Cardano (ADA) is outperforming its peers in the Decentralized Finance (DeFi) ecosystem with a parabolic surge in Total Value Locked (TVL).

Cardano TVL by the Numbers

Per data to Data from DeFiLlama, Cardano’s TVL went through the roof, climbing from $188.65 million as of October 17 to the $529.42 million it is today. Effectively, this TVL jump accounts for a total growth rate of 180.636% within that period.

This is no easy feat considering the enormous work required to attract the right liquidity into the Cardano network in the presence of DeFi heavyweights like Ethereum (ETH) and Solana (SOL). With the latest impressive uptick, Cardano’s overall ranking in the DeFi world has improved, rising to the 12th position at the time of writing.

The major contributor to Cardano’s growth is Indigo, a decentralized non-custodial synthetic assets protocol built for the network. Indigo’s TVL comes in at $120.2 million and is closely followed by decentralized exchange Minswap and Liqwid, a decentralized lending protocol with TVLs of $103.77 million and $60.18 million respectively.

Since it enabled smart contracts on its network, this is arguably the first time the impact of its massive developmental work on Cardano will be recognized. Among the protocols launched this year, Cardano DJED stablecoin from COTI also commands enormous liquidity with TVL pegged at $26.13 million at the time of writing.

Cardano’s recognized DeFi strides come from consistent protocol upgrades by the blockchain’s parent company Input Output Global (IOG). Effectively, the locked ADA in all smart contracts represented on the network has grown from 272.27 million in January to 824.06 million at the moment.

Is ADA’s Path to ADA Cleared?

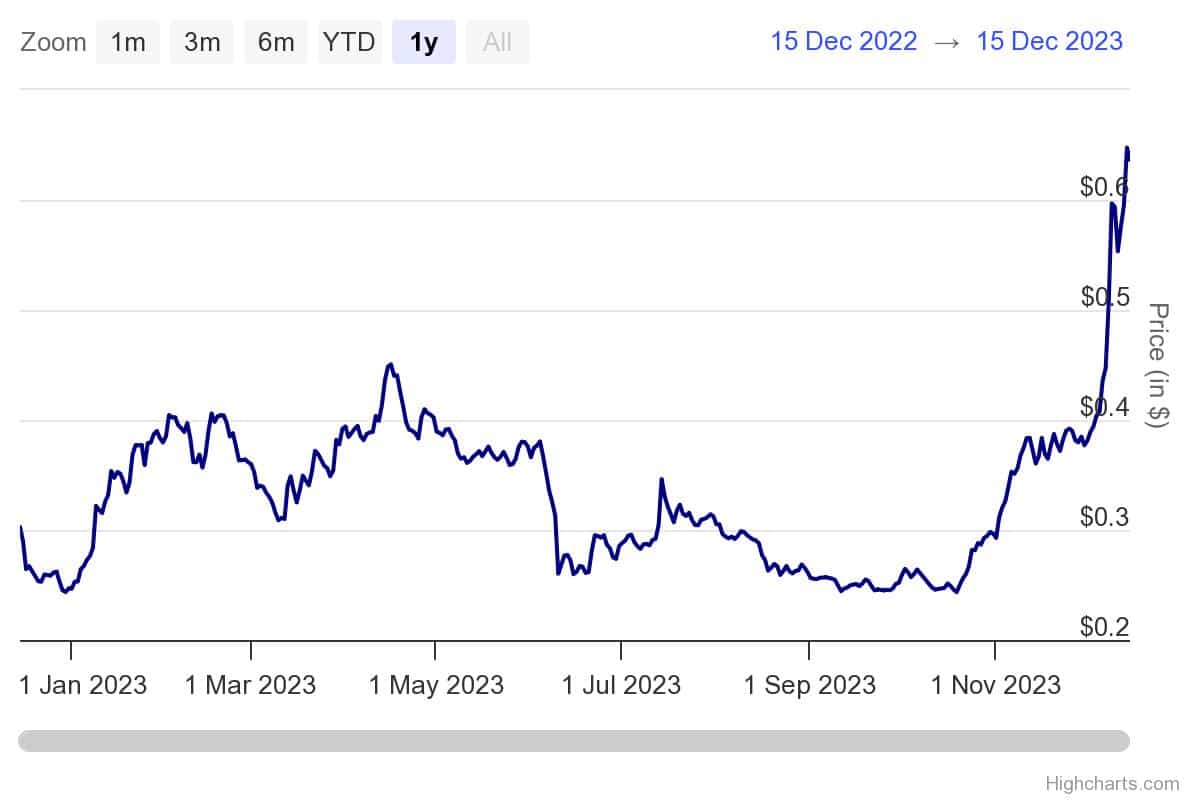

DeFi growth is a bullish sign in the market that might have a positive impact on price ultimately. At the time of writing, Cardano’s price is pegged at $0.617, down by 2.42% in the past 24 hours. The current bearish outlook, aggravated by the 54% drop in volume to $856,135,342 also underscores the inherent conservative sentiment in the market at the moment.

Cardano typically has interesting on-chain metrics that suggest the current gloom may not last for long. Ultimately, a rebound might be plotted when this DeFi data is properly priced in and general market sentiment changes on Bitcoin ETF hype.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/cardano-ada-defi-tvl-jumps-180-will-ada-price-break-0-7/

✓ Share: