Jito is the newest name in the Solana ecosystem, recently launched on Binance. Today, let’s learn about this project with Coincu through the article Jito Review.

What is Jito?

Jito is Solana’s premier liquid staking platform, enabling users to stake their SOL tokens and, in return, receive liquid staking JitoSOL tokens. JitoSOL can be utilized across various decentralized finance (DeFi) activities within the Solana ecosystem, including lending and farming, providing users with diverse avenues to maximize their profits.

What sets Jito apart is its innovative mechanism that seamlessly integrates additional rewards from Miner Extractable Value (MEV). The protocol distinguishes itself by being the sole liquid staking platform that combines liquid staking token returns with MEV rewards.

Jito not only facilitates traditional staking rewards but also goes a step further by offering MEV rewards, creating a favorable environment for users to achieve optimized profits. This unique blend of liquid staking and MEV rewards positions Jito as a pioneer in Solana’s rapidly evolving decentralized finance landscape, promising users an unparalleled and lucrative staking experience.

Read more: AltLayer Review: The Remarkable Protocol Supports Rollup Infrastructure

Features of Jito

Maximizing Profits with JitoSOL

Jito introduces the concept of Maximum Extraction Value (MEV), a mechanism allowing users to maximize profits from their capital investment. The project’s overarching mission is to efficiently extract MEV and distribute it among stakers and validators, contributing to the overall security and decentralization of the Solana network.

Within the Jito ecosystem, users can stake their Solana tokens through the Jito Stake Pool, earning JitoSOL tokens in return. This unique token not only provides liquidity but also combines staking rewards with MEV rewards. $JitoSOL stands out with two distinct features:

- MEV Transaction Rewards: JitoSOL grants additional rewards to users from MEV transactions occurring on the Solana network, enabling them to capitalize on the network’s activities.

- Validator Network Performance: The platform strategically stakes with validators utilizing software designed to enhance network performance. This improvement is achieved through an auction mechanism, minimizing network overload and ensuring efficient operations.

JitoSOL automatically accumulates value from both staking and MEV rewards. This integrated approach allows users not only to profit from validators but also to accumulate gains through Lending or Yield Farming protocols, maintaining capital efficiency in the dynamic DeFi space.

Optimizing Stakes with Kobe

Recognizing the need for constant optimization in staking, Jito introduces Kobe, an automated system designed to facilitate the movement of stakes based on changing conditions.

As users deposit SOL into the reserve or validator performance fluctuates, Kobe utilizes open-source code inspired by Solana’s Stake-o-matic program. This system maintains network information about validators and the network, automatically delegating staking to each validator.

Kobe serves as a critical tool for stakeholders aiming to maximize profits. Whether reacting to underperforming validators or downtime issues, users can seamlessly transfer their tokens to more reliable validators through Kobe, ensuring an ongoing pursuit of optimized returns.

Jito Components

JitoSOL introduces two groundbreaking components, StakeNet and JITOSOL, ushering in a new era of transparency, decentralization, and perpetual staking.

StakeNet: A Decentralized Staking Protocol

StakeNet stands at the forefront as a decentralized, transparent, and self-sustaining protocol designed for operating Staking Pools. Positioned as the cornerstone of JitoSOL’s vision, StakeNet transforms JitoSOL into a perpetual protocol, set to play a pivotal role in Solana DeFi.

Key components of StakeNet:

This revolutionary program stores three years of comprehensive history for each validator on the network. From vote credits to commissions and MEV earnings, the Validator History Program ensures transparency by providing a cryptographically verified record of previous actions. This invaluable data empowers users and on-chain programs to make informed decisions about validator behavior.

Leveraging on-chain validator history, the Steward Program calculates points and staking amounts for each validator.

A coordinated group of “keepers” operates a state machine, ensuring that staking is strategically assigned to the best-performing validators. This autonomous system, grounded in verified historical data, establishes a perpetually running and efficient mechanism for staking within the Solana ecosystem.

