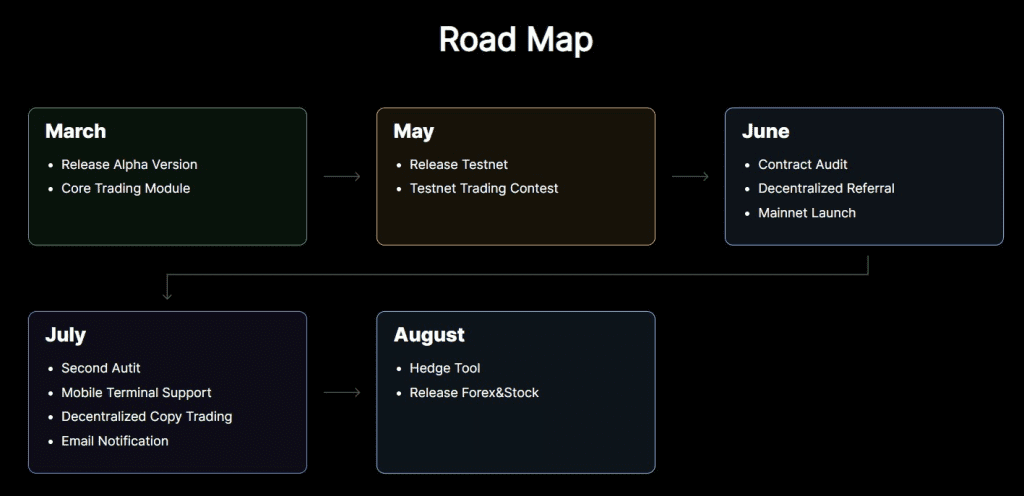

KiloEx roadmap

The project’s anticipated development roadmap is shown below. Currently, KiloEx is simultaneously launching its mainnet and beta test; users can test the platform on the BNB Testnet or directly use the BNB chain, but only mainnet users can access the offers and incentives.

- March: introduction of the core trading module and alpha version

- May: testnet and trading contest launch

- June: perform contract audit, deploy referral program, and launch mainnet

- July: second audit, support for mobile portal and copy trading program, implementation of email notification

- August: introduction of hedging tools along with foreign exchange assets and stocks

Investors and partners of KiloEx

Recently, KiloEx became one of four projects that won Binance Labs‘ MVB VI program and received a grant from it.

Conclusion of KiloEx Review

KiloEx’s expanded asset offering allows customers to trade many sorts of digital assets in a flexible and effective manner. This lets KiloEx stand out and compete with major competitors like DYDX, Gain Network, and GMX.

Furthermore, with an airdrop rate of up to 10%, KiloEx provides compelling incentives for consumers to engage and explore their platform. Airdrops not only generate excitement, but also provide users with the possibility to gain substantial prizes in the future, resulting in support and a strong user community. Hopefully Coincu’s KiloEx Review article has helped you get more information about the project.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 11 times, 2 visit(s) today

Source: https://coincu.com/246512-kiloex-review/