XRP has faced a major drawback, breaching the pivotal price thresholds at $0.60, $0.59, $0.57 and $0.55 since the start of the year against a backdrop of several bearish factors.

Despite registering a bullish close on New Year’s Day, XRP has been largely underperforming with this month just 24 days into the year. The altcoin has dropped 16% this month, heading toward its worst-performing month since August 2023 when it collapsed by 26.75%.

XRP’s woes have resulted in a breach of several pivotal support levels that the asset had in the past leveraged as potent defense against bearish pressure. XRP first dropped below $0.61 and $0.60 on Jan. 3, with an attempt at recovering these price levels on Jan. 11 foiled by the bears.

The crypto asset then dropped below $0.59 on Jan. 14, subsequently relinquishing $0.57 three days later. Now, amid the latest price slump, XRP has breached the pivotal $0.55 level, currently battling to hold above the support at $0.51. The Crypto Basic reported the next possible trajectory for the asset in a report today.

This period of sustained bearishness has caught some investors off guard. However, others have aptly prepared for the downturn, augmenting their holdings in anticipation of a recovery. The ones taken unawares have had but one question: what exactly is behind this downtrend?

The Broader Market Collapse

The primary catalyst of the current XRP slump is the recent collapse in the broader crypto market triggered by Bitcoin (BTC). The global cryptocurrency market cap has lost $130 billion over the past week, dropping 7.7% and triggering an 11% decline in XRP’s value within the same timeframe.

This market-wide downtrend began on Jan. 11, shortly after the SEC approved the spot ETF products. BTC had spiked to a high of $48,969, resulting in an upswing in the broader market, with XRP rising to $0.6240 that day. However, the upward momentum died down, triggered by major BTC selloffs.

– Advertisement –

Most of these selloffs came from large Bitcoin whales and long-term holders. The Grayscale Bitcoin Trust (GBTC), which features an astronomically high fee of 1.5% as an ETF, also compounded the selloff campaign as institutional investors dumped their GBTC shares to switch to other ETF products.

This trend has exerted selling pressure on BTC, leading to an 8.05% drop in the last week. Since XRP and the rest of the crypto market remains correlated with BTC, they have also recorded similar declines.

Absence of a Spot XRP ETF

Following the approval of the spot Bitcoin ETF products and the discussions around crypto exchange-traded funds, speculation surrounding a spot XRP ETF has emerged. Most industry commentators pushing for this product cite XRP’s unique legal clarity as a basis.

Recall that a fake BlackRock iShares XRP ETF emerged on the official Delaware ICIS platform last November. This incident further exposed the desire for an XRP ETF. Despite the sustained push for the product, no asset manager has filed for it.

As a result, investor confidence has waned, given XRP’s unique position as a non-security. The initial expectations following Judge Analisa Torres’ July 13 ruling was a flood of institutional interest and demand. This has not materialized, resulting in dashed hopes.

XRP Whale Dumps

Whales have an impact on the price direction of a cryptocurrency due to their substantial holdings. One of the factors contributing to Bitcoin’s drop is whale distribution. This factor is also behind XRP’s price collapse, as XRP whales take to selling off some of their assets.

One of these massive whale movements occurred on Monday, involving the transfer of 29.1 million XRP to Bitstamp. Notably, traders move their crypto assets to exchange when they wish to sell them off. The address in question was activated by Ripple.

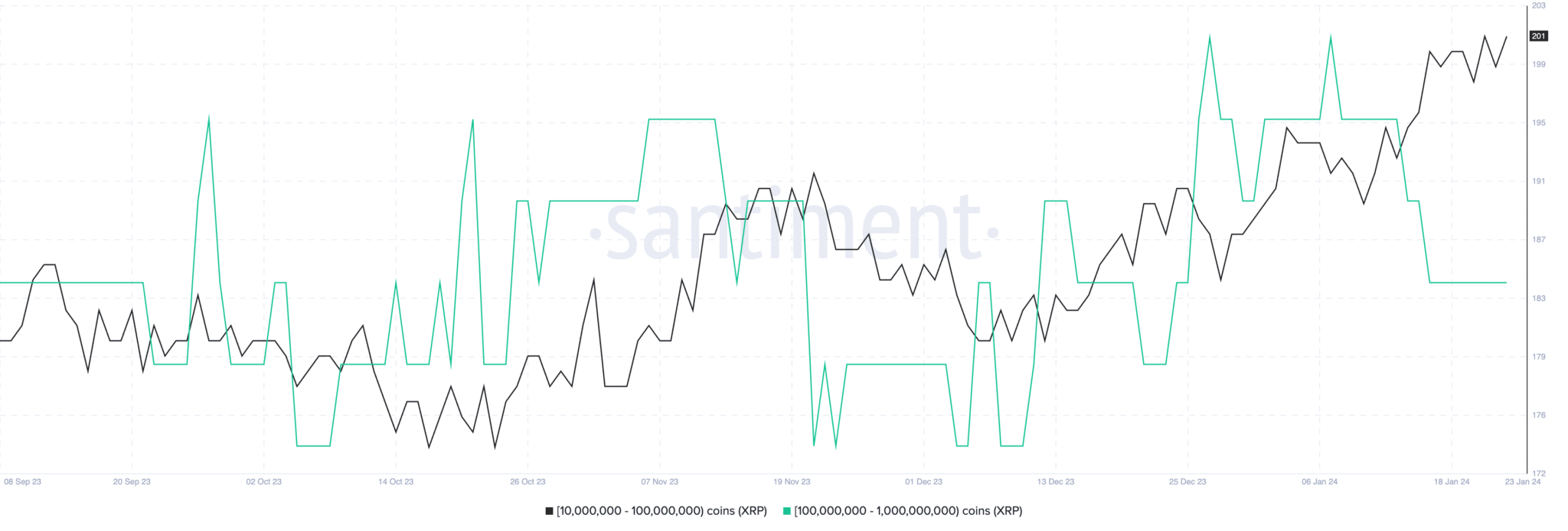

In addition, data from Santiment corroborates the claim of whale dumps. According to a Santiment chart, despite an uptick in addresses holding between 10 million and 100 million XRP, those with balances between 100 million and 10 billion XRP have considerably dropped this month. This is due to a widespread selloff.

XRP Development Activity and Market Sentiment

Another major contributor to the XRP downtrend is market sentiment and development activity on the XRP Ledger (XRPL).

These factors are intertwined, as more developers on a network and a higher development activity tend to influence bullishness among market participants.

XRP’s outlook in this regard remains bleak, as recently reported by The Crypto Basic. While other mainstream networks boasted monthly active developers in the thousands, with Ethereum recording up to 7,864, the XRP ecosystem only had 136 monthly active developers.

Current data suggests that XRP has 45 full-time developers while Ethereum boasts 2,392. The XRP ecosystem sits 49th on the list of networks with highest full-time developers, making it one of the worst-performing mainstream blockchains in this metric.

In the report, The Crypto Basic called attention to crypto YouTuber Moon Kambo’s remarks on the correlation between development activity and price movements. Notably, the media personality highlighted the impact of this metric in the previous market cycle.

Meanwhile, XRP has defended the $0.51 threshold, currently changing hands for $0.5147. However, it remains to be seen if the asset can hold off the bears until the next market resurgence. 24-hour trade volume has skyrocketed 28% to $1,431,329,574 amid the massive selloffs.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2024/01/24/four-factors-behind-current-xrp-market-collapse/?utm_source=rss&utm_medium=rss&utm_campaign=four-factors-behind-current-xrp-market-collapse