JITOSOL: Liquid Staking Token with Diverse Profit Opportunities

JITOSOL emerges as Jito’s liquid staking token, offering users the opportunity to earn rewards by staking SOL into the protocol. Beyond the interest gained from staking, JITOSOL holders can engage in a myriad of profit-generating activities, including lending and yield farming across various DeFi platforms within the Solana ecosystem.

Key features of JITOSOL:

Users can stake SOL directly on Jito’s website, receiving JITOSOL at an enticing 1:1 ratio with a competitive Annual Percentage Yield (APY) of 6.88% (as of November 30, 2023). A quick conversion option allows users to revert JITOSOL back to SOL after a brief 2-3 day period.

JITOSOL’s value experiences growth based on cumulative profits, ensuring holders receive consistent returns, regardless of how the token is stored. Additionally, users holding JITOSOL benefit from accumulated profits stemming from the protocol’s MEV rewards, enhancing the overall value proposition for stakeholders.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Read more: Top Notable Solana Bridges In 2024

How does Jito work?

Jito operates through a series of well-defined steps, ensuring transparency and efficiency in its operations.

Step 1: Seamless SOL Deposit and JitoSOL Conversion

Users begin their journey with Jito by depositing SOL into the protocol, receiving JitoSOL at a 1:1 ratio. For instance, a deposit of 1,000 SOL results in the issuance of 1,000 JitoSOL.

Step 2: MEV-Enabled Validators Handling User SOL

Jito takes a novel approach by sending users’ SOL to MEV-enabled Validators, trusted authenticators in the network.

Step 3: Validators Engage in Block Space Auctions

These Validators actively participate in block space auctions, unlocking MEV rewards as a result of their contributions to the network.

Step 4: Redistribution of MEV Rewards

The MEV rewards earned by Validators are thoughtfully redistributed to users, enhancing the overall profitability of their JitoSOL holdings.

Step 5: JitoSOL Accumulates Rewards

Users witness their JitoSOL accumulating both MEV rewards and staking rewards, creating a dynamic and rewarding financial ecosystem.

How JitoSOL works

JitoSOL, the native token of the Jito protocol, can be seamlessly utilized across various DeFi platforms on Solana, including Mango Market, Marginfi, Solend, Orca, Kamino Finance, Raydium, Hawksights, and more. This versatility allows users to diversify their portfolios and explore additional avenues for profit generation. The MEV rewards provided by Jito distinguish it from other protocols within the Solana ecosystem, setting it apart from competitors like Marinade Finance or Lido Finance.

To sustain its operations and ensure continued innovation, Jito implements a modest annual management fee equivalent to 4% of total rewards (MEV + Stake). Additionally, a withdrawal fee of 0.1% of the withdrawal value is charged, further aligning the protocol’s success with user prosperity.

As of the latest update, Jito has garnered significant traction, boasting an impressive deposit of nearly 7.1 million SOLs from approximately 160,000 users. The protocol has established a robust Validator network comprising 1800 partners, collaborating with prominent platforms such as Everstake, Figment, Kiln, Cogen Crypto, Staking Facilities, and P2P. These strategic partnerships underline Jito’s commitment to creating a robust and secure ecosystem for its users.

JTO token

The Jito project’s governance token, or JTO token, gives the community the ability to influence Jito’s policies and development direction by allowing token holders to take part in important network decisions like fee setting, delegation strategy selection, and treasury management.

Key Metrics

- Token Name: JITO

- Ticker: JTO

- Blockchain: Solana

- Token Standard: SPL

- Contract: jtojtomepa8beP8AuQc6eXt5FriJwfFMwQx2v2f9mCL

- Token type: Utility & Governance

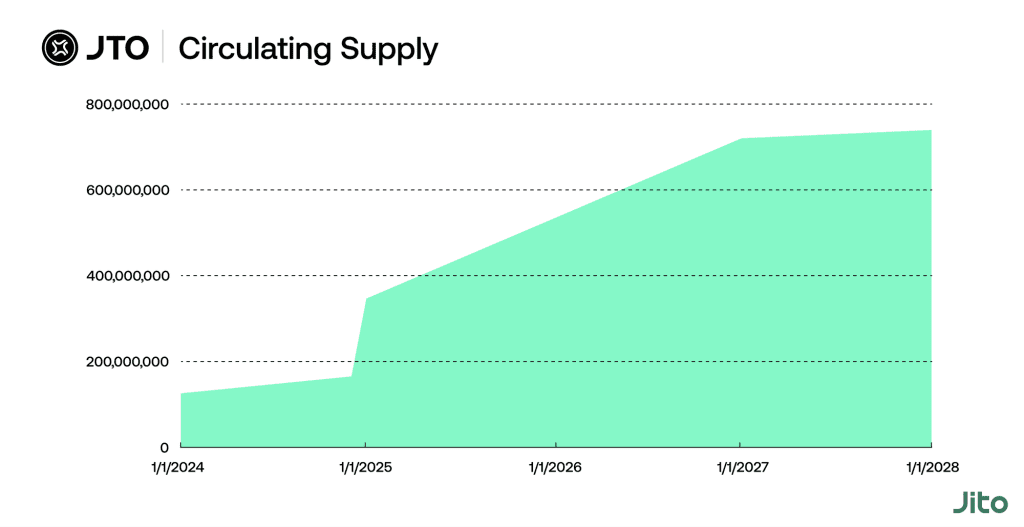

- Total Supply: 1,000,000,000 JTO

- Circulating Supply: 115,000,000 JTO

Token Allocation

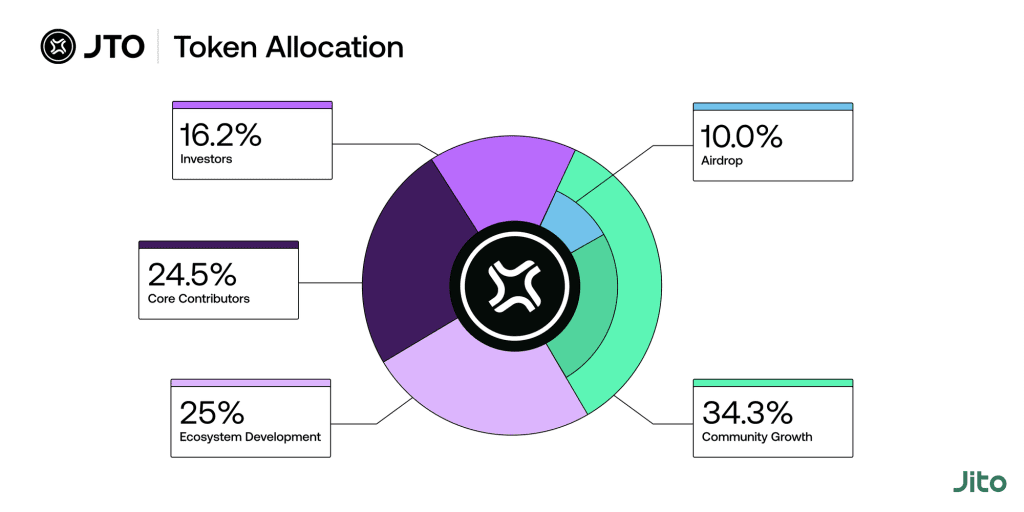

Jito announces the JTO token allocation rate as follows:

- Investors: 16.2%

- Airdrop: 10.0%

- Core Contributors: 24.5%

- Ecosystem Development: 25%

- Community Growth: 34.3%

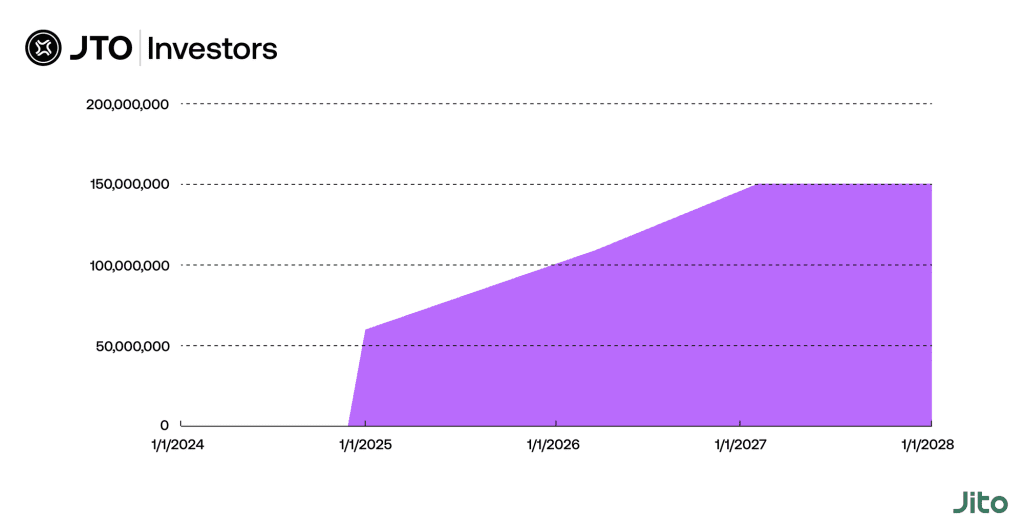

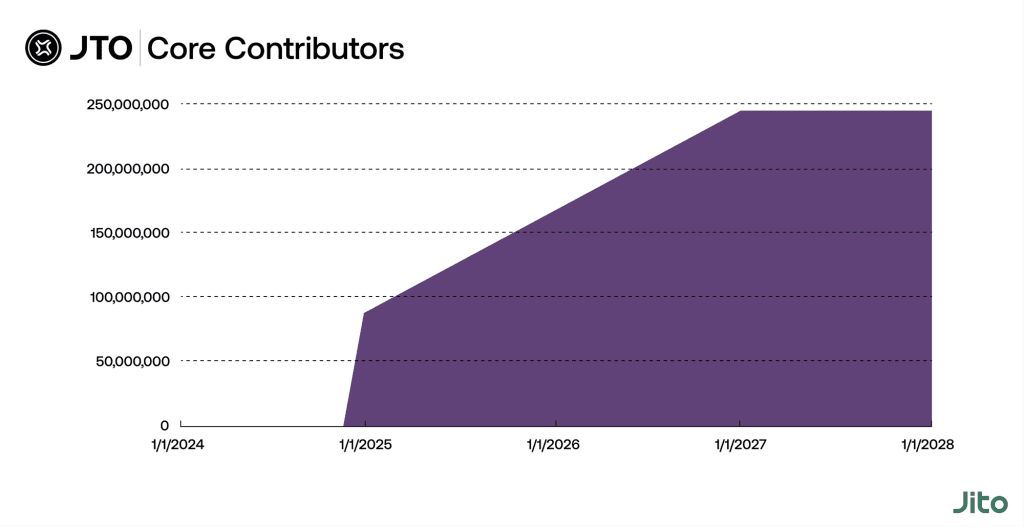

Token Release Schedule

- Ecosystem Development will be used to fund the community and contributors to help promote the expansion of the Jito ecosystem;

- Airdrop will be fully open at TGE;

- Community Growth will be managed by DAO;

- Investor & Core Team will be locked for a year and then gradually opened over the next three years.

Use cases

The following scenarios include the use of JTO tokens:

- Provide airdrop awards for early protocol adopters;

- Grant JTO holders the ability to vote on changes to StakeNet parameters, manage reserve funds, and oversee JITOSOL revenue streams.

JTO Trading Platform

Currently, users can trade JTO on some decentralized exchanges, such as Orca, Jupiter Exchange, Raydium,… on Solana or some centralized exchanges such as OKX, Binance, Coinbase, HTX,…

Roadmap

Although the project has launched an airdrop program for early users to acknowledge their contributions to the development of Jito, the platform has not yet disclosed a comprehensive strategy for future development.

JTO Airdrop

The Jito Foundation has revealed its JTO token airdrop program, allocating 10% of the total token supply (100,000,000 JTO) for distribution. This initiative is aimed at recognizing and rewarding the pivotal role played by the community in fostering the development of the Jito Network.

As part of this distribution strategy, an immediate airdrop of 90,000,000 JTO tokens will take place, while the remaining 10,000,000 tokens are slated for gradual unlocking over the course of the next year. Comparable parallels are being made between the JTO decline and the subsequent rise in activity on Solana. The token has rebounded from its affiliation with FTX and has more than quadrupled in price over the past year.

Eligibility for the JTO token airdrop is contingent upon the participant’s level of engagement and contribution to the project. Criteria include prolonged holding of JitoSOL, active participation with JitoSOL on DeFi platforms, and involvement in Solana validators through MEV servers (Jito-Solana).

The breakdown of the JTO token airdrop unfolds in two phases:

The first phase involves the immediate distribution of 90,000,000 JTO tokens.

The second phase will see the gradual unlocking of an additional 10,000,000 JTO tokens throughout the upcoming year.

Those deemed eligible for the airdrop encompass:

Individuals with a minimum of 100 accumulated points by November 25, 2023.

Validators who operated the server from epoch 366 to 536 and sustained their operations thereafter.

Researchers contributing to Jito through MEV servers, having provided a tip of at least 1 SOL before November 25, 2023. This tip is regarded as a valuable contribution to the network and serves as a criterion for determining eligibility for the JTO token airdrop.

Investors and partners of Jito

Investors

December 21, 2021: Jito Raises $2.1M

On December 21, 2021, Jito achieved a notable milestone by securing $2.1 million in funding. While specific details regarding the funding round were not disclosed, this injection of capital underscores the early support and confidence garnered by Jito at that stage.

August 11, 2023: Series A Round Yields $10M Investment

Fast-forwarding to August 11, 2023, Jito experienced a remarkable leap in funding during its Series A round. The company successfully raised $10 million, a testament to its growing prominence in the market.

This round witnessed the active participation of prominent investors, including Delphi Digital, Multicoin Capital, Robot Ventures, Alameda Research, and Framework Ventures. Specific details regarding the utilization of the funds or the company’s valuation were not disclosed in the provided information.

Partners

In order to provide users holding JitoSOL tokens like Solana, Orca, Raydium, and Serum with a wide range of use cases, Jito collaborates with other DeFi initiatives inside the Solana ecosystem.

Jito’s team

JitoSOL is built and developed by Jito Labs:

Lucas Bruder

Lucas Bruder, the Co-Founder and CEO of Jito Labs, brings a wealth of experience to the table. Holding a Bachelor’s degree in Electrical and Computer Engineering from Carnegie Mellon University, Lucas embarked on his career as a Software Engineer with stints at renowned companies such as Mindtribe Product and Tesla Motors.

His journey continued to soar at Built Robostic, a company specializing in diverse robotic applications, where he held pivotal roles as Technical Lead and Engineering Manager. Following a brief tenure with the software outsourcing company Ouster, Lucas laid the foundation for Jito Labs in November 2021.

Zano Sherwani

Joining forces with Lucas in the creation of Jito Labs is Zano Sherwani, the Co-Founder of the company. Zano’s academic prowess includes a Bachelor of Science in Computer Science from George Mason University.

Fueling his passion for software engineering, Zano dedicated two years to HUNGRY, a company providing event services, before contributing over a year of his expertise to Amazon. The collaboration between Lucas and Zano culminated in the establishment of Jito Labs in September 2021.

Conclusion of Jito Review

Jito stands out as an LSD protocol, adding significant value to the SOL coin. The platform encourages users to actively participate by staking their SOL into the protocol, promising optimized rewards in return.

As users flock to Jito, the protocol not only becomes a valuable asset within the Solana ecosystem but also contributes to the broader dynamics of the blockchain landscape. The strategic incentivization of staking SOL aligns with the protocol’s mission to bolster the adoption and utility of SOL. Hopefully, Coincu’s Jito Review article has helped you get more information about this project.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 3 times, 3 visit(s) today

Source: https://coincu.com/245673-jito-review/