Tensor NFT marketplace has emerged as a notable point of interest within the community, often dubbed the “Blur on Solana.” This project has captured the attention of enthusiasts and experts alike, sparking curiosity about its underlying nature and functionalities. Today, let’s learn about this interesting project with Coincu through the Tensor Review article.

What is Tensor?

Tensor is a leading NFT exchange platform, strategically positioned on the Solana blockchain. This innovative NFT Marketplace, deployed on Solana, caters to the evolving needs of users, particularly traders, offering a suite of support tools to enhance their NFT trading experience.

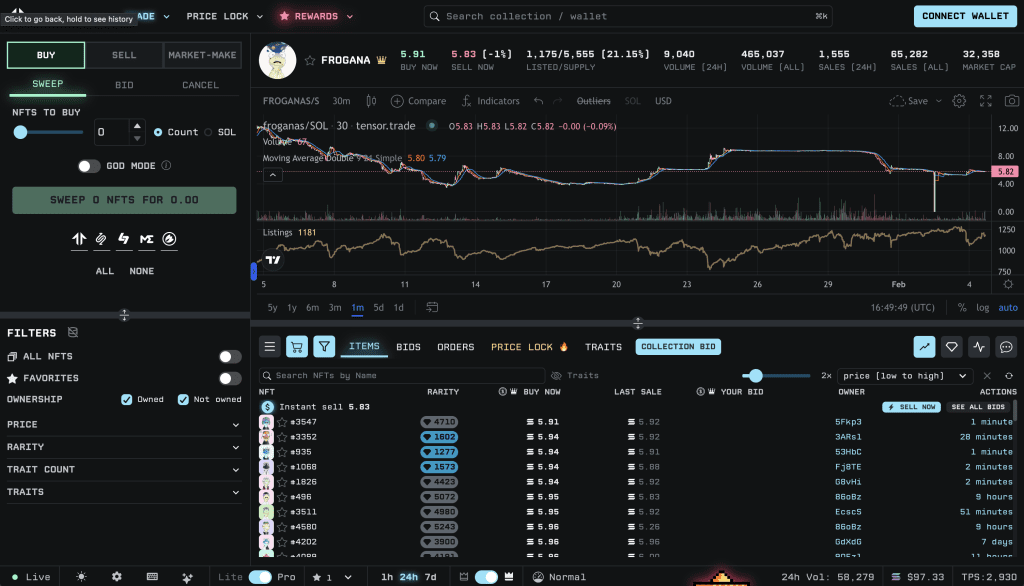

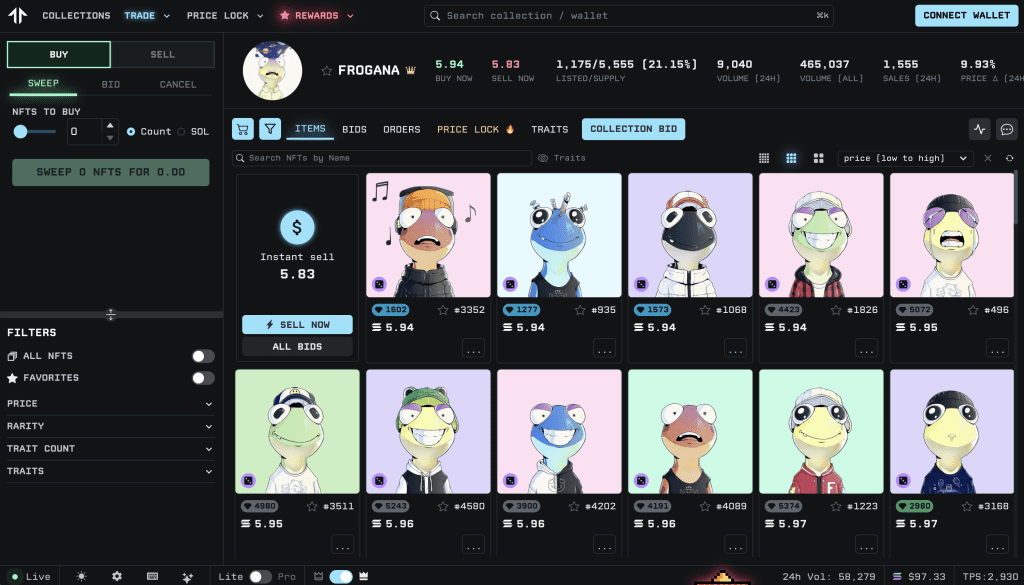

One of the distinctive features of Tensor is its commitment to scalability, providing traders in the NFT field with a versatile platform to execute transactions seamlessly. The platform boasts an array of tools, including TradingView integrated price charts, buying and selling actions, as well as advanced charts and analysis, empowering users to make informed decisions in their NFT transactions.

Tensor‘s comprehensive array of services encompasses various facets of NFT trading, including exchange, auction, storage, conversion, and NFT management. This multifaceted approach ensures that users have access to a robust set of functionalities, fostering a dynamic and efficient marketplace for NFT enthusiasts.

The genesis of Tensor’s evolution can be traced back to February 2022, when the platform embarked on developing an oracle platform for NFTs. Notably, Tensor’s efforts were recognized at the Hackathon Riptide, where the platform received accolades for its innovative strides in the NFT space. Following this recognition, Tensor strategically adjusted its trajectory, redirecting its focus towards the development of a professional NFT exchange tailored for Solana traders.

Read more: opBNB Review: The First Layer 2 Of BNB Chain

Tensor products

Tensor Aggregator

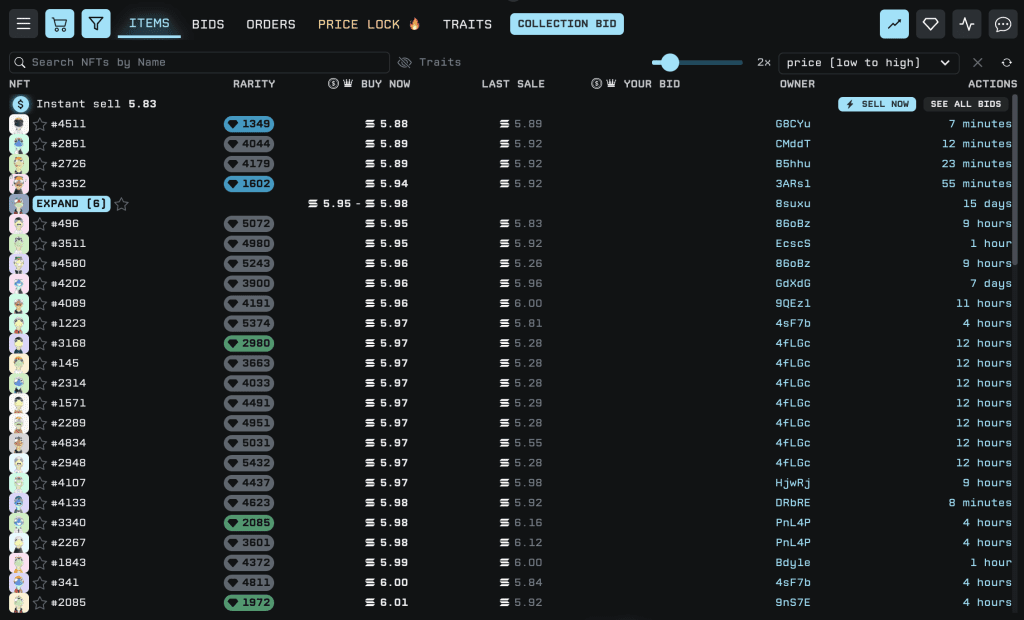

Tensor Aggregator is a groundbreaking tool, empowering users to streamline their liquidity management across various major marketplaces. This innovative platform boasts an updated interface with real-time data, enhancing the user experience.

Tensor Aggregator facilitates liquidity pooling for NFTs across several prominent markets on Solana. Notable platforms in its supported network include TensorSwap, HadeSwap, HyperSpace, MagicEden, and Solanart. This extensive range of liquidity sources grants users unparalleled flexibility in meeting their diverse needs within the decentralized ecosystem.

Offering versatility to cater to different user preferences, Tensor Aggregator introduces two distinctive modes: Lite and Pro. Tensor Aggregator Pro, a premium version, integrates seamlessly with TradingView. This integration marks a significant milestone for traders, providing them with the capability to monitor real-time price movements through advanced charts, thereby elevating their trading experience.

The user-friendly interface of Tensor Aggregator ensures a seamless experience for users, allowing them to aggregate liquidity effortlessly from major marketplaces on Solana. The platform’s commitment to providing real-time data updates ensures that users are always informed about market trends and shifts.

An additional advantage of the Tensor Aggregator lies in its fee structure. Users can aggregate liquidity from various marketplaces without incurring additional charges, making it a cost-effective solution for liquidity management. This fee-free model aligns with Tensor Aggregator’s mission to empower users by minimizing costs associated with decentralized trading.

