The world’s largest cryptocurrency Bitcoin (BTC) has experienced substantial selling pressure recently with the BTC price crashing to $40,000 earlier today. This has happened as there have been large outflows from the Grayscale Bitcoin Trust (GBTC) moving into the newly launched Bitcoin ETFs.

Bitcoin Price Can Correct to $34,000

Renowned crypto analyst Ali Martinez has pointed out the adherence of Bitcoin’s price movements to a parallel channel. According to Martinez, this indicates that Bitcoin encountered resistance at the upper boundary of the channel, situated at $48,000.

The analyst anticipates a retracement for Bitcoin, projecting a decline to the lower boundary at $34,000. Subsequently, Martinez foresees a rebound, with Bitcoin aiming to revisit the upper boundary, which is set at $57,000. This observation provides valuable insights into the potential price trajectory of Bitcoin, offering a perspective on key support and resistance levels within the established parallel channel.

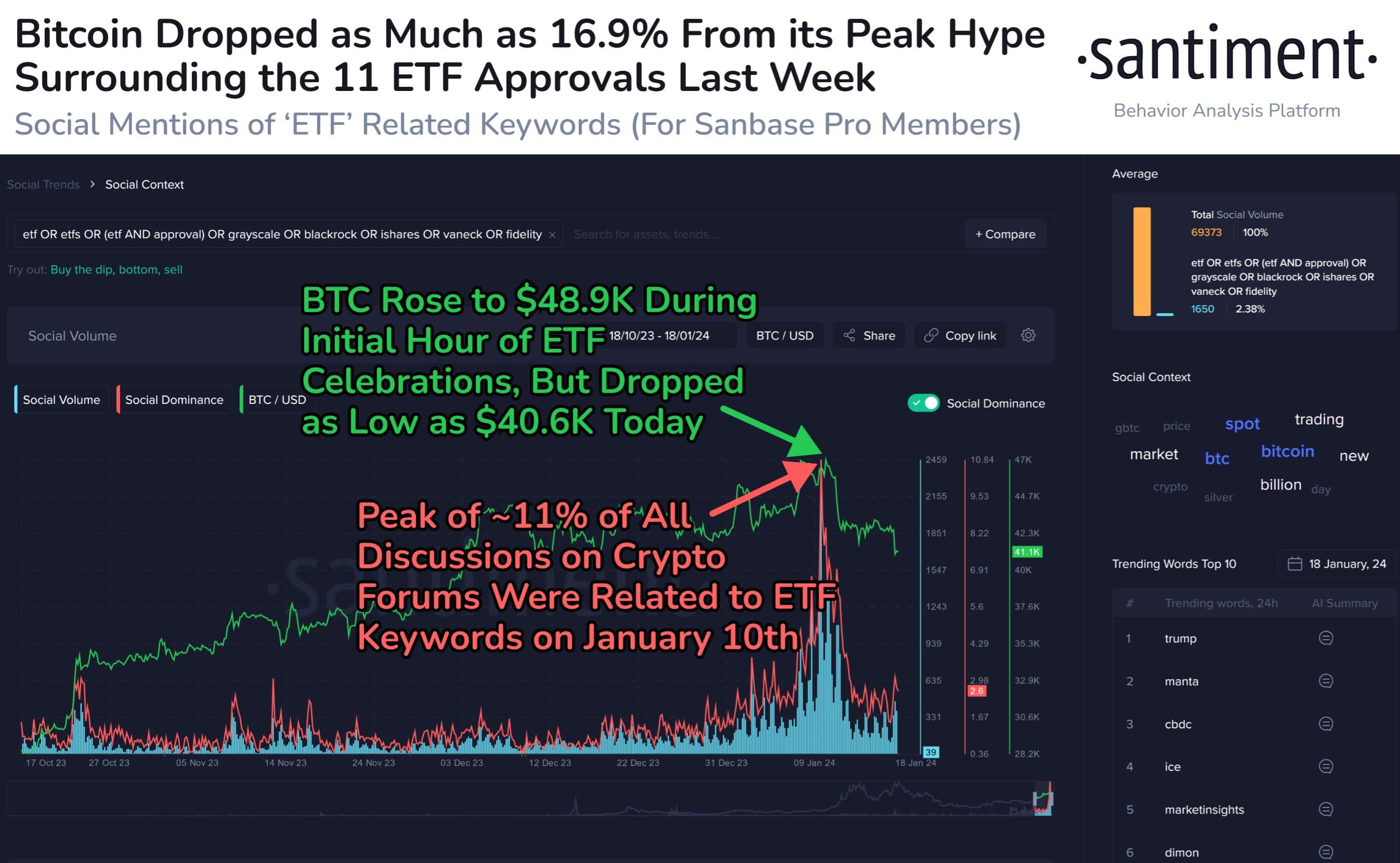

Santiment, a prominent on-chain data provider, reports that traders continue to maintain optimism regarding the long-term implications of the approval of 11 initial Spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) on January 10th. However, Santiment highlights a notable shift in sentiment, suggesting that the Fear of Missing Out (FOMO) surrounding the approvals may have contributed to a local cryptocurrency market top.

Experts posit that the widely anticipated approvals were already factored into market prices at the time of the announcements, leading to a subsequent decline in Bitcoin’s value. After Bitcoin experienced a significant drop to $40.6K, representing a 16.9% decrease from its peak market value the previous week, Santiment observes that the narrative surrounding these ETFs might shift.

There is a keen interest in monitoring whether the crowd’s sentiment turns negative, associating words like “scam,” “ripoff,” or “disaster” with the approved ETFs. If a bearish sentiment emerges around the subject that initially drove prices higher from October through December, Santiment anticipates that Fear, Uncertainty, and Doubt (FUD) could trigger selloffs from novice traders.

Expect Multi-Month Stagnation

In a recent analysis, On-chain College suggests that a multi-month correction or stagnation for Bitcoin price could be in the making. Such a trend, according to the analysis, does not necessarily signal an impending bear market and could potentially pave the way further for a robust bull run in the future as coins transition to stronger hands within the market.

Amidst the current market conditions, attention stays on the short-term cost basis for Bitcoin, currently situated at $37.8K. Historically, this level has also served as a support level during bull markets and a resistance level during bear markets, adding significance to its role in shaping market dynamics. The insights provided by On-chain College further offer a nuanced perspective on the potential trajectories for Bitcoin price, acknowledging the historical implications of key price levels in influencing market trends.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/bitcoin-btc-price-can-correct-to-34000-expect-multi-month-stagnation/

✓ Share: