- More than $250 million have been withdrawn from Voyager Digital after a year-long suspension.

- The crypto broker’s balance has now been reduced to $176.38 million.

- Voyager’s Clean Asset ratio is currently at 96.15%, which includes various tokens such as BTC, ETH, USDC, and SHIB.

Crypto broker Voyager Digital is witnessing a significant outflow of funds, with withdrawals resuming after a year-long suspension. Creditors are swiftly moving to retrieve their money, resulting in a massive outflow exceeding $250 million.

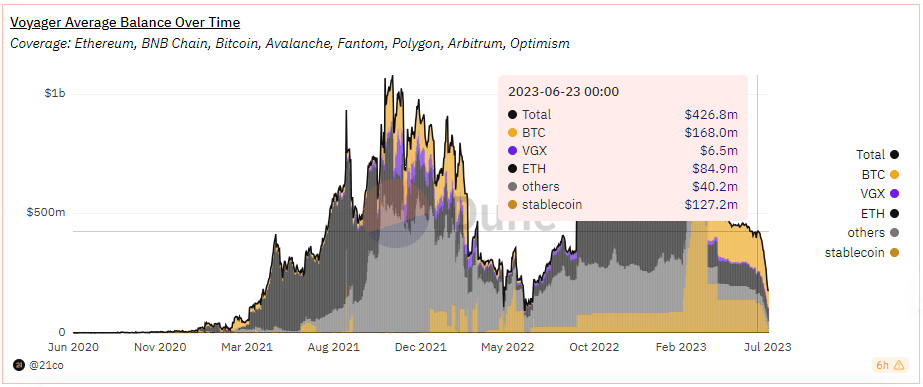

Having filed for Chapter 11 bankruptcy and halting investor withdrawals, Voyager Digital, a struggling crypto lender, recently reopened its withdrawal services on June 23. The platform’s balance, which stood at $426.8 million when withdrawals resumed, has now reduced to $176.38 million. Notably, numerous transactions exceeding $1 million have taken place.

Data from Dune Analytics reveals that more than $250 million worth of crypto assets have been withdrawn from Voyager. Presently, the platform retains approximately $176 million worth of crypto assets, demonstrating a Clean Asset ratio of 96.15%. This figure includes $69 million in BTC, $50.99 million in ETH, $18.56 million in USDC, $15.7 million in SHIB, and several other tokens.

Earlier in May, U.S. Bankruptcy Judge Michael Wiles granted approval to Voyager’s proposed liquidation plan. This enabled the firm to return approximately $1.33 billion in crypto assets to its customers and signified the conclusion of its reorganization efforts under Chapter 11.

Under this bankruptcy plan, customers are expected to recover 35.72% of their deposits. Following the distribution of these initial funds, Voyager will continue seeking additional assets for further creditor payouts.

Voyager’s announcement on May 8 revealed, “Depending upon the resolution of the FTX/Alameda preference claim dispute, the success of any additional claims brought by the Voyager Plan Administrator against third parties, as well as any recovery by the Voyager estate as a creditor in the Three Arrows Capital liquidation, customers may receive additional recoveries in the future.”

Since filing for bankruptcy protection in July 2022, citing market volatility, Voyager Digital has faced a tumultuous journey. Notably, two unsuccessful attempts to sell its assets to Binance US and FTX had the platform continue to grapple with financial challenges.

Source: https://coinedition.com/voyager-digital-sees-significant-asset-withdrawals-exceeding-250m/