Tensor AMM & Marketplace

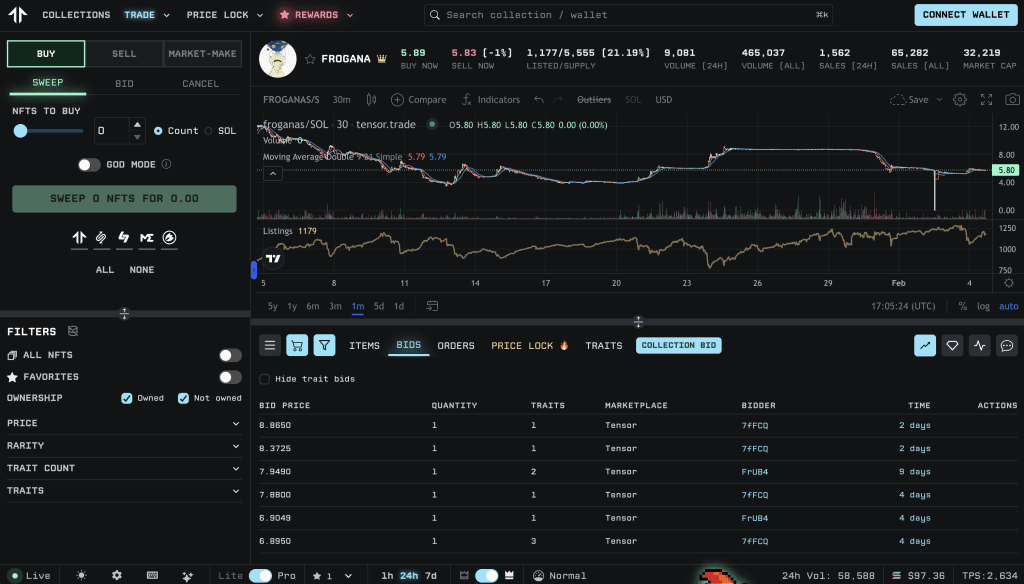

What sets Tensor AMM & Marketplace apart is its unique combination of AMM and NFT marketplace features. The platform facilitates auctions on curated collections and offers sellers instant liquidity through a user-friendly “sell now” button.

Notably, Tensor employs a bonding curve for its orders, enabling Dollar-Cost Averaging (DCA) for NFTs. This, in turn, introduces a reward mechanism for early liquidity providers, incentivizing active participation in the marketplace.

One of the standout features of Tensor’s offering is the empowerment it gives to users. Individuals can operate their own AMM and have the flexibility to design their fees, providing a customizable and user-centric experience.

Unlike many other platforms, Tensor NFT marketplace imposes no execution fees for listing, bids, or market-making. The only fee incurred is a minimal 1% charge for takers, making it an attractive option for both buyers and sellers. Tensor presently permits NFTs to provide liquidity via the following techniques:

TensorSwap’s first method allows users to place bids to purchase any NFT within a specific collection (Collection A) at descending prices. This unique mechanism empowers buyers to acquire NFTs at decreasing rates, enhancing the overall accessibility of NFTs within a targeted collection.

The second method introduced by TensorSwap enables sellers to list multiple NFTs simultaneously, with prices adjusting along a linear curve. This feature not only streamlines the listing process but also ensures that prices change progressively, providing a dynamic and market-responsive environment for NFT transactions.

TensorSwap’s third method focuses on market-making orders, allowing users to contribute liquidity for both buy and sell orders within a specific NFT collection. This innovative functionality ensures that users can actively participate on both sides of the market, promoting liquidity and facilitating smoother transactions within the NFT space.

These three distinctive mechanisms collectively empower users to adopt various liquidity provision strategies, enhancing the overall efficiency and vibrancy of the NFT market.

Rarity Ranking

The Rarity Ranking mechanism is a rarity rating system that offers a comprehensive evaluation of the price of NFT collectibles. Tensor’s Rarity Ranking currently supports four distinct systems for each collection, enhancing the precision and depth of the assessment.

Notably, two mechanisms, namely the HowRare and MoonRank methodologies, are automatically calculated and readily available for every collection. Additionally, two other mechanisms, Trait Normalized and Team Vision, rely on HowRare’s API and are selectively applied to specific collections, enriching the overall evaluation process.

The HowRare mechanism and MoonRank methodology stand as the core components, automatically providing insights into the rarity of each NFT collection. On the other hand, the Trait Normalized and Team Vision mechanisms, powered by HowRare’s API, offer additional layers of evaluation, catering to the unique attributes of select collections.

One of the distinctive features of Tensor’s Rarity Ranking is its extensive coverage within the Solana ecosystem. As of the latest update, Tensor supports the Rarity Ranking of over 10,000 collections, reaffirming its commitment to providing a comprehensive assessment tool for the vast and diverse world of Solana-based NFTs.

