According to a recent analysis by cryptocurrency analysis firm CryptoQuant, the selling behavior of Bitcoin miners can have a significant impact on the short-term price movement of the coin.

The analysis shared showed that there is a correlation between the Flow from Miners to Exchange metric and fluctuations in the market price of Bitcoin.

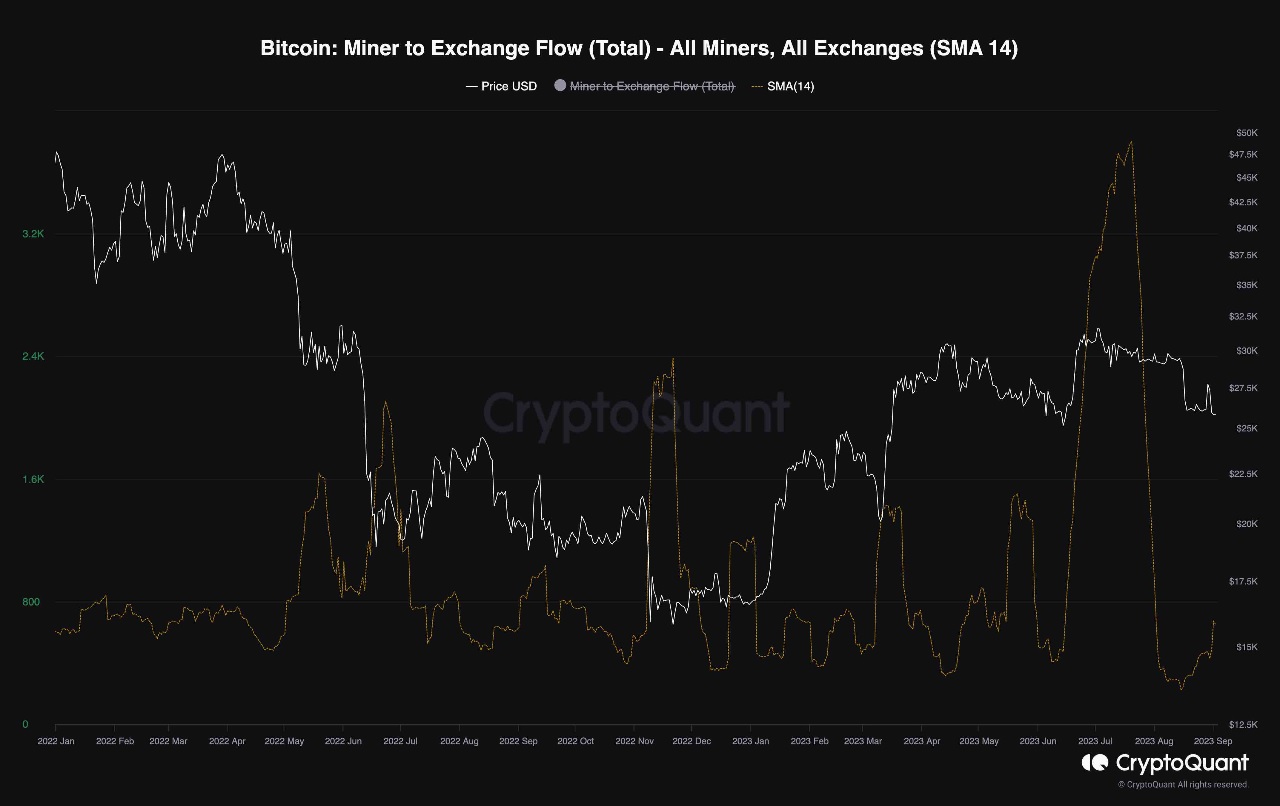

The Miner to Exchange Flow metric measures the volume of coins transferred from miners to spot exchanges, indicating potential selling pressure from miners looking to cash out their rewards. In the analysis, a 14-day moving average was applied to this metric and compared with Bitcoin’s price changes over the last few months.

The chart revealed that price declines, whether large or small, consistently coincide with situations where miners begin to transfer their Bitcoin holdings to spot exchanges.

However, there has been a notable development recently, with a significant increase in the metric occurring simultaneously with the price of Bitcoin touching the $30,000 level again in August.

Interestingly, this increase in miner activity contributed to a significant price decline, pushing Bitcoin’s value back down to the $25,000 threshold. Following this, the metric dropped significantly, falling to its lowest level of the year.

Still, according to analysts, there are signs of a slight recovery in this metric, indicating that miner activity may revive in the coming days. Analysts said users would be wise to carefully monitor miners’ behavior and be alert to increased or decreased selling activity.

*This is not investment advice.

Follow our Telegram and Twitter account now for exclusive news, analytics and on-chain data!

Source: https://en.bitcoinsistemi.com/high-correlation-detected-between-bitcoin-miners-sales-and-btc-price-analysts-explain/