TensorSwap

TensorSwap is an NFT exchange utilizing an AMM mechanism. This platform not only facilitates the buying and selling of NFTs but also empowers users to become liquidity providers for their very own NFT Pools.

TensorSwap’s unique proposition extends to NFT projects seeking an efficient distribution channel for their digital assets. Opting for TensorSwap allows these projects to seamlessly distribute NFTs to their communities. In return, TensorSwap earns revenue through transaction fees imposed on users, coupled with a fixed royalty rate of 0.9%.

Next, the Tensor Review article will explore the outstanding features of this NFT platform.

Outstanding Features of Tensor

Here’s a comprehensive look at the platform’s unique offerings:

Tensor takes a user-centric approach by implementing a 0% fee structure for various activities such as listing, bids, and market-making. This commitment to a fee-free environment creates favorable conditions for users, setting Tensor apart in the competitive NFT landscape.

With a portfolio boasting over 10,000 diverse NFT collections on the Solana blockchain, the Tensor NFT marketplace presents users with a plethora of choices. This expansive selection ensures that users can explore and engage with a wide array of NFTs, meeting the varied preferences of the community.

Tensor prioritizes user convenience with a thoughtfully designed interface tailored for traders. The platform integrates essential support tools, including TradingView Charts and Attribute Filters, empowering users to execute transactions seamlessly and efficiently.

Beyond catering to traders, Tensor extends its support to collectors and liquidity providers. This inclusive approach broadens the platform’s user base, fostering a diverse community of participants with varying interests and roles within the NFT ecosystem.

Tensor revolutionizes the way users assess NFT values by integrating four distinct rating and evaluation systems. This comprehensive approach to rarity provides users with a more accurate understanding of the value associated with each NFT collection, aiding in informed decision-making.

Tensor introduces the innovative Sweep feature, allowing users to effortlessly purchase large quantities of NFTs. This automation eliminates the need for manual processing of each NFT, streamlining the acquisition process for those looking to make bulk purchases.

To further incentivize user engagement, Tensor implements a point accumulation and reward mechanism for active users. This system encourages continued participation on the platform, creating a dynamic and motivated community of users.

Let this Tensor Review article continue with understanding the working mechanism of the platform.

Working mechanism of Tensor

For Buyers

- Sweep Orders: Buyers on the Tensor NFT marketplace can leverage the innovative Sweep order feature, where liquidity is aggregated from the five largest NFT marketplace platforms within the Solana ecosystem. This consolidation ensures that buyers have access to a substantial pool of liquidity, enhancing the efficiency of their transactions.

- Bid Orders: Tensor NFT marketplace introduces a Bid order system, allowing buyers to set specific parameters for their purchasing strategy. Users can define the Start Price, indicating the initial price at which they are willing to purchase the first NFT. Additionally, buyers can set the Decrease By parameter, determining the percentage by which the price decreases when a seller lists an NFT. This dynamic pricing mechanism adds a layer of flexibility to the buying process, adapting to market conditions.

For Sellers

Tensor NFT marketplace simplifies the selling process for users by enabling them to list NFTs on the platform instantly. Sellers benefit from liquidity aggregated from TensorSwap or HadeSwap, streamlining the listing process and providing broader exposure to potential buyers.

For Liquidity Providers (LPs)

Tensor extends support to Liquidity Providers through Market-Making, allowing LPs to play a crucial role in the ecosystem. LPs can actively contribute liquidity by setting parameters for the Pool:

- Start Price: LPs can determine the initial selling price for the first NFT in the Pool.

- Change By: This parameter empowers LPs to dictate how the price changes with each transaction within the Pool, offering a responsive and adaptive pricing model.

- Desired Fee: LPs can specify the amount of fees they wish to earn through each transaction within the Pool, aligning incentives for both liquidity providers and the platform.

Why Tensors Are Dubbed Blur On Solana?

Despite being a relative newcomer on the Solana blockchain, Tensor NFT marketplace has swiftly risen to prominence within the NFT marketplace, positioning itself as a leading platform. This success can be attributed to several key factors that set Tensor apart from its competitors.

Speed and Cost-Efficiency

Tensor distinguishes itself with remarkable speed and low transaction fees, offering users a seamless NFT marketplace experience. Overcoming the drawbacks of other platforms like Magic Eden, Tensor ensures smooth scrolling and tab switching, creating a user-friendly environment.

Leveraging Solana’s infrastructure, Tensor NFT marketplace significantly reduces transaction costs, gaining a competitive edge over NFT marketplaces operating on Ethereum or Polygon.

Decentralized Governance Model

A pivotal element contributing to Tensor’s success is its adoption of a decentralized autonomous organization (DAO) governance model. This approach grants ownership and operational rights to the platform’s users, fostering a fair and transparent ecosystem.

By allowing users to actively participate in decision-making processes, Tensor establishes a strong bond between the project and its community. This stands in stark contrast to centralized platforms like Opensea, where community contributions are often overlooked, leading to user dissatisfaction and migration to alternatives like Blur.

Active User Rewards

Tensor implements a point calculation mechanism to reward active users on its platform. While opinions may vary on the attractiveness of these rewards, they serve as a valuable incentive for users to remain engaged with Tensor. This strategy aims to cultivate a dedicated user base, ensuring sustained usage and fostering long-term platform loyalty.

Strategic Choice of Solana

Tensor strategically opts for Solana as its blockchain of choice. Recognizing the challenges of competing directly with industry giants like OpenSea and Blur, Tensor’s decision to operate on Solana allows it to target a smaller customer base and minimize head-to-head competition.

Moreover, this choice positions Tensor to explore cross-chain functionality and target Layer 2 solutions such as Arbitrum, Optimism, and Base, potentially expanding its customer base further.

Continuous Innovation and Product Updates

Tensor’s commitment to staying competitive is evident in its regular introduction of new features. Notable additions include “Yolo Buy,” enabling users to participate in lotteries with small amounts of Sol for NFT opportunities, and “Trait Bird,” allowing users to bid on NFTs with specific characteristics.

The platform also provides features like tracking NFT exchange price movements and bid history notifications, showcasing Tensor’s dedication to enhancing user experience and staying ahead of market trends.

Compare Tensor with MagicEden and OpenSea

Each platform offers a distinctive set of features catering to the diverse needs of users. Let’s delve into a comparative analysis to understand the unique offerings of these platforms:

TensorSwap takes the lead by introducing a private fee shaping feature, allowing users to set market-making fee rates ranging from 0% to 25%. This empowers users with unprecedented control over their transactions, a feature notably absent on MagicEden and OpenSea.

Setting itself apart, TensorSwap has implemented a points reward system that incentivizes users for various activities on the platform, primarily for setting orders. This innovative approach not only fosters user engagement but also contributes to increased platform usage. Conversely, MagicEden and OpenSea lack a comparable points reward system.

One of TensorSwap’s major advantages lies in its remarkably low transaction fees. Charging a mere 0.1% in platform fees and up to 0.9% in content creator fees, TensorSwap outshines both MagicEden and OpenSea in terms of cost-effectiveness. In contrast, the latter two platforms employ different fee structures, dependent on transaction types and NFT categories.

TensorSwap distinguishes itself by offering users unparalleled flexibility in customizing order types. This includes the ability to set limits for entire collections and engage in market-making orders. In contrast, MagicEden and OpenSea concentrate on more specific command types, providing a different approach to user interactions.

Tensor’s team

The development team at Tensor comprises a multitude of professionals with experience in the Web3 market, including:

- Richard, the co-founder of Tensor, is a software developer with experience working with the Solana platform; prior to founding Tensor, Richard held positions at technology companies like Google and Shopify;

- Ilmol, the CTO of Tensor, is an expert in blockchain technology and has built numerous applications based on the Solana platform;

Tensor also has a number of other support staff members with experience in engineering, design, and finance.

Investors and Partners

In March 2023, Tensor successfully concluded a $3 million Seed Round, led by Placeholder and including participation from numerous other partners like Alliance, Solana Ventures, Big Brain Holdings, Monke Ventures, and a number of other notable members of the Solana community, including the Solana platform founders.

Tensor’s roadmap

NFT is evolving so quickly that it will be challenging to offer a long-term roadmap; instead, the project is progressively growing to give users what they require or what they desire:

- Gamified incentives (points, lootboxes & NFTs)

- Automation and NFT sniping

- Margin and leverage

- Perps and derivatives

- Expansion to other chains

- Notifications and alerts

- Single login for multiple wallets

- API for programmatic trading

- Advanced trading analytics

- Data export for tax and P&L management

Conclusion of Tensor Review

Tensor made its mark on the NFT Marketplace scene on March 26, 2023, despite entering the game later than some competitors. Since then, it has quickly risen to prominence, overshadowing MagicEden and Hadeswap in the Solana ecosystem. Much like the competition between OpenSea and Blur in the Ethereum market, MagicEden is now Tensor’s primary rival on Solana.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 8 times, 8 visit(s) today

Source: https://coincu.com/246045-tensor-review-on-